Home equity is a valuable asset that many homeowners possess but may not fully understand or utilize. So, what is home equity and how can it be put to good use? Simply put, home equity refers to the difference between the current market value of your home and the outstanding balance on your mortgage. It represents the portion of your property that you truly own. By understanding how to leverage this equity, you can access funds for home improvements, debt consolidation, or other financial needs. Let’s explore the potential of home equity and discover how it can benefit you.

What is Home Equity and How to Use It

Introduction

Before we dive into the details of home equity and how to utilize it, let’s first understand what it means. Home equity refers to the portion of your property that you truly own, calculated by subtracting the outstanding mortgage balance from the appraised value of your home. It’s essentially the value of your home that is not currently owed to the lender.

Harnessing the power of home equity can provide you with a range of opportunities, such as financing home improvements, paying for education, consolidating debt, or even funding a dream vacation. In this article, we will explore the concept of home equity in depth and guide you on how to make the most of it.

Understanding Home Equity

Home equity is built over time as you make mortgage payments, increasing the amount of ownership you have in your property. It can also rise if the value of your property appreciates. Let’s take a closer look at how home equity is calculated:

Loan-to-Value Ratio (LTV)

The loan-to-value ratio (LTV) is a critical factor in determining home equity. It is calculated by dividing the mortgage loan amount by the appraised value of the property. For example, if you have a mortgage loan of $150,000 on a property appraised at $200,000, the LTV ratio would be 75% ($150,000 divided by $200,000).

By subtracting the LTV ratio from 100%, you can determine the percentage of home equity you currently possess. In the given example, the home equity would be 25% (100% – 75%).

Appreciation

Another way to increase home equity is through the appreciation of your property’s value. Real estate markets fluctuate, and if the value of your home rises over time, it can boost your equity. However, it’s important to note that appreciation is not guaranteed and can vary depending on various factors, including the location and condition of your property.

Principal Payments

Every mortgage payment you make includes both principal and interest. The principal payment goes toward reducing the amount you owe on your loan, thereby increasing your equity. Over time, as you continue to make mortgage payments, the principal portion becomes more significant, accelerating the growth of your home equity.

Benefits of Home Equity

Now that we have a clear understanding of what home equity is, let’s explore the benefits it offers. Home equity can be a valuable financial resource, providing you with several advantages:

1. Financing Home Improvements

Home equity loans or home equity lines of credit (HELOCs) can be ideal solutions for funding renovations or remodeling projects. These loans allow you to tap into your home equity and borrow against it, providing you with the necessary funds to enhance your living space. Since home equity loans typically offer lower interest rates than personal loans or credit cards, they can be a cost-effective way to finance your home improvements.

2. Consolidating Debt

If you have high-interest debts like credit card bills or personal loans, consolidating them using your home equity can help streamline your finances. By taking out a home equity loan or HELOC, you can pay off your existing debts and consolidate them into a single, more manageable monthly payment. This can potentially save you money on interest payments and simplify your debt repayment strategy.

3. Education Financing

Education costs can place a significant financial burden on individuals and families. By utilizing your home equity, you can finance higher education expenses at a lower interest rate compared to student loans or other educational financing options. This can provide you with more favorable terms and potentially save you money over the long term.

4. Emergency Funding

Life is unpredictable, and unexpected expenses can arise at any time. Having access to your home equity through a home equity line of credit can serve as a financial safety net during emergencies. Whether it’s medical bills, major car repairs, or any other unforeseen costs, tapping into your home equity can provide quick access to the funds you need.

5. Investment Opportunities

For those looking to make investments, home equity can open up doors to various opportunities. By leveraging your home equity, you can invest in real estate, start a business, or explore other investment avenues. However, it’s crucial to evaluate the risks involved and ensure that the potential returns outweigh the costs and potential impact on your home equity.

Using Home Equity Responsibly

While home equity can provide numerous benefits, it’s essential to use it responsibly. Here are some key considerations:

1. Evaluate Your Financial Situation

Assess your overall financial health and determine if using your home equity is the right move for you. Consider factors such as your income stability, existing debt levels, and long-term financial goals. It’s crucial to have a clear understanding of how utilizing your home equity aligns with your financial strategy.

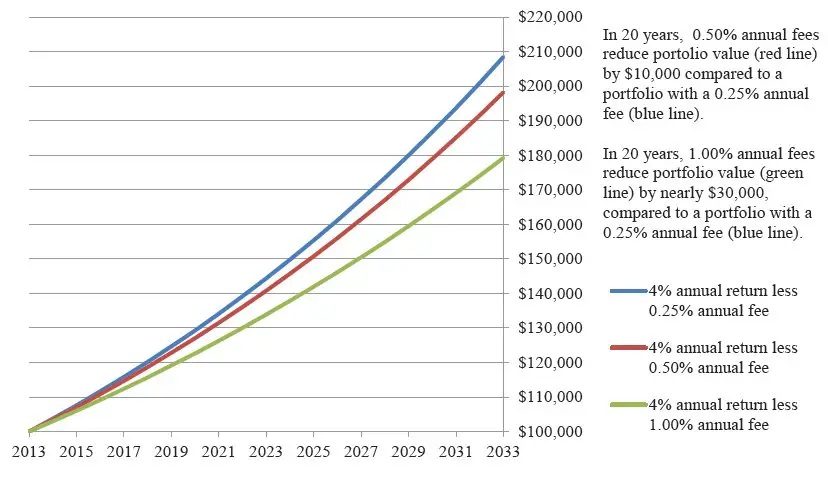

2. Calculate the Potential Costs

Before tapping into your home equity, carefully evaluate the associated costs, including interest rates, origination fees, and closing costs. Factor in the impact it may have on your monthly budget and long-term financial outlook. Working closely with a financial advisor can help you understand the potential costs and make informed decisions.

3. Plan for Repayment

Ensure you have a solid plan in place for repaying any loans or lines of credit you utilize. Consider the impact on your monthly cash flow and budget accordingly. Failing to make timely payments can put your home at risk, so it’s crucial to be diligent in managing your finances and meeting your repayment obligations.

4. Seek Professional Advice

If you’re unsure about how to best leverage your home equity, it’s advisable to consult with a trusted financial advisor. They can help you analyze your individual circumstances, explore available options, and guide you towards making informed decisions that align with your financial goals.

Home equity provides homeowners with a valuable asset that can be utilized in various ways. Whether it’s financing home improvements, consolidating debt, funding education, or seizing investment opportunities, tapping into your home equity can be a strategic financial move. However, it’s crucial to exercise caution and use home equity responsibly. By understanding the concept of home equity and considering the associated costs and risks, you can leverage this asset to achieve your financial goals and enhance your overall financial well-being. Remember, financial decisions should always be made after careful consideration and with the guidance of trusted professionals.

What Is Equity In A Home

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is home equity?

Home equity refers to the current market value of a homeowner’s property minus any outstanding mortgage or loan balances. It is the portion of the property that the homeowner truly owns.

How can I use home equity?

There are several ways to utilize home equity:

- Home Improvement: Homeowners can use their equity to finance renovations, repairs, or upgrades to their property.

- Debt Consolidation: Home equity can be used to pay off high-interest debts, such as credit card or personal loans, by taking out a home equity loan or line of credit.

- Education Expenses: Homeowners can use their equity to fund education costs, such as tuition fees, by refinancing their mortgage or obtaining a home equity loan.

- Investments: Home equity can be leveraged to invest in other properties, stocks, or businesses, potentially generating additional income.

- Emergency Expenses: Homeowners can tap into their home equity in times of financial emergencies, such as medical bills or unexpected home repairs.

How do I calculate my home equity?

To calculate your home equity, subtract the outstanding mortgage balance from the current market value of your property. The resulting amount is your home equity.

What factors affect the amount of home equity I have?

Several factors influence the amount of home equity you have, including:

- The current market value of your property

- The outstanding balance on your mortgage or home loans

- The amount of principal you have paid off on your mortgage

- Market conditions and property appreciation

What is a home equity loan?

A home equity loan, also known as a second mortgage, is a loan that allows homeowners to borrow against the equity in their property. The loan is typically repaid over a fixed term with a fixed interest rate.

What is a home equity line of credit (HELOC)?

A home equity line of credit (HELOC) is a revolving line of credit that homeowners can access using their home equity as collateral. It works similar to a credit card, where borrowers can borrow and repay funds as needed during the specified draw period.

What are the advantages of using home equity?

Using home equity offers several advantages:

- Potential access to a larger amount of funds compared to other types of loans

- Lower interest rates compared to credit cards or personal loans

- Possible tax advantages, as the interest paid on home equity loans may be tax deductible (consult a tax advisor for specific details)

- Flexibility in using the funds for various purposes

What are the risks of using home equity?

Using home equity does come with certain risks, including:

- The possibility of losing your home if you default on the loan payments

- Accruing more debt and potentially entering a cycle of borrowing

- Variable interest rates on some home equity products, which can result in higher payments over time

- The potential for property value depreciation, which may reduce your overall home equity

Final Thoughts

Home equity refers to the value of a homeowner’s stake in their property. It can be an invaluable financial resource and can be used in various ways to support personal goals. One way to use home equity is through a home equity loan or line of credit, which allows homeowners to borrow against the value of their property. This can be used for expenses like home renovations, debt consolidation, or education. Another option is a cash-out refinance, where homeowners can refinance their mortgage for an amount higher than what is owed and receive the difference in cash. By understanding what home equity is and how to use it effectively, homeowners can tap into this valuable asset to achieve their financial aspirations.