Interest rate risk in bonds refers to the potential impact of changes in interest rates on the value of bond investments. It is a crucial aspect that every bond investor should understand. So, what exactly is interest rate risk in bonds? In simple terms, it is the risk that the value of a bond will fluctuate as a result of changes in interest rates. Understanding this risk is essential for making informed investment decisions and managing one’s portfolio effectively. In this article, we will dive deeper into the concept of interest rate risk in bonds and explore its implications for investors. Let’s get started!

What is Interest Rate Risk in Bonds?

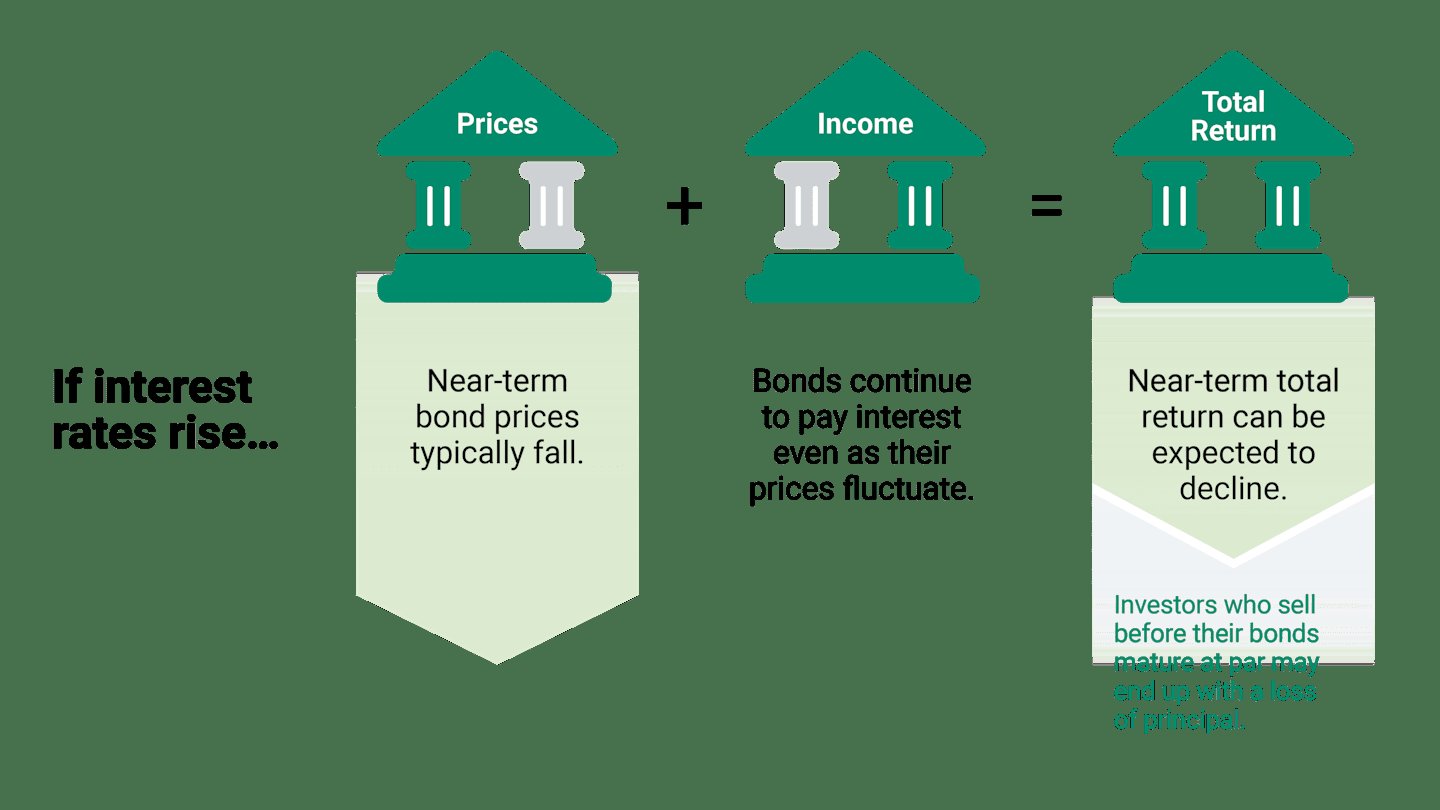

Interest rate risk in bonds refers to the potential for a change in interest rates to impact the value of a bond. When interest rates rise, the price of existing bonds decreases, and when interest rates fall, the price of existing bonds increases. This risk arises from the inverse relationship between bond prices and interest rates.

Interest rate risk affects both individual bond investors and bond funds. Understanding this risk is crucial for investors to make informed decisions and manage their bond portfolios effectively.

The Relationship Between Bonds and Interest Rates

To understand interest rate risk, it is important to grasp the relationship between bonds and interest rates. When you purchase a bond, you are essentially lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity.

The interest rate, also known as the coupon rate, is fixed when the bond is issued. However, prevailing market interest rates can differ significantly from the bond’s coupon rate. Changes in interest rates have a direct impact on the value of a bond.

When interest rates rise, new bonds are issued with higher coupon rates to attract investors. With higher coupon rates available in the market, existing bonds with lower coupon rates become less attractive, resulting in a decrease in their value. As a result, the market price of existing bonds declines.

Conversely, when interest rates fall, new bonds are issued with lower coupon rates, making existing bonds with higher coupon rates more valuable. This leads to an increase in the market price of existing bonds.

Factors Affecting Interest Rate Risk

Several factors contribute to the sensitivity of a bond’s price to changes in interest rates. Understanding these factors can help investors assess the level of interest rate risk associated with a particular bond or bond portfolio. Some of the key factors include:

1. Time to Maturity: Bonds with longer maturities are generally more sensitive to changes in interest rates compared to short-term bonds. This is because the longer the time until maturity, the more exposure the bond has to potential interest rate fluctuations.

2. Coupon Rate: Bonds with lower coupon rates are typically more sensitive to interest rate changes compared to bonds with higher coupon rates. A bond with a low coupon rate will have a greater percentage of its total return tied to changes in its market price rather than interest income.

3. Yield to Maturity: Yield to maturity represents the total return an investor can expect from a bond if held until maturity. Bonds with lower yields to maturity are generally more sensitive to changes in interest rates because a larger proportion of their returns come from price appreciation.

4. Market Conditions: The overall economic environment and market conditions can also impact interest rate risk. Uncertainty, inflation expectations, and central bank policies can all influence interest rates and consequently affect bond prices.

Measuring Interest Rate Risk

To assess and quantify interest rate risk, investors commonly use duration and convexity measures. These measures provide insights into how a bond’s price is expected to change in response to fluctuations in interest rates.

1. Duration: Duration measures the sensitivity of a bond’s price to changes in interest rates. It helps investors estimate how much the price of a bond is likely to change for a given change in interest rates. The higher the duration, the more sensitive the bond is to interest rate movements.

2. Convexity: While duration provides an accurate estimate of bond price changes for small interest rate movements, convexity accounts for larger changes. Convexity measures the curvature of the relationship between bond prices and interest rates. It helps refine the accuracy of duration calculations and provides a better estimate of price changes.

Managing Interest Rate Risk

Investors have several strategies available to manage interest rate risk in their bond portfolios. These strategies aim to minimize the potential negative impact of changing interest rates on bond prices. Some common approaches include:

1. Diversification: Spreading investments across different types of bonds and maturities can help reduce interest rate risk. By diversifying, investors can offset potential losses in one bond with gains in another.

2. Active Management: Actively managing a bond portfolio involves regularly reviewing and adjusting the holdings based on interest rate expectations and market conditions. This approach allows investors to take advantage of potential opportunities and minimize risks.

3. Bond Laddering: Bond laddering involves purchasing bonds with different maturities to create a consistent stream of income and spread interest rate risk over time. By staggering the maturities, investors can reinvest the proceeds from maturing bonds at prevailing interest rates.

4. Consider Floating Rate Bonds: Floating rate bonds have interest rates that adjust periodically based on a reference rate, typically a benchmark interest rate. These bonds can help mitigate interest rate risk as their coupon payments increase when interest rates rise.

5. Utilize Interest Rate Hedging Instruments: Sophisticated investors may choose to use interest rate hedging instruments, such as interest rate swaps or options, to protect against adverse interest rate movements. These instruments can be complex and may require specialized knowledge.

The Benefits and Challenges of Interest Rate Risk

While interest rate risk presents challenges for bond investors, it also offers potential benefits:

Benefits:

– Potential for capital appreciation when interest rates decline.

– Ability to lock in higher coupon rates when interest rates are high.

– Diversification benefits within a balanced investment portfolio.

Challenges:

– Potential decrease in bond prices and capital losses when interest rates rise.

– Reduced income from bond investments if interest rates remain low.

– The need for active management and monitoring of interest rate movements.

Understanding interest rate risk in bonds is crucial for investors looking to effectively manage their bond portfolios. Recognizing the relationship between bonds and interest rates, assessing the factors that influence interest rate risk, and using appropriate risk management strategies can help investors navigate this challenging aspect of bond investing. While interest rate risk cannot be completely eliminated, informed decision-making and proactive portfolio management can help mitigate its potential negative impacts.

Interest Rate Risk

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is interest rate risk in bonds?

The interest rate risk in bonds refers to the potential for the value of a bond to fluctuate due to changes in interest rates. When interest rates rise, the value of existing bonds decreases, and vice versa.

How does interest rate risk affect bond prices?

When interest rates rise, the value of existing bonds decreases because investors can now earn higher returns from newly issued bonds. Conversely, when interest rates fall, bond prices tend to rise as the fixed interest payments become more attractive.

What factors contribute to interest rate risk in bonds?

Several factors contribute to interest rate risk in bonds, including the bond’s time to maturity, coupon rate, and prevailing market interest rates. Bonds with longer maturity periods are generally more sensitive to interest rate changes.

Can interest rate risk lead to capital losses in bond investments?

Yes, interest rate risk can lead to capital losses in bond investments. If an investor sells a bond before its maturity in a rising interest rate environment, they may receive less than the initial investment.

Are all bonds equally affected by interest rate risk?

No, not all bonds are equally affected by interest rate risk. Bonds with longer maturities and lower coupon rates tend to be more sensitive to interest rate changes compared to those with shorter maturities and higher coupon rates.

How can investors manage interest rate risk in bonds?

Investors can manage interest rate risk in bonds by diversifying their bond holdings, investing in bonds with shorter maturities, and considering bonds with floating interest rates. Additionally, regularly reviewing and adjusting the bond portfolio can help mitigate risk.

Is there any benefit to interest rate risk in bonds?

While interest rate risk can lead to potential capital losses, it also presents opportunities for investors. When interest rates rise, investors can purchase new bonds with higher yields, potentially increasing their income from fixed income investments.

Does interest rate risk only affect individual bond investors?

No, interest rate risk affects both individual bond investors and institutional investors. Institutional investors, such as pension funds and insurance companies, also face the challenge of managing interest rate risk in their bond portfolios.

Final Thoughts

Interest rate risk in bonds refers to the potential for changes in interest rates to impact the value of bonds. When interest rates rise, bond prices generally fall, and vice versa. This risk arises because the value of a fixed-rate bond is based on future cash flows, which are discounted at the prevailing interest rate. As a result, if interest rates increase, future cash flows become less valuable, leading to a decrease in bond prices. It is crucial for investors to understand and manage interest rate risk in bonds to make informed investment decisions and mitigate potential losses.