Looking to grow your savings while keeping your funds easily accessible? Wondering what a money market account is and what benefits it offers? Look no further! A money market account is a type of savings account that typically yields higher interest rates, making it an attractive option for those seeking to maximize their savings. In this article, we will explore what a money market account is and delve into its numerous benefits. Whether you’re a seasoned investor or just starting to build your financial portfolio, understanding the ins and outs of a money market account is crucial for harnessing the full potential of your savings. So, without further ado, let’s dive in!

What is a Money Market Account and Its Benefits

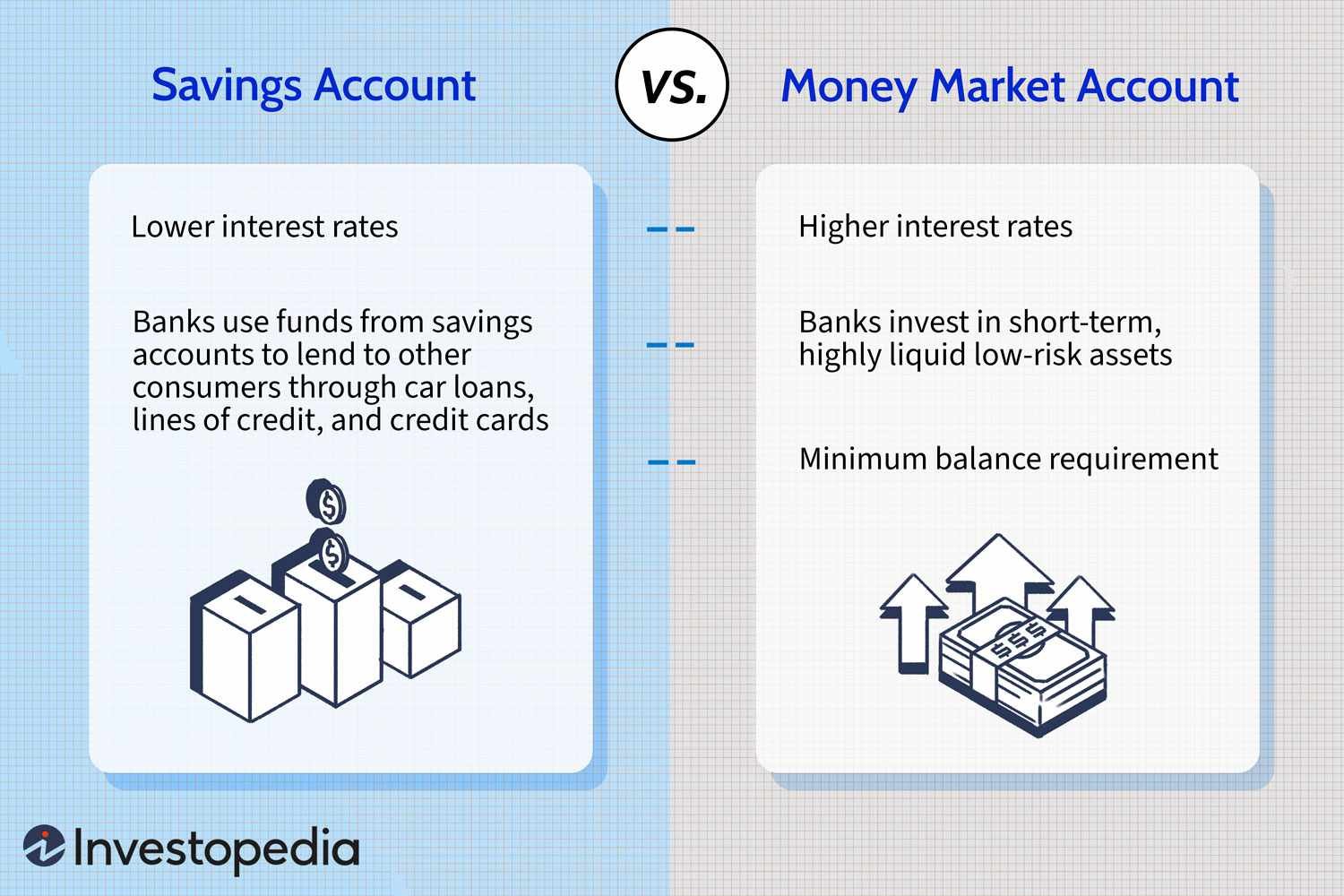

A money market account is a type of financial account offered by banks and credit unions that combines the features of a savings account and a checking account. It provides a secure place to store your money while earning a higher interest rate compared to a traditional savings account. Money market accounts are often favored by individuals who want to grow their savings without taking on too much risk.

How Does a Money Market Account Work?

When you open a money market account, you deposit your money into the account and the financial institution uses those funds to invest in low-risk, short-term securities such as Treasury bills, certificates of deposit (CDs), and commercial paper. The interest earned from these investments is then credited to your account.

Key Features of a Money Market Account

Money market accounts come with several features that make them attractive to savers. Let’s take a closer look at some of these key features:

- Interest Rates: Money market accounts typically offer higher interest rates compared to regular savings accounts. The rates are often tiered based on the deposit amount and may vary depending on the financial institution.

- Limited Check Writing: Unlike traditional savings accounts, money market accounts allow you to write a limited number of checks each month. This feature provides greater flexibility for accessing your funds when needed.

- Federal Insurance: Money market accounts are insured by the Federal Deposit Insurance Corporation (FDIC) for banks and by the National Credit Union Administration (NCUA) for credit unions. This insurance ensures that your funds are protected up to the maximum coverage limit.

- Minimum Balance Requirements: Some money market accounts require a minimum balance to open the account and to avoid monthly maintenance fees. Be sure to check the specific requirements of the financial institution.

- Liquidity: Money market accounts offer easy access to your funds through checks, ATM withdrawals, and electronic transfers, making it convenient to manage your finances.

- No Lock-In Period: Unlike certificates of deposit (CDs) that have a fixed term, money market accounts allow you to withdraw your funds at any time without penalty.

- Security: Money market accounts are considered low-risk investments as they invest in highly liquid and stable securities.

The Benefits of a Money Market Account

Now that we understand how money market accounts work and their key features, let’s explore the benefits they offer:

1. Higher Interest Rates

One of the main advantages of a money market account is the higher interest rates. These accounts typically offer better returns compared to regular savings accounts. The interest you earn on your money market account can help your savings grow faster over time.

2. Safety and Security

Money market accounts are considered safe and secure investments. The funds deposited in these accounts are insured by the FDIC or NCUA, providing protection against the potential loss of your money. This peace of mind is especially important for risk-averse individuals who want to safeguard their savings.

3. Easy Access to Funds

Unlike some other types of investments, money market accounts offer easy access to your funds. You can write a limited number of checks each month, make ATM withdrawals, or initiate electronic transfers to manage your finances conveniently. This accessibility makes money market accounts suitable for both short-term and long-term saving goals.

4. Diversification of Investments

Money market accounts provide an opportunity to diversify your investment portfolio. By allocating some of your savings to a money market account, you can balance higher-risk investments in your portfolio with the stability and security of a money market account. This diversification can help mitigate potential losses during market downturns and provide stability to your overall investment strategy.

5. No Risk of Losing Principal

With money market accounts, your principal amount is not at risk. Unlike other investment options that may be subject to market fluctuations, money market accounts focus on low-risk securities. This ensures that the money you deposit will be preserved and will earn interest over time.

6. Flexibility

Money market accounts offer flexibility in terms of deposit and withdrawal options. Financial institutions often have different tiers based on deposit amounts, allowing you to choose an account that suits your financial goals. Additionally, you can make regular deposits and withdrawals without penalties or restrictions, making it a convenient choice for managing your savings.

Is a Money Market Account Right for You?

While money market accounts offer numerous benefits, they may not be suitable for everyone. Here are a few factors to consider when determining if a money market account is the right choice for you:

1. Financial Goals

Consider your financial goals and time horizon. If you have short-term savings goals, such as building an emergency fund or saving for a down payment on a house, a money market account could be a good fit. However, if you have long-term goals such as retirement savings, you might want to explore other investment options that offer potentially higher returns.

2. Risk Tolerance

Money market accounts are generally low-risk investments. If you prioritize the safety of your principal and prefer stable returns over higher-risk investments, a money market account aligns with your risk tolerance.

3. Liquidity Needs

Consider your liquidity needs and how frequently you may need to access your funds. Money market accounts provide easy access to your money, making them suitable for individuals who require flexibility in managing their finances.

4. Minimum Balance Requirements

Some money market accounts have minimum balance requirements to avoid fees and qualify for higher interest rates. Ensure that you can comfortably meet these requirements before opening an account.

Money market accounts offer a balance of safety, liquidity, and growth potential for individuals looking to grow their savings with relatively low risk. With attractive interest rates, easy access to funds, and federal insurance coverage, money market accounts provide an excellent option for short-term savings goals and emergency funds. Consider your financial objectives, risk tolerance, and liquidity needs to determine if a money market account aligns with your overall financial strategy. Remember to compare the offerings of different financial institutions and choose the account that best suits your needs. Start utilizing the benefits of a money market account today and watch your savings grow over time.

What Is A Money Market Account?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a money market account?

A money market account is a type of savings account offered by banks and credit unions. It typically offers higher interest rates than a regular savings account and allows limited withdrawals.

How does a money market account work?

Money market accounts work by allowing you to deposit funds into the account, which then earns interest over time. You can usually access your funds through checks, debit cards, or electronic transfers, but there may be limitations on the number of withdrawals you can make.

What are the benefits of a money market account?

Money market accounts offer several benefits, including:

– Higher interest rates compared to regular savings accounts

– FDIC insurance, which means your funds are protected up to the legal limit

– Flexibility to access your funds when needed

– Potential to earn a higher yield compared to other types of accounts

– Low risk, as money market accounts invest in low-risk securities

What is the minimum balance requirement for a money market account?

The minimum balance requirement for a money market account varies depending on the financial institution. Some banks may require a minimum initial deposit, while others may have ongoing minimum balance requirements to avoid fees or earn higher interest rates. It is important to check with your bank or credit union for specific details.

Can I write checks from my money market account?

Yes, most money market accounts allow you to write checks. This provides you with a convenient way to make payments directly from your account. However, there may be restrictions on the number of checks you can write or minimum amount limits.

Is a money market account the same as a money market fund?

No, a money market account and a money market fund are not the same. A money market account is a deposit account offered by banks and credit unions, while a money market fund is a type of mutual fund that invests in short-term debt securities.

Are money market accounts safe?

Money market accounts are generally considered safe because they are FDIC-insured up to the legal limit. This means that even if the bank fails, your funds are protected. However, it’s important to note that money market accounts are not risk-free, as their value can fluctuate based on interest rates and market conditions.

Can I lose money in a money market account?

While money market accounts are generally considered low-risk, it is possible to lose money. The value of your account can fluctuate based on changes in interest rates, and there is a risk that the return on your investment may not keep up with inflation. However, the risk of losing principal is relatively low compared to other types of investments.

Final Thoughts

A money market account is a type of savings account offered by banks and financial institutions that provides a higher interest rate compared to traditional savings accounts. It typically requires a higher minimum balance and offers limited check-writing capabilities. The benefits of a money market account include earning a competitive interest rate, easy access to funds, and FDIC insurance for account safety. This type of account is ideal for individuals looking to earn a higher return on their savings while maintaining liquidity and security. So, if you’re seeking a secure and flexible savings option, a money market account is worth considering.