Welcome to our blog article on what is peer-to-peer lending and its risks. If you’ve ever wondered about the concept and potential dangers of peer-to-peer lending, you’ve come to the right place. In this comprehensive discussion, we will explore the ins and outs of this increasingly popular form of borrowing and investing. Peer-to-peer lending, often referred to as P2P lending, is a way for individuals to lend and borrow money directly from one another, bypassing traditional financial institutions. However, as with any financial endeavor, there are risks involved that need to be taken into consideration. Let’s dig in and explore the world of peer-to-peer lending and its associated risks.

What is Peer-to-Peer Lending and Its Risks

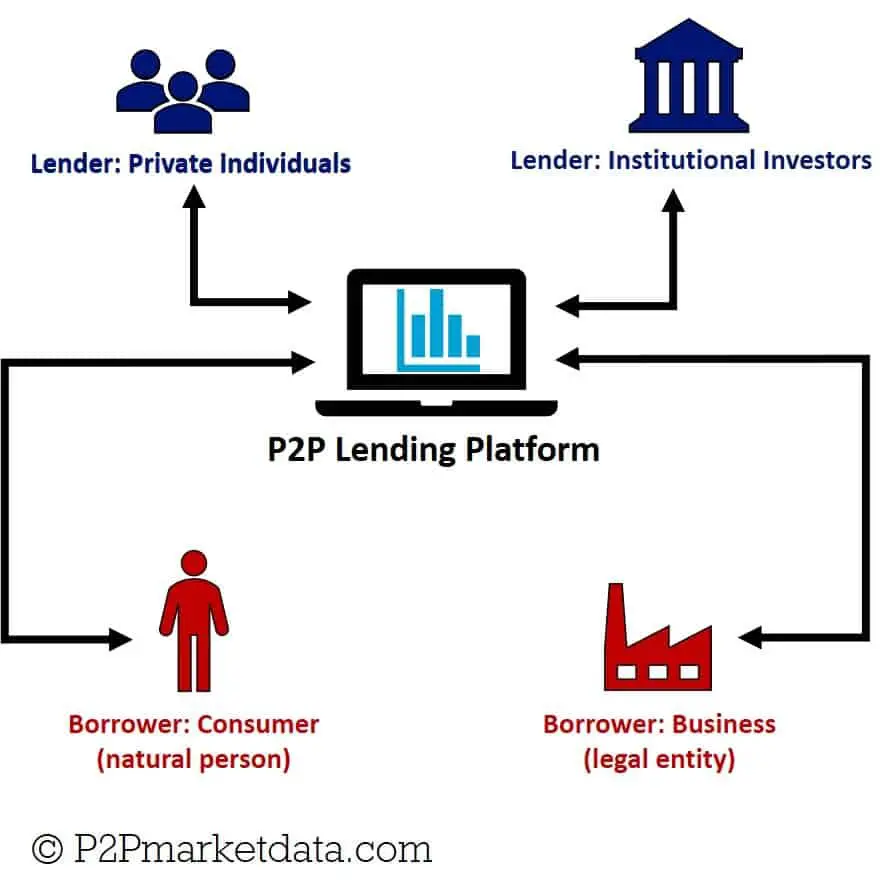

Peer-to-peer (P2P) lending has gained significant popularity in recent years as an alternative form of borrowing and investing. It involves connecting individual lenders directly with borrowers through an online platform, cutting out traditional financial institutions like banks. This innovative lending model offers advantages for both borrowers and lenders, but it is important to understand the risks involved before participating in this type of lending.

How Does Peer-to-Peer Lending Work?

In a peer-to-peer lending setup, borrowers apply for loans through an online platform that matches them with potential lenders. The platform acts as a facilitator, verifying the borrower’s creditworthiness and determining an appropriate interest rate. Once a match is made, lenders can review borrower profiles and decide whether to fund their loan requests. The loan amount is then disbursed to the borrower, who makes regular repayments to the lenders through the platform.

Peer-to-peer lending platforms typically earn revenue by charging fees to both borrowers and lenders. They may charge origination fees, servicing fees, or transaction fees, which are deducted from the loan amount or the interest earned by lenders.

The Benefits of Peer-to-Peer Lending

Peer-to-peer lending offers several advantages over traditional lending options. Here are some of the key benefits:

- Access to Funding: P2P lending provides an alternative source of funding for individuals who may not qualify for loans from traditional financial institutions. The lending criteria on online platforms tend to be more flexible, allowing borrowers with less-than-perfect credit histories to secure loans.

- Better Interest Rates: Since peer-to-peer lending eliminates the intermediaries involved in traditional lending, borrowers may be able to obtain loans at lower interest rates. Additionally, lenders can potentially earn higher returns compared to traditional investments like savings accounts or bonds.

- Diversification: Peer-to-peer lending allows investors to diversify their portfolios by allocating funds to a variety of loan listings. They can spread their investments across different borrowers and loan types to reduce risk and increase potential returns.

- Transparency and Convenience: Online platforms provide transparent information about borrowers, including credit scores, loan purpose, and repayment histories. Investors have the convenience of accessing this information to make informed decisions regarding which loans to fund.

Potential Risks of Peer-to-Peer Lending

While peer-to-peer lending offers enticing benefits, it’s essential to consider the potential risks involved:

1. Default Risk

Borrowers may default on their loan obligations, which can result in financial losses for lenders. Even with thorough credit assessments, there is always a risk that borrowers may be unable to repay their loans due to unforeseen circumstances such as job loss, medical emergencies, or economic downturns. It is crucial for lenders to diversify their investments across multiple loans to mitigate the impact of potential defaults.

2. Lack of Collateral

Unlike traditional loans, P2P loans are typically unsecured, meaning they do not require collateral. If a borrower defaults on the loan, there may be no physical asset that lenders can recover to offset their losses. This lack of collateral increases the risk for lenders, as there is no guarantee of asset-backed recovery in case of default.

3. Platform Risk

The success and reliability of peer-to-peer lending heavily depend on the platform’s operations. If the platform encounters financial difficulties or fails, it may impact the ability of lenders to receive repayments and borrowers to access funds. It is crucial to research and choose reputable platforms with a strong track record.

4. Regulatory Risk

Regulations surrounding peer-to-peer lending can vary significantly across different jurisdictions. Changes in regulations or legal frameworks can impact the operations of lending platforms and introduce uncertainties for both lenders and borrowers. It is important to stay informed about the regulatory landscape to assess any potential risks associated with compliance or changes in the industry.

5. Illiquidity

Peer-to-peer loans are typically long-term investments with fixed repayment schedules. While some platforms offer secondary markets that allow investors to sell their loan investments before maturity, liquidity can still be limited. It may not always be easy to sell or exit investments quickly, especially if there is a lack of demand or market volatility.

6. Limited Investor Protection

Unlike traditional banking institutions, peer-to-peer lending platforms may not offer the same level of investor protection. While efforts are often made to assess borrower creditworthiness, there is no guarantee that lenders will recover their investments in case of borrower defaults or platform failures. It is vital to thoroughly understand the platform’s terms and conditions, including any provisions for investor protection.

Peer-to-peer lending has revolutionized the way individuals borrow and invest money. It provides opportunities for borrowers to access funding and investors to earn attractive returns. However, it is crucial to carefully consider the risks before participating in peer-to-peer lending. Default risk, lack of collateral, platform risk, regulatory risk, illiquidity, and limited investor protection are some of the key factors that potential participants should be aware of. By understanding and effectively managing these risks, individuals can make informed decisions and navigate the peer-to-peer lending landscape more confidently.

WARNING: Why Peer To Peer Lending is a BAD INVESTMENT

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is peer-to-peer lending?

Peer-to-peer lending is a form of lending that allows individuals or businesses to borrow money directly from other individuals or investors, without the involvement of traditional financial institutions like banks. It is facilitated through online platforms that connect borrowers and lenders.

How does peer-to-peer lending work?

In peer-to-peer lending, borrowers create a profile on an online platform, stating the amount of money they need and the purpose of the loan. Lenders review these profiles and choose the borrowers they want to lend money to. Once a loan is agreed upon, the platform facilitates the transfer of funds between the borrower and the lender.

What are the risks associated with peer-to-peer lending?

While peer-to-peer lending offers potential benefits, it also comes with certain risks:

- Credit risk: There is a risk that borrowers may default on their loans, leading to potential loss of invested funds for lenders.

- Liquidity risk: Unlike traditional banks, peer-to-peer lending platforms may not offer instant access to borrowed funds, making it less liquid in some cases.

- Platform risk: If the platform you are using shuts down or faces financial difficulties, it can affect the repayment of loans or your ability to access your investment.

- Regulatory risk: Changes in regulations or legal frameworks governing peer-to-peer lending can impact the operations and profitability of the platforms.

Is peer-to-peer lending regulated?

Regulations governing peer-to-peer lending vary by country. Some jurisdictions have specific regulations in place to protect both borrowers and lenders, while others have yet to establish comprehensive regulations for this type of lending. It is important for both borrowers and lenders to understand the legal framework in their respective jurisdictions.

What are the benefits of peer-to-peer lending?

Peer-to-peer lending offers several advantages:

- Lower interest rates: Borrowers can often secure loans at lower interest rates compared to traditional financial institutions.

- Higher returns: Lenders can potentially earn higher returns on their investments compared to other traditional investment options.

- Accessibility: Peer-to-peer lending provides access to funding for borrowers who may have difficulty obtaining loans through traditional channels.

- Diversification: Lenders can diversify their investment portfolio by spreading funds across multiple borrowers.

How can I minimize the risks of peer-to-peer lending?

To minimize risks, consider the following:

- Do thorough research on the platform you plan to use, including its track record, reputation, and reviews from other users.

- Diversify your investments by lending to multiple borrowers, reducing the impact of potential defaults.

- Assess the creditworthiness of borrowers before committing to lending them money.

- Understand the terms and conditions of the loans and the platform’s policies for handling defaults or late payments.

Can I lose all my money in peer-to-peer lending?

While there is a risk of losing money in peer-to-peer lending, the extent of this risk can be minimized by following best practices, diversifying investments, and conducting thorough due diligence on borrowers and platforms. However, it is essential to understand that there is still a possibility of losing some or all of your invested funds.

Are there any fees associated with peer-to-peer lending?

Peer-to-peer lending platforms generally charge fees to both borrowers and lenders. These fees can vary depending on the platform and the specific services provided. It is important to carefully review the fee structure of a platform before participating in peer-to-peer lending.

Final Thoughts

In conclusion, peer-to-peer lending is a form of online lending that connects individual borrowers with lenders through platforms. It offers advantages such as lower interest rates, flexible loan terms, and a streamlined application process. However, it also comes with risks that borrowers and lenders need to be aware of. These risks include the potential for defaults, fraud, and the lack of regulation and government protection. Therefore, it is important for individuals to carefully assess the risks involved before engaging in peer-to-peer lending, ensuring they are making informed decisions to protect their investments and financial stability.