Looking to invest your money and earn higher returns? Peer-to-peer lending might just be the answer. So, what is peer-to-peer lending and its risks? In simple terms, it is a way for individuals to lend money to others without involving traditional financial institutions. This innovative concept allows borrowers to access funds quickly and investors to earn potentially higher interest rates. But before you dive in, it’s essential to understand the risks involved. Understanding the potential pitfalls will help you make informed decisions and navigate this exciting but somewhat uncharted financial terrain. Let’s explore the ins and outs of peer-to-peer lending and shed light on its associated risks.

What is Peer-to-Peer Lending and Its Risks

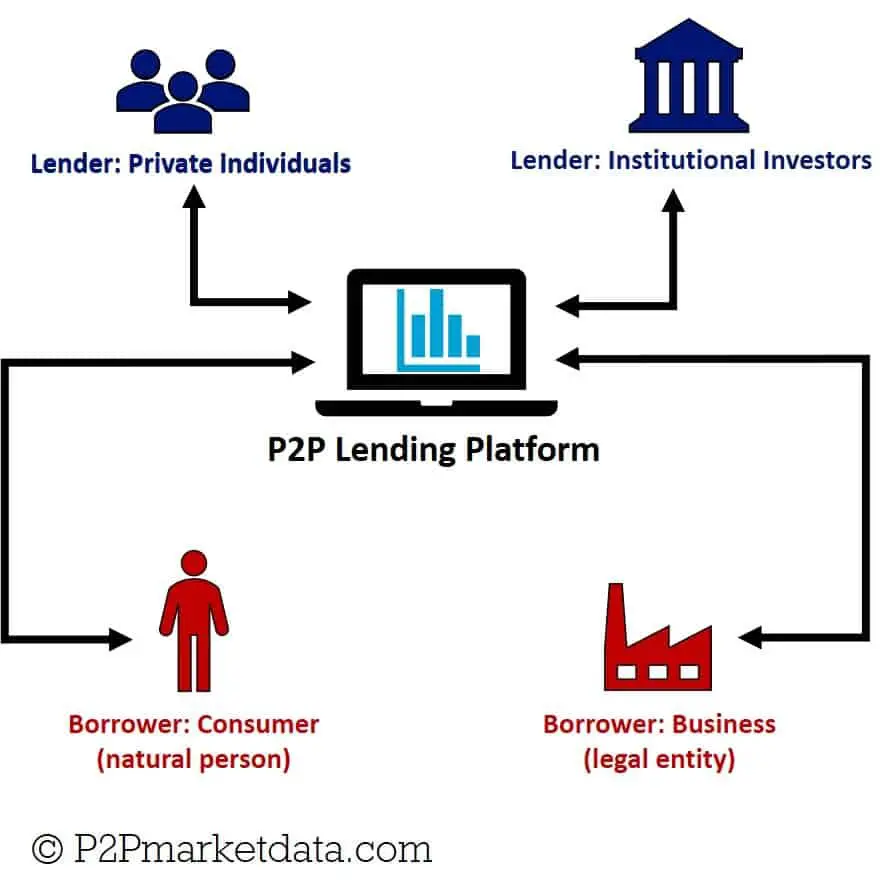

Peer-to-peer lending, also known as P2P lending or social lending, is a popular alternative to traditional bank loans. It allows individuals to lend and borrow money directly from each other without the need for intermediaries like banks. P2P lending platforms connect borrowers with lenders, enabling them to transact online and negotiate interest rates and loan terms. While P2P lending has gained traction in recent years due to its ease and accessibility, it is important for both borrowers and lenders to understand the risks involved in this form of lending.

The Mechanics of Peer-to-Peer Lending

P2P lending platforms operate through an online marketplace where borrowers can post loan requests and lenders can review and fund those requests. Here’s how the process typically works:

1. Borrower Application: A borrower submits an application for a loan on a P2P lending platform, providing details about their financial situation, the purpose of the loan, and the desired loan amount.

2. Loan Listing: The platform evaluates the borrower’s application and assigns an interest rate based on factors such as credit score, income, and loan purpose. Once approved, the loan is listed on the platform for lenders to review.

3. Lender Selection: Lenders can browse through the loan listings and invest in the loans that align with their investment criteria. They can choose to fund an entire loan or a fraction of it.

4. Loan Funding: When enough lenders have committed to funding a loan, the loan is considered fully funded, and the borrower receives the loan amount.

5. Loan Repayment: Borrowers make monthly payments, including principal and interest, to the platform. The platform distributes these payments to lenders according to their investment amounts.

Benefits of Peer-to-Peer Lending

Peer-to-peer lending offers several advantages for both borrowers and lenders, which contribute to its growing popularity:

For Borrowers:

– Flexibility: P2P lending platforms often have more lenient lending criteria compared to traditional banks, making it easier for borrowers with lower credit scores to secure loans.

– Competitive Interest Rates: Peer-to-peer lending platforms leverage the power of competition among lenders, potentially resulting in more competitive interest rates for borrowers.

– Speed and Convenience: The online nature of P2P lending allows borrowers to complete the loan application process quickly and conveniently without the need for in-person visits to banks.

For Lenders:

– Diversification: P2P lending offers an opportunity for lenders to diversify their investment portfolios by allocating funds to different borrowers and loan types.

– Higher Returns: Compared to traditional savings accounts and other conservative investment options, P2P lending has the potential to generate higher returns for lenders.

– Social Impact: P2P lending allows lenders to support individuals and small businesses directly, promoting financial inclusion and bypassing traditional financial institutions.

Risks of Peer-to-Peer Lending

While peer-to-peer lending presents several benefits, it is crucial for both borrowers and lenders to be aware of the risks involved. These risks include:

1. Default Risk: The primary risk in P2P lending is the possibility of borrowers defaulting on their loans. If a borrower fails to make repayments, lenders may suffer losses or delays in receiving their expected returns.

2. Platform Risk: P2P lending platforms act as intermediaries in the lending process. If a platform faces financial difficulties, experiences fraud, or shuts down, it can lead to losses for both borrowers and lenders.

3. Marketplace Liquidity: P2P lending is not as liquid as some other investment options. Once lenders commit their funds to loans, it may be challenging to withdraw or sell their loans before the loan term ends.

4. Regulatory and Legal Risks: The regulatory environment surrounding P2P lending is still evolving in many jurisdictions. Changes in regulations or legal issues related to P2P lending can impact the stability and operations of platforms, affecting lenders and borrowers.

5. Credit Risk: While P2P lending platforms assess borrowers’ creditworthiness, there is still a risk of inaccurate or incomplete evaluations leading to higher default rates.

Managing Risks in Peer-to-Peer Lending

To mitigate the risks associated with P2P lending, both borrowers and lenders can take certain precautions:

For Borrowers:

– Conduct thorough research on P2P lending platforms before choosing one to ensure their credibility and track record.

– Borrow only what is necessary and within their ability to repay, considering their income, expenses, and other financial obligations.

– Read and understand the loan agreement, including interest rates, fees, and any penalties for late payments or defaults.

For Lenders:

– Diversify investments across multiple loans and borrowers to reduce exposure to any single default.

– Assess borrowers’ creditworthiness by reviewing their financial information, credit history, and purpose of the loan.

– Regularly monitor loan performance and be prepared to take necessary actions if borrowers show signs of financial distress.

Peer-to-peer lending has revolutionized the lending landscape by offering an alternative to traditional financing options. It provides borrowers with increased access to funds and offers lenders the potential for higher returns. However, it is important to understand the risks involved, such as default risk, platform risk, marketplace liquidity, regulatory and legal risks, and credit risk. By conducting thorough research, diversifying investments, and practicing due diligence, borrowers and lenders can make informed decisions and navigate the P2P lending landscape more confidently.

Is P2P Lending Safe? P2P Lending Risks Explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is peer-to-peer lending?

Peer-to-peer lending, also known as P2P lending or marketplace lending, is a method of lending money to individuals or businesses without involving traditional financial institutions such as banks. It allows borrowers to connect directly with lenders through online platforms, cutting out the middleman.

How does peer-to-peer lending work?

In peer-to-peer lending, borrowers create loan listings on P2P lending platforms, outlining the desired loan amount and the interest rate they are willing to pay. Lenders then review these listings and choose which loans they want to fund. Once funded, borrowers receive the loan amount, and they repay the loan with interest over a specified period.

What are the benefits of peer-to-peer lending?

Peer-to-peer lending offers several advantages. It provides borrowers with access to financing that may be more flexible and potentially at lower interest rates compared to traditional loans. Lenders, on the other hand, have the opportunity to earn higher returns on their investments compared to other conventional investment options.

What are the risks of peer-to-peer lending?

While peer-to-peer lending can be rewarding, it does come with certain risks. One major risk is the potential for defaults. If borrowers fail to repay their loans, lenders may face financial losses. Additionally, as P2P lending is relatively new, there may be limited regulation, which could expose lenders and borrowers to fraudulent activities or unscrupulous practices.

How can I mitigate the risks of peer-to-peer lending?

To minimize the risks associated with peer-to-peer lending, it is important to diversify your investments across multiple loans rather than investing all your funds in one borrower. Properly assessing the creditworthiness of borrowers, carefully reading loan details, and choosing reputable platforms with robust risk assessment processes can also help mitigate risks.

Are there any fees involved in peer-to-peer lending?

Yes, P2P lending platforms typically charge fees to facilitate the lending process. These fees can vary from platform to platform and may include origination fees, servicing fees, or late payment fees. It is important to carefully review the fee structure of the chosen platform before engaging in peer-to-peer lending.

What happens if a borrower defaults on a peer-to-peer loan?

In the event of a borrower defaulting on a peer-to-peer loan, the lender may face financial losses. The P2P lending platform may try to recover the outstanding amount through collection efforts or by involving a collection agency. However, there is no guarantee of full recovery, and lenders should be prepared for potential losses.

Is my investment in peer-to-peer lending protected?

Unlike traditional banking, peer-to-peer lending investments are not typically protected by federal deposit insurance. However, some P2P lending platforms may offer their own protection schemes or partner with third-party providers to offer additional safeguards. It is essential to understand the specific protection measures offered by the platform you choose.

Please note that these FAQs provide general information and should not be considered as financial advice. It is recommended to consult with a qualified financial advisor before engaging in peer-to-peer lending or any investment activity.

Final Thoughts

Peer-to-peer lending is a form of borrowing and lending that takes place directly between individuals without the involvement of traditional financial institutions. While it offers several benefits, such as lower interest rates and easier access to loans, it also carries certain risks. The main risk is the potential for default by borrowers, as there is no guarantee that they will repay the borrowed amount. Additionally, the lack of regulation and oversight compared to traditional lending institutions increases the risk of fraudulent activities. It is important for investors to carefully assess and diversify their portfolios to mitigate these risks. In conclusion, peer-to-peer lending presents opportunities for both borrowers and investors, but it is crucial to be aware of its risks and take necessary precautions to safeguard one’s financial interests.