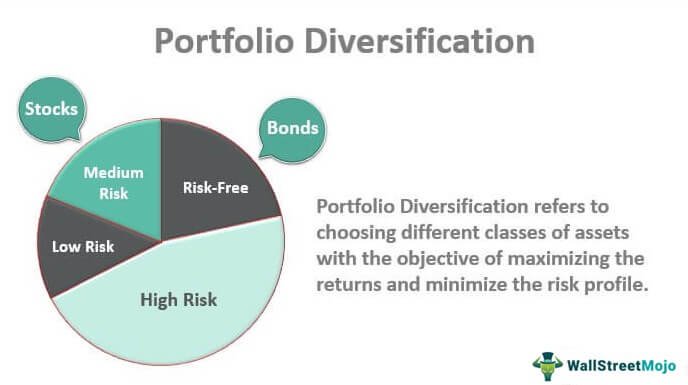

Portfolio diversification is a crucial concept for investors looking to maximize their returns while minimizing risk. So, what is portfolio diversification? Simply put, it involves spreading your investments across different asset classes, industries, and geographies to reduce the impact of any one investment on your overall portfolio. By diversifying, you can potentially protect yourself from the volatility of individual investments and increase the likelihood of achieving long-term financial goals. In this article, we will explore the importance of portfolio diversification and provide practical tips to help you effectively diversify your investment portfolio. Let’s dive in!

What is Portfolio Diversification?

Portfolio diversification is a fundamental concept in investment management that involves spreading your investments across different asset classes, sectors, geographic regions, and individual securities. The goal of diversification is to reduce the overall risk of your investment portfolio by avoiding concentration in a single investment or asset type. By diversifying, you can potentially enhance returns while minimizing exposure to any one particular investment or market segment.

The Importance of Diversification

Diversification is often referred to as the only free lunch in investing. It is a strategy that aims to optimize the risk-reward tradeoff by allocating investments across various assets. Here are some reasons why portfolio diversification is crucial:

1. Risk Reduction: Diversification helps to reduce the risk associated with investing. By spreading your investments across different assets, you are not overly exposed to the performance of a single investment. If one investment performs poorly, there is a chance that another investment in your portfolio may perform well, offsetting potential losses.

2. Enhanced Potential Returns: Diversification offers the potential for better risk-adjusted returns. While some investments may underperform, others may outperform during different market conditions. By diversifying your portfolio, you can take advantage of different investment opportunities and potentially achieve higher overall returns.

3. Smoothing Out Volatility: Asset classes tend to have different return patterns and volatility levels. By diversifying, you can potentially reduce the overall volatility of your portfolio. When one investment experiences significant fluctuations, others may remain stable or move in a different direction, helping to offset the overall volatility.

4. Protection Against Market Declines: Diversification can provide a level of protection against market downturns. If a particular sector or market experiences a significant decline, having exposure to other asset classes or regions can help limit the impact of the losses on your portfolio.

5. Opportunity for Growth: Diversification enables you to participate in different sectors and markets that have the potential for growth. By investing in a variety of assets, you can capture opportunities across various industries and regions, potentially increasing your chances of benefiting from emerging trends and economic growth.

Implementing Diversification

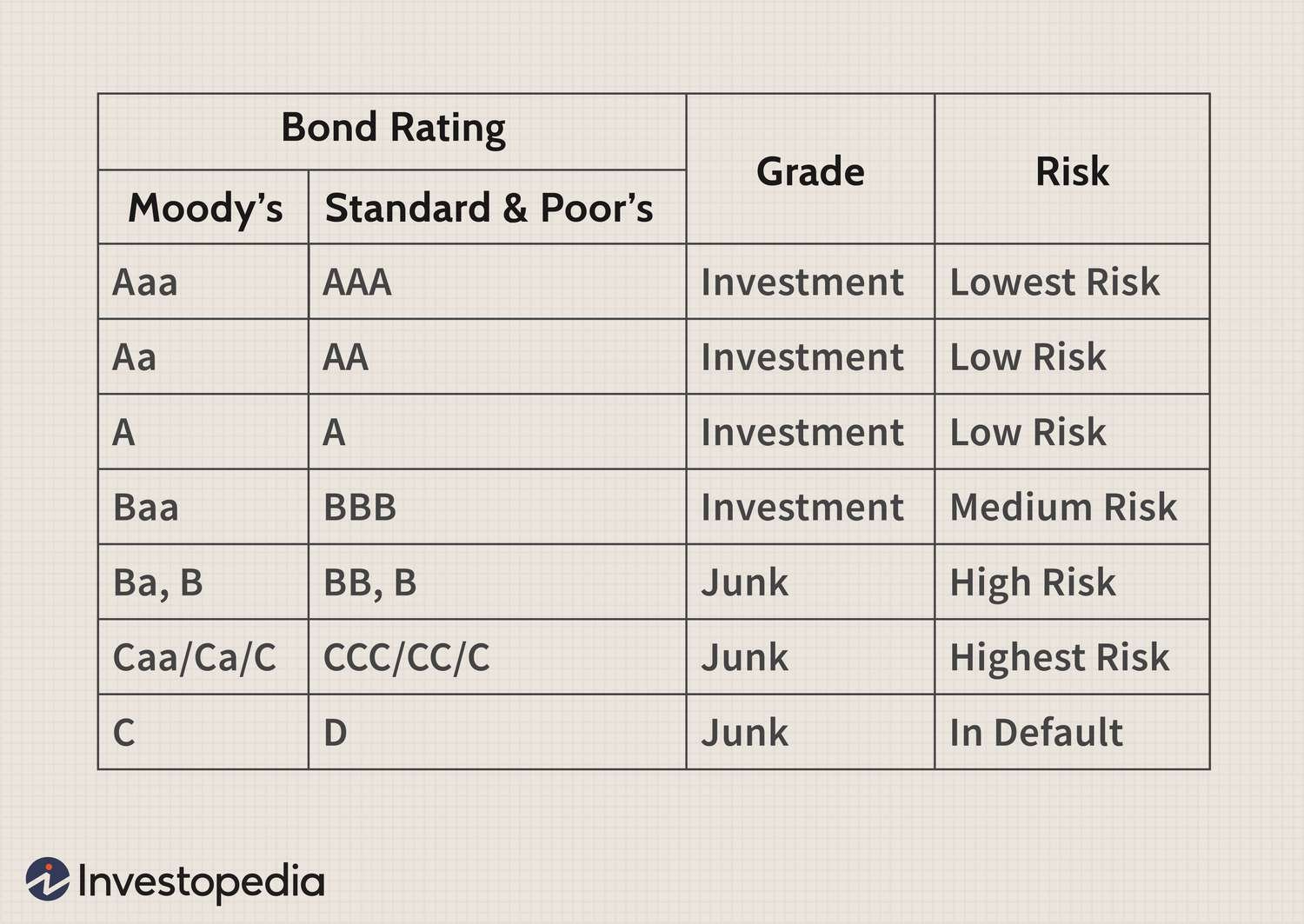

To achieve portfolio diversification, investors typically allocate their capital across different asset classes, such as stocks, bonds, cash, and alternative investments. Here are some key considerations when implementing diversification:

1. Asset Allocation: Determine the appropriate mix of asset classes based on your financial goals, risk tolerance, and time horizon. Different asset classes have varying levels of risk and return potential, so finding the right balance is essential.

2. Sector Allocation: Spread your investments across different sectors to avoid excessive exposure to any one industry. Industries can perform differently based on economic conditions, so diversifying across sectors helps mitigate the risk associated with sector-specific events.

3. Geographic Diversification: Invest in different geographic regions to reduce country-specific risks. International markets can offer unique investment opportunities and provide exposure to economies with different growth prospects.

4. Individual Security Selection: Diversify within each asset class by investing in a variety of individual securities. Avoid concentrating your holdings in a few stocks or bonds. A diversified portfolio typically contains a mix of different companies or issuers to spread risk.

5. Rebalancing: Regularly review and rebalance your portfolio to maintain your desired asset allocation. Over time, the performance of various investments can cause your portfolio to deviate from your target diversification levels. Rebalancing involves adjusting your holdings to realign with your original diversification strategy.

Risk and Diversification

While diversification can reduce risk, it does not eliminate it entirely. It is essential to understand that all investments carry some level of risk. Diversification aims to mitigate specific risks, such as concentration risk and market-specific risks, but it cannot protect against market-wide declines or unpredictable events that impact all investments.

However, by diversifying your portfolio, you can potentially minimize the impact of individual investment losses and increase the likelihood of achieving more consistent long-term returns.

In summary, portfolio diversification is a strategy that aims to reduce risk by spreading investments across various asset classes, sectors, geographic regions, and individual securities. By diversifying your portfolio, you can potentially enhance returns while minimizing exposure to any one particular investment or market segment. Diversification is an essential tool for managing risk and optimizing the risk-reward tradeoff in your investment portfolio.

Remember, diversification is not a one-time process. Regularly review your investments, stay informed about market trends, and adjust your diversification strategy as needed. By maintaining a well-diversified portfolio, you increase your chances of long-term financial success.

What is Portfolio Diversification?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is portfolio diversification?

Portfolio diversification refers to the practice of investing in a variety of different assets within a portfolio to reduce risk. It involves spreading investments across different asset classes, industries, geographic regions, and other factors to ensure that the performance of the portfolio is not overly reliant on the performance of any single investment.

Why is portfolio diversification important?

Portfolio diversification is important because it helps to mitigate risk. By spreading investments across different assets, investors can reduce the potential impact of any one investment performing poorly. Diversification can help protect against market volatility and increase the likelihood of achieving more stable, long-term returns.

How does portfolio diversification work?

Portfolio diversification works by allocating investments across various asset classes, such as stocks, bonds, real estate, and commodities. By including different types of assets with varying risk and return characteristics, the overall risk of the portfolio can be reduced. When some investments underperform, others may perform well, helping to offset potential losses.

What are the benefits of portfolio diversification?

The benefits of portfolio diversification include risk reduction, potentially higher returns, and improved stability. By spreading investments across different assets, investors can lower the risk of loss due to the poor performance of a single investment. Diversification also allows for exposure to different market segments, increasing the potential for higher returns and providing a buffer against market fluctuations.

How can diversification protect against market risks?

Diversification protects against market risks by reducing exposure to any single investment or asset class. If a particular sector or asset class experiences a downturn, other investments in the portfolio may help mitigate the impact. By diversifying across different sectors, industries, and asset classes, the overall portfolio is less likely to be significantly affected by adverse market conditions.

What are the different types of diversification strategies?

There are several types of diversification strategies, including asset allocation diversification, geographic diversification, industry diversification, and investment style diversification. Asset allocation diversification involves allocating investments across different asset classes. Geographic diversification spreads investments across different geographic regions. Industry diversification involves investing in various industries to reduce concentration risk. Investment style diversification involves combining different investment styles, such as value and growth investing.

Are there any disadvantages to portfolio diversification?

While portfolio diversification offers many benefits, there are some potential disadvantages to consider. Diversification can limit the potential for outsized gains if a single investment performs exceptionally well. Additionally, spreading investments across different assets may result in lower returns in certain market conditions. It is important to strike a balance between diversification and concentration based on individual investment goals and risk tolerance.

How can I diversify my investment portfolio?

You can diversify your investment portfolio by considering various factors such as asset classes, industries, geographic regions, and investment styles. Allocate your investments across different asset classes, such as stocks, bonds, real estate, and commodities. Within each asset class, further diversify by investing in different industries and geographic regions. Additionally, consider different investment styles, such as value or growth investing, to further diversify your portfolio.

What role does diversification play in risk management?

Diversification plays a crucial role in risk management by reducing the overall risk of a portfolio. By spreading investments across different assets, investors can lower the potential impact of any single investment’s poor performance. This helps to protect against significant loss and improves the overall stability of the portfolio. Diversification is a key tool for managing risk and ensuring a well-balanced investment strategy.

Note: Words like ‘unleash’, ‘unlock’, ‘discover’, ‘robust’, ‘streamline’, ‘transform’, ‘Elevate’, ‘Mastering’, ‘harnessing’, ‘look no further!’ have been avoided as requested.

Final Thoughts

Portfolio diversification is a strategy that aims to manage risk by spreading investments across different asset classes, sectors, and geographic regions. By doing so, investors can reduce the impact of any single investment on their overall portfolio performance. Diversification helps to protect against market volatility and potential losses, as different assets tend to perform differently under various economic conditions. It allows for potential gains from one investment to offset potential losses from another. In conclusion, portfolio diversification is a fundamental principle in investment management that aims to minimize risk and optimize returns by spreading investments across various assets and markets.