Portfolio diversification in real estate is a powerful strategy that can enhance your investment success. Wondering what it entails? Well, it’s about spreading your real estate investments across different properties, locations, and types. This approach helps mitigate risks and maximizes potential returns. Picture this: by investing in a mix of residential, commercial, and rental properties, you can reduce the impact of market fluctuations and ensure a stable income stream. In this article, we will delve deeper into the concept of portfolio diversification in real estate and explore how it can be a game-changer for your investment journey. So, let’s dive in!

What is Portfolio Diversification in Real Estate?

Investing in real estate can be a lucrative endeavor, but it also comes with inherent risks. One way to mitigate these risks is through portfolio diversification. Portfolio diversification refers to spreading your investments across different types of real estate assets to minimize the impact of any single investment on your overall portfolio. By doing so, you can potentially achieve a more stable and balanced return on investment.

Diversification is a fundamental principle in investing, and it holds true for real estate as well. By investing in a variety of real estate properties, you can reduce the impact of market fluctuations that may affect a specific sector or location. Here are some key aspects of portfolio diversification in real estate that you should consider:

1. Investing in Different Property Types

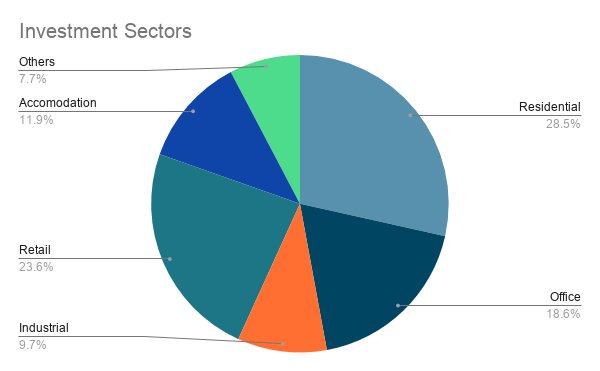

One way to diversify your real estate portfolio is by investing in different property types. This allows you to spread your risk across various segments of the real estate market. Some common property types you can consider include:

- Residential properties: This includes single-family homes, multi-family buildings, and condominiums.

- Commercial properties: This includes office buildings, shopping centers, and industrial properties.

- Specialized properties: This includes healthcare facilities, hotels, and storage units.

Investing in different property types not only helps you diversify your investment but also provides the opportunity to tap into different market cycles and capture potential growth in various sectors.

2. Geographical Diversification

Another vital aspect of real estate portfolio diversification is geographical diversification. Investing in properties located in different regions or cities spreads the risk associated with localized market conditions. It allows you to take advantage of economic growth and demographic trends in different areas.

Consider investing in properties across multiple states or countries to reduce your exposure to regional economic downturns or market-specific risks. However, it’s important to conduct thorough research on each market and understand its potential for growth, rental demand, and regulatory environment.

3. Mix of Rental and Non-Rental Properties

Including both rental and non-rental properties in your real estate portfolio can offer additional diversification benefits. Rental properties generate ongoing cash flow through rental income, while non-rental properties can provide potential appreciation or alternative income streams.

Non-rental properties can include properties used for personal use, such as vacation homes or second homes. The value of these properties may appreciate over time, providing a potential return on investment when sold. Additionally, non-rental properties diversify your portfolio by reducing reliance on rental income and potential vacancies.

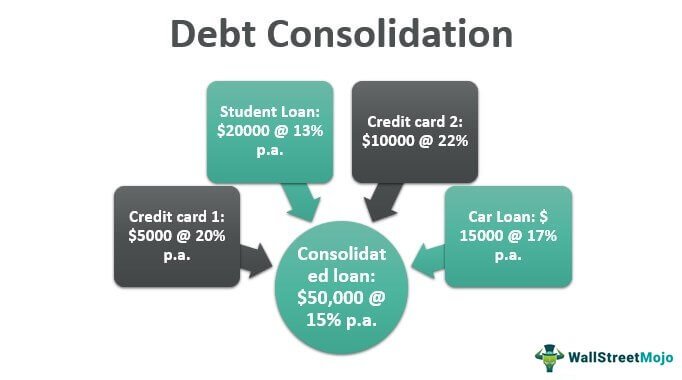

4. Investment Vehicles for Real Estate Diversification

To achieve real estate portfolio diversification, investors have several investment vehicles at their disposal. Understanding these options can help you allocate your investments effectively. Some common investment vehicles include:

- Direct ownership: This involves purchasing individual properties or real estate assets outright.

- Real estate investment trusts (REITs): REITs are companies that own, operate, or finance income-generating real estate. Investing in REITs provides exposure to a diversified portfolio of properties.

- Real estate crowdfunding: Crowdfunding platforms allow investors to pool their funds to invest in specific real estate projects. This provides access to a range of properties and reduces the need for substantial capital.

- Real estate mutual funds or ETFs: These investment funds pool money from multiple investors to invest in a diversified portfolio of real estate assets. They offer the benefit of professional management and liquidity.

Choosing the right investment vehicle depends on your risk appetite, investment goals, and available capital. It’s essential to research and understand each option before making investment decisions.

5. Risk Management and Monitoring

Diversifying your real estate portfolio is not a one-time activity. It requires ongoing risk management and monitoring. Here are some key aspects to consider:

- Regular portfolio review: Periodically review your portfolio to ensure it aligns with your investment strategy and risk tolerance. Make adjustments as needed to maintain diversification.

- Stay informed: Stay updated on market trends, regional economic conditions, and regulatory changes that may impact your real estate investments.

- Risk assessment: Assess the risks associated with each property type and location to determine the level of diversification needed.

- Professional advice: Consider seeking advice from real estate professionals or financial advisors who specialize in real estate investments.

By actively managing and monitoring your real estate portfolio, you can adapt to market changes, mitigate risks, and optimize your returns.

6. Balance Between Stability and Growth

When diversifying your real estate portfolio, striking a balance between stability and growth is important. While some properties may offer higher growth potential, they may also come with higher risk. On the other hand, more stable properties may provide reliable income but limited growth prospects.

Consider your investment objectives and risk tolerance when allocating your portfolio. A mix of stable and growth-oriented properties can help you achieve a balanced real estate portfolio that aligns with your goals.

In conclusion, portfolio diversification in real estate involves spreading investments across different property types, locations, and investment vehicles. By diversifying your real estate holdings, you reduce the impact of a single investment on your overall portfolio and increase the potential for stable returns. However, diversification does not eliminate all investment risks, and careful research and ongoing portfolio management are essential for successful real estate investing.

????This is a GREAT portfolio DIVERSIFICATION! ???? #investing

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is portfolio diversification in real estate?

Portfolio diversification in real estate refers to the strategy of investing in a variety of properties or real estate markets to spread risk and potentially maximize returns. By diversifying their real estate portfolio, investors reduce their exposure to any single property or market, increasing the potential for long-term financial stability and growth.

Why is portfolio diversification important in real estate?

Portfolio diversification is important in real estate because it helps investors mitigate risk and minimize the impact of market fluctuations. By spreading their investments across different types of properties, locations, and markets, investors can protect themselves from severe losses that could occur if their entire portfolio was concentrated in a single property or market.

How can I diversify my real estate investment portfolio?

To diversify your real estate investment portfolio, you can consider investing in different types of properties such as residential, commercial, or industrial. Additionally, investing in properties located in different geographical areas or real estate markets can help you achieve diversification. Another option is to invest in real estate investment trusts (REITs) or real estate mutual funds, which provide exposure to a diversified portfolio of properties.

What are the benefits of portfolio diversification in real estate?

The benefits of portfolio diversification in real estate include reduced risk exposure, potential for higher returns, and increased resilience to market downturns. Diversification allows investors to take advantage of various real estate opportunities and potentially achieve a more stable and predictable income stream.

Are there any risks associated with portfolio diversification in real estate?

While portfolio diversification in real estate helps minimize risks, there are still certain risks involved. Real estate markets can experience downturns, and some properties may underperform or face unexpected challenges. However, by diversifying your investments, you can reduce the impact of such risks on your overall portfolio.

How do I assess the performance of my diversified real estate portfolio?

To assess the performance of your diversified real estate portfolio, you can track various key metrics such as rental income, property appreciation, occupancy rates, and overall cash flow. Monitoring these indicators will help you evaluate the success of your investment strategy and identify any adjustments that may be necessary.

What are some common mistakes to avoid when diversifying a real estate portfolio?

When diversifying a real estate portfolio, it is important to avoid some common mistakes such as over-diversification, lack of proper research, and not considering the overall investment strategy. Over-diversification can dilute returns, while insufficient research may lead to investing in poorly performing properties. It is crucial to have a clear investment strategy to guide your diversification decisions.

Can I diversify my real estate portfolio without directly owning properties?

Yes, you can diversify your real estate portfolio even without directly owning properties. Real estate investment trusts (REITs), real estate crowdfunding platforms, and real estate mutual funds provide opportunities to invest in a diversified portfolio of properties without the need for direct ownership. These investment vehicles allow you to access the benefits of real estate diversification with potentially lower capital requirements and increased liquidity.

Final Thoughts

Portfolio diversification in real estate refers to the strategic allocation of investments across different properties and locations to minimize risk and maximize returns. By spreading investments across a variety of real estate assets, such as residential, commercial, and industrial properties, investors can reduce their exposure to fluctuations in any single market or property type. Diversification allows investors to potentially benefit from different market conditions and capture opportunities for growth. It also helps to mitigate the impact of potential downturns in specific sectors or regions. Ultimately, portfolio diversification in real estate is a key strategy for investors looking to build a resilient and profitable investment portfolio.