Quantitative easing and its impact have become hot topics in the world of economics. Wondering what exactly quantitative easing is and how it affects the economy? Look no further! In simple terms, quantitative easing refers to a monetary policy where central banks buy government securities to inject money into the economy. This strategy is often used to stimulate economic growth and combat recessionary pressures. But what are the consequences of this approach? Let’s delve into the intricacies of quantitative easing and explore its impact on various aspects of the economy.

What is Quantitative Easing and Its Impact

Quantitative easing (QE) is a monetary policy tool employed by central banks to stimulate the economy. It involves the purchase of government securities or other financial assets from the market to increase the money supply and encourage lending and investment. This article will delve into the concept of quantitative easing, its purpose, how it works, and its impact on various aspects of the economy.

Understanding Quantitative Easing

Quantitative easing is typically implemented by central banks when traditional monetary policies are ineffective in stimulating economic growth. In a normal scenario, central banks primarily influence the economy through the manipulation of interest rates. By lowering interest rates, borrowing becomes cheaper, leading to increased consumer spending, business investments, and economic growth. Conversely, raising interest rates curbs inflationary pressures and cools down an overheating economy.

However, during periods of economic downturn or when interest rates are already low, central banks may employ unconventional measures like quantitative easing to boost economic activity. Instead of adjusting interest rates, central banks directly inject money into the economy by purchasing financial assets, such as government bonds or corporate bonds, from commercial banks and other financial institutions. This injection of liquidity aims to lower borrowing costs, increase the availability of credit, and stimulate spending and investment.

The Process of Quantitative Easing

The process of quantitative easing involves several steps:

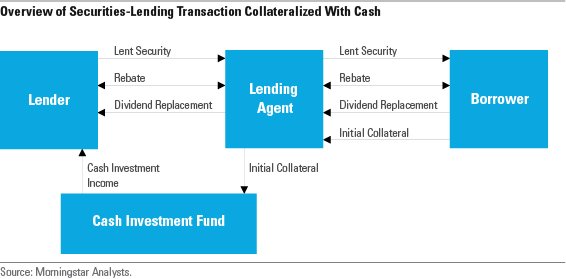

1. Asset Purchase: The central bank initiates the quantitative easing process by purchasing government bonds or other assets from commercial banks and financial institutions. These assets are typically held by these institutions as part of their reserves.

2. Increased Reserves: The central bank pays for the assets by crediting the accounts of the selling institutions. This increases the reserves of these institutions, providing them with more funds to lend.

3. Boosting Money Supply: The increased reserves allow commercial banks to expand their lending activities, which in turn enhances the money supply in the economy. This increased money supply encourages borrowing and spending.

4. Lowering Long-Term Interest Rates: As the central bank continues to purchase assets, it reduces the supply of these assets in the market. This reduced supply drives up their prices and lowers their yields. Consequently, long-term interest rates decline, making it cheaper for businesses and individuals to borrow and invest.

Overall, the aim of quantitative easing is to stimulate economic growth by increasing the availability of credit and lowering borrowing costs, thereby encouraging consumption and investment.

The Impact of Quantitative Easing

Quantitative easing has both intended and unintended consequences on various aspects of the economy. The following sections explore the impact of quantitative easing in detail:

1. Interest Rates and Inflation

– Lower Interest Rates: Quantitative easing aims to reduce interest rates to stimulate borrowing and investment. By purchasing government bonds, central banks increase demand for these bonds, which leads to rising bond prices and falling yields. This decline in yields lowers long-term interest rates, making it cheaper for individuals and businesses to borrow.

– Inflationary Pressures: Quantitative easing can potentially increase inflationary pressures in the economy. By injecting money into the system, central banks aim to boost spending and investment. However, if the increase in money supply is not met with a corresponding increase in the production of goods and services, it can lead to inflationary pressures.

2. Stock Markets and Asset Prices

– Stock Market Boost: Quantitative easing often has a positive impact on stock markets. As central banks purchase financial assets, it leads to an increase in demand for these assets, including stocks. This increased demand can push up stock prices, benefiting investors and providing a boost to consumer wealth and confidence.

– Asset Price Inflation: Quantitative easing has the potential to inflate asset prices beyond their intrinsic values. When there is excess liquidity in the economy, investors may divert funds into assets such as real estate or stocks, causing prices to surge. This can create asset price bubbles that may eventually burst, leading to market instability.

3. Currency Exchange Rates

– Currency Depreciation: Quantitative easing can lead to currency depreciation. When a central bank injects money into the economy, it increases the supply of the domestic currency. This increased supply can lead to a decrease in the currency’s value relative to other currencies, making exports more competitive and imports more expensive.

– Trade Imbalances: Currency depreciation resulting from quantitative easing may create trade imbalances. A weaker currency can boost a country’s exports, making them more attractive in the international market. However, it also makes imports more expensive, potentially leading to trade imbalances and impacting the balance of payments.

4. Economic Growth and Employment

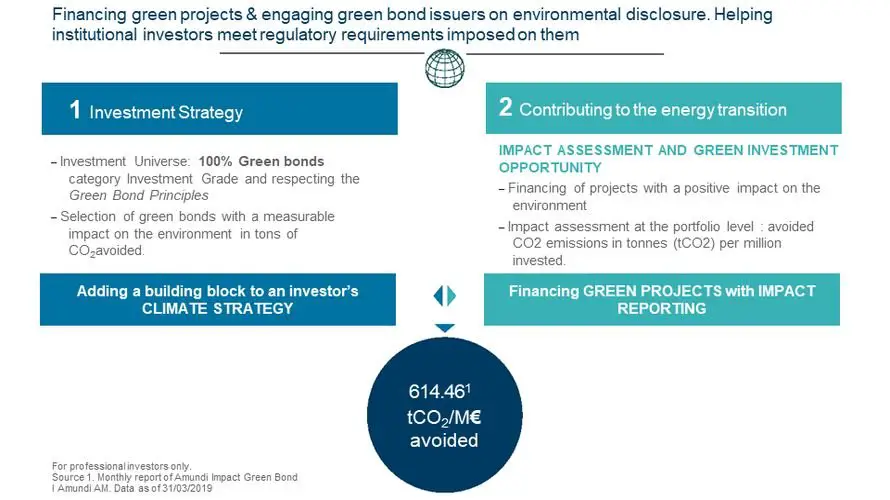

– Economic Stimulus: The primary objective of quantitative easing is to stimulate economic growth during times of economic downturn. By lowering interest rates, increasing credit availability, and encouraging borrowing and investment, quantitative easing aims to boost overall economic activity and promote recovery.

– Employment Impact: Quantitative easing can have a positive impact on employment. By spurring economic growth, businesses are more likely to expand their operations and hire additional workers. Additionally, lower borrowing costs resulting from quantitative easing can incentivize businesses to invest in new projects, creating job opportunities.

In conclusion, quantitative easing is a monetary policy tool employed by central banks to stimulate economic growth during periods of economic downturn or when interest rate adjustments are ineffective. By injecting liquidity into the economy, quantitative easing aims to lower borrowing costs, increase credit availability, and stimulate spending and investment. However, it also has potential impacts on interest rates, inflation, stock markets, currency exchange rates, and employment. Understanding these effects is crucial for policymakers and investors to navigate the complex dynamics of the economy.

What is Quantitative Easing?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is quantitative easing and its impact?

Quantitative easing refers to a monetary policy implemented by central banks to stimulate the economy. It involves the purchase of government bonds and other financial assets from commercial banks, which increases the money supply and lowers interest rates. The impact of quantitative easing can vary, but it is primarily aimed at boosting economic growth, encouraging lending and investment, and combating deflation.

How does quantitative easing work?

Quantitative easing works by injecting liquidity into the financial system. Central banks create new money electronically and use it to purchase government bonds and other assets. This increases the reserves of commercial banks, allowing them to lend more money to businesses and individuals. By reducing interest rates, quantitative easing also aims to encourage borrowing and investment, thereby stimulating economic activity.

What are the goals of quantitative easing?

The goals of quantitative easing are to stimulate economic growth, combat deflation, increase inflation, lower long-term interest rates, and encourage lending and investment. By injecting liquidity into the financial system and lowering borrowing costs, central banks aim to boost consumer spending, business investment, and overall economic activity.

What are the potential benefits of quantitative easing?

Quantitative easing can have several potential benefits. It can help to reduce borrowing costs for businesses and individuals, making it easier to obtain loans for investment or consumption. It can also support asset prices, such as stocks and real estate, which can increase household wealth and confidence. Additionally, quantitative easing can stimulate economic growth, create jobs, and mitigate the risk of deflationary spirals.

Are there any risks or drawbacks associated with quantitative easing?

Yes, there are risks and drawbacks associated with quantitative easing. One concern is the potential for inflation to rise too quickly if the money supply expands rapidly without a corresponding increase in goods and services. Another risk is that quantitative easing may lead to excessive risk-taking and the creation of asset bubbles in financial markets. Moreover, there is a possibility that central banks may find it challenging to unwind the stimulus measures effectively without disrupting the economy.

Has quantitative easing been used before?

Yes, quantitative easing has been used before. It gained prominence during the global financial crisis of 2007-2008 when central banks, such as the US Federal Reserve, the Bank of England, and the European Central Bank, implemented large-scale quantitative easing programs to stabilize financial markets and stimulate economic growth. Since then, it has been used in various countries during periods of economic downturn or deflationary pressures.

Does quantitative easing always achieve its desired results?

Quantitative easing does not always guarantee the desired results. Its effectiveness can vary depending on several factors, including the severity of the economic downturn, the overall health of the financial system, and the willingness of banks and businesses to lend and invest. Additionally, other external factors, such as global economic conditions and fiscal policies, can influence the impact of quantitative easing on the economy.

Can quantitative easing be used indefinitely?

While quantitative easing can be an effective tool during times of economic crisis or recession, it is generally intended as a temporary measure. Prolonged and excessive use of quantitative easing can create risks, such as inflationary pressures and unsustainable asset price increases. Central banks aim to withdraw the stimulus gradually once the economy shows signs of recovery and stability, which may involve reducing bond purchases and increasing interest rates.

Final Thoughts

Quantitative easing is a monetary policy tool used by central banks to stimulate the economy. By purchasing government bonds and other securities, the central bank injects money into the economy, which increases liquidity and lowers interest rates. This can help encourage borrowing and spending, stimulating economic growth. However, quantitative easing can also have negative consequences, such as the risk of inflation and potential distortions in asset prices. Overall, quantitative easing has a significant impact on the economy, affecting factors such as employment, inflation, and exchange rates. Understanding the effects of quantitative easing is crucial for policymakers and investors alike.