Tax-loss harvesting is a smart strategy employed by investors to reduce their tax liability and maximize their investment returns. Wondering what tax-loss harvesting is and how it works? Well, it’s a process where investors sell securities that have experienced losses to offset the gains from other investments. By strategically selling these underperforming assets, investors can generate losses that can be used to offset taxable gains, thereby reducing their overall tax bill. Let’s delve deeper into the concept of tax-loss harvesting and explore how this tactic can be harnessed effectively to optimize your investment portfolio.

What is Tax-Loss Harvesting and How it Works

Tax-loss harvesting is an investment strategy that can help investors minimize their tax liabilities and potentially increase their after-tax returns. It involves selling investments that have experienced a loss to offset capital gains and reduce taxable income. By strategically harvesting losses, investors can improve their overall tax efficiency and potentially enhance their long-term portfolio performance.

Understanding Tax Losses and Capital Gains

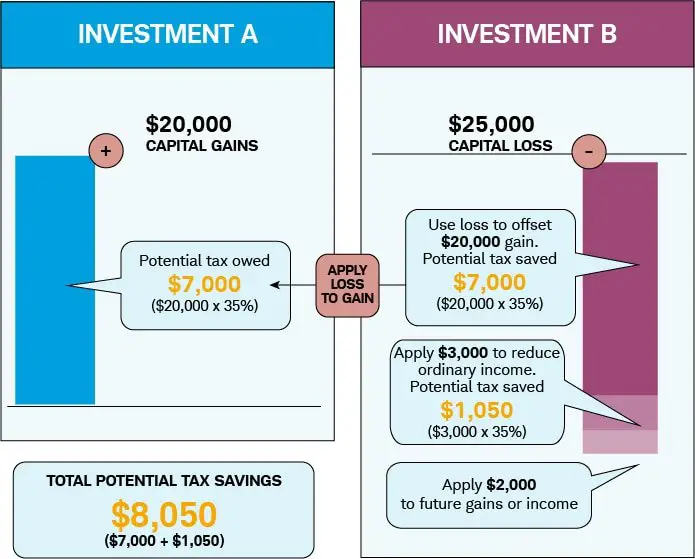

Before diving into the details of tax-loss harvesting, it’s important to understand the concept of tax losses and capital gains. When an investor sells an investment, they may have either a capital gain or a capital loss. A capital gain occurs when the selling price is higher than the purchase price, resulting in a profit. On the other hand, a capital loss occurs when the selling price is lower than the purchase price, resulting in a loss.

Capital gains are taxable, meaning that investors must report and pay taxes on the profits they make from their investments. However, capital losses can be used to offset capital gains, reducing the overall tax liability. This is where tax-loss harvesting comes into play.

How Tax-Loss Harvesting Works

Tax-loss harvesting involves selling investments that have experienced a loss to offset capital gains. Here’s a step-by-step breakdown of how it works:

1. Identify Investments with Losses: The first step is to identify which investments in your portfolio have experienced losses. These investments are known as “harvestable losses.”

2. Sell Harvestable Losses: Once you have identified the harvestable losses, you sell these investments to realize the losses for tax purposes. It’s important to note that tax-loss harvesting only works for taxable investment accounts, not for tax-advantaged accounts like IRAs or 401(k)s.

3. Offset Capital Gains: The losses from the harvested investments are used to offset any capital gains you may have realized throughout the year. By offsetting capital gains, you can reduce your taxable income and potentially lower your tax bill.

4. Carryover Losses: If your capital losses exceed your capital gains, you can carry over the remaining losses to future years. These losses can be used to offset future capital gains, providing tax benefits in subsequent tax years.

5. Maintain Portfolio Allocation: After selling the harvestable losses, it’s important to maintain the desired asset allocation of your portfolio. This can be achieved by reinvesting the proceeds from the sold investments into similar assets or by using the cash to purchase other investments that align with your investment goals.

Benefits of Tax-Loss Harvesting

Tax-loss harvesting offers several benefits for investors, including:

1. Tax Efficiency: By strategically harvesting losses, investors can offset capital gains and potentially reduce their taxable income. This can result in tax savings and increased after-tax returns.

2. Portfolio Rebalancing: Tax-loss harvesting also provides an opportunity to rebalance your portfolio. By selling investments that have experienced losses, you can reallocate your portfolio to align with your long-term investment objectives.

3. Long-Term Performance: By consistently implementing tax-loss harvesting strategies, investors may enhance their overall portfolio performance over the long term. By reducing taxes, they can potentially reinvest more money and compound their returns over time.

Considerations and Limitations

While tax-loss harvesting can be a valuable strategy, there are some considerations and limitations to keep in mind:

1. Wash Sale Rule: The wash sale rule prohibits investors from repurchasing the same or a substantially identical investment within 30 days before or after selling it at a loss for tax purposes. Violating this rule can result in the disallowance of the loss for tax purposes. Therefore, investors need to be cautious and mindful of the wash sale rule when implementing tax-loss harvesting strategies.

2. Transaction Costs: Selling investments to harvest losses may incur transaction costs, such as brokerage fees or bid-ask spreads. It’s important to consider the impact of these costs when evaluating the potential benefits of tax-loss harvesting.

3. Short-Term vs. Long-Term Capital Gains: It’s worth noting that short-term capital gains are taxed at a higher rate than long-term capital gains. Therefore, tax-loss harvesting can be particularly beneficial for individuals with short-term capital gains.

4. Market Volatility: Tax-loss harvesting relies on market volatility and investments that have experienced losses. In a highly volatile market, there may be more opportunities for tax-loss harvesting. However, during periods of steady growth, harvestable losses may be limited.

5. Tax Planning: Tax-loss harvesting is just one component of an overall tax planning strategy. It’s important to consult with a tax professional to ensure that tax-loss harvesting aligns with your specific tax situation and long-term financial goals.

In conclusion, tax-loss harvesting is a powerful investment strategy that can help investors minimize their tax liabilities and potentially enhance their after-tax returns. By strategically selling investments that have experienced losses, investors can offset capital gains and reduce their taxable income. However, it’s important to consider the limitations and consult with a tax professional to ensure that tax-loss harvesting is suitable for your individual circumstances.

How Does Tax-Loss Harvesting Work?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is tax-loss harvesting and how does it work?

Tax-loss harvesting is a strategy used by investors to minimize their tax liability by offsetting capital gains with capital losses. When an investment experiences a decline in value, investors can sell that investment at a loss, which can then be used to offset taxable gains realized from the sale of other investments. By doing so, investors can lower their overall tax burden.

Are there any limitations to tax-loss harvesting?

Yes, there are certain limitations to tax-loss harvesting. The most important one is the “wash-sale rule,” which prohibits investors from repurchasing the same or substantially similar investment within 30 days before or after the sale. Violating this rule will nullify the tax benefits of the loss.

Who can benefit from tax-loss harvesting?

Tax-loss harvesting can be beneficial for anyone who has taxable investment accounts. It is particularly advantageous for individuals who have realized capital gains, as tax-loss harvesting can help offset those gains and reduce the tax owed.

Is tax-loss harvesting only applicable to stocks?

No, tax-loss harvesting can be applied to various types of investments, including stocks, bonds, mutual funds, and ETFs. It is important to note that tax-loss harvesting is most effective in taxable investment accounts as opposed to tax-advantaged accounts like IRAs or 401(k)s.

Can I implement tax-loss harvesting on my own?

Yes, some investors choose to implement tax-loss harvesting strategies on their own. However, it can be complex, requiring careful tracking of investment transactions and consideration of tax rules. Many investors opt to work with a financial advisor or use automated investment platforms that offer tax-loss harvesting services.

What are the potential benefits of tax-loss harvesting?

The main benefit of tax-loss harvesting is the reduction of tax liability. By offsetting capital gains with capital losses, investors can lower their taxable income and potentially save on taxes. Additionally, tax-loss harvesting can help rebalance investment portfolios and provide an opportunity to improve overall investment returns.

Is there a minimum investment required for tax-loss harvesting?

There is no specific minimum investment required for tax-loss harvesting. However, the effectiveness of tax-loss harvesting may depend on the amount of capital gains and losses generated within an investor’s portfolio. It is advisable to consult with a financial advisor to determine if tax-loss harvesting is suitable for your individual circumstances.

Are there any risks associated with tax-loss harvesting?

While tax-loss harvesting can provide tax benefits, it is crucial to consider potential risks. Selling investments solely for the purpose of tax-loss harvesting may disrupt long-term investment strategies and incur transaction costs. Additionally, market conditions can impact the availability of capital losses. It is important to carefully evaluate the potential benefits and risks before implementing tax-loss harvesting strategies.

Final Thoughts

Tax-loss harvesting is a strategy used by investors to offset capital gains taxes by selling investments that have experienced losses. This technique involves selling these investments at a loss and then reinvesting the proceeds into similar assets to maintain market exposure. By realizing losses, investors can reduce their taxable income, therefore minimizing the amount of taxes owed. The process of tax-loss harvesting is relatively straightforward: identify investments with losses, sell them, and reinvest the proceeds in a way that maintains portfolio allocation. By effectively implementing tax-loss harvesting, investors can potentially lower their tax burden while still staying invested in the market.