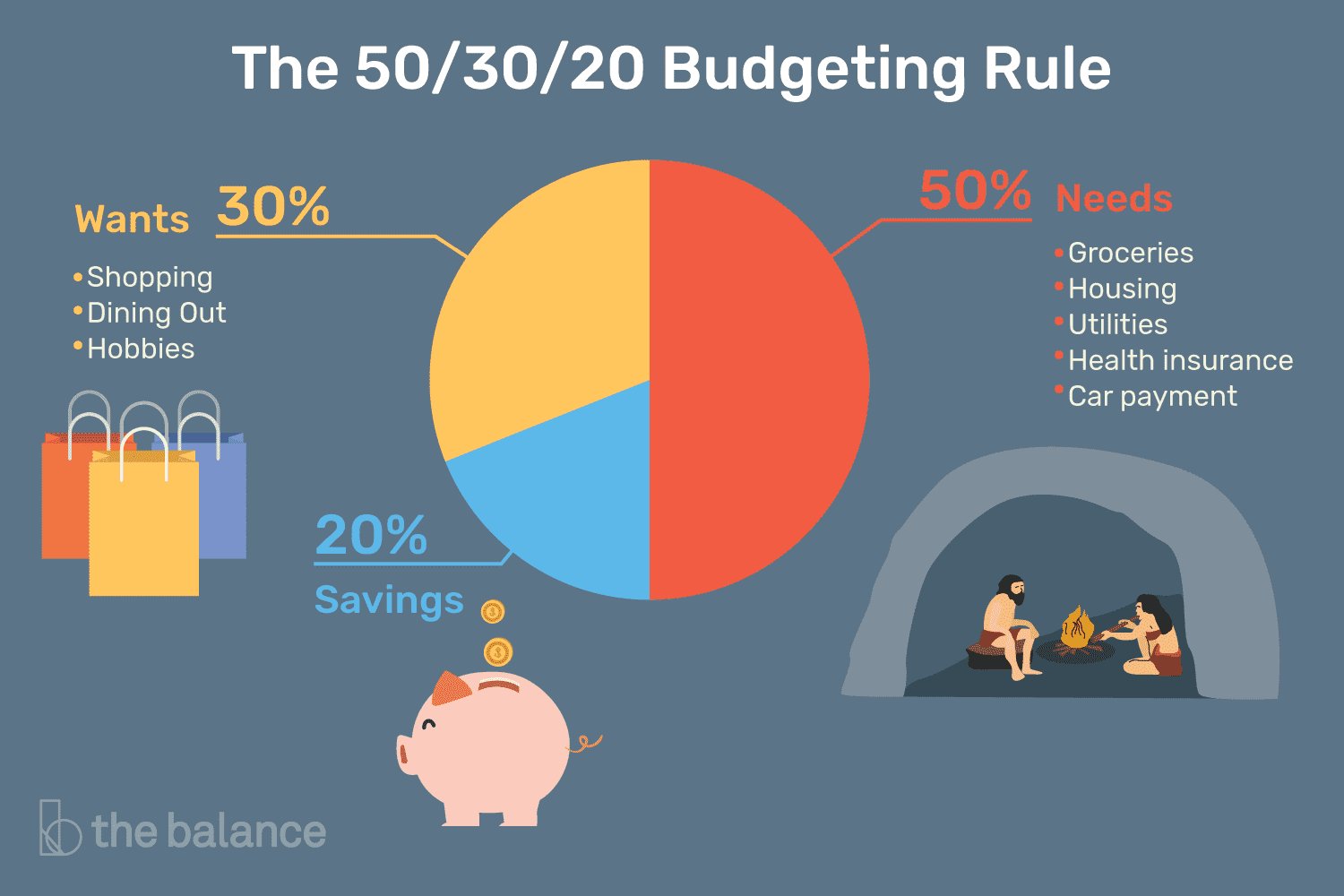

The 50/30/20 rule in budgeting is a game-changer when it comes to managing your finances. Wondering what it is? Well, it’s a simple yet effective strategy that helps you allocate your income in a way that promotes financial stability and smart spending habits. By following this rule, you can ensure that 50% of your income goes towards necessities, 30% towards wants, and 20% towards savings or debt repayment. In this article, we’ll delve into the ins and outs of the 50/30/20 rule in budgeting, giving you all the tools you need to take control of your finances. So, let’s get started!

What is the 50/30/20 Rule in Budgeting?

Budgeting is an essential skill that can help individuals manage their finances effectively. With numerous budgeting methods available, it can be overwhelming to choose the right one. However, the 50/30/20 rule is a popular budgeting strategy that provides a simple and flexible framework for managing income and expenses. In this article, we’ll explore what the 50/30/20 rule entails, how it works, and how you can implement it to achieve financial stability and reach your goals.

Understanding the Basics of the 50/30/20 Rule

The 50/30/20 rule is a budgeting guideline that suggests dividing your after-tax income into three main categories: needs, wants, and savings. According to this rule, you should allocate 50% of your income towards essential expenses, 30% towards discretionary spending, and 20% towards financial goals. Let’s dig deeper into each category:

1. Needs (50%)

The first category, needs, comprises essential expenses that are necessary for your basic living. These expenses typically include:

- Housing: Rent or mortgage payments, property taxes, and utility bills.

- Transportation: Car payments, fuel, insurance, and public transportation costs.

- Food: Groceries and essential household supplies.

- Healthcare: Health insurance, medications, and medical bills.

- Utilities: Internet, phone, electricity, water, and sanitation bills.

- Debt Payments: Student loans, credit card debt, and other outstanding loans.

By limiting your needs to 50% of your income, you ensure that your essential expenses are covered while leaving room for discretionary spending and savings.

2. Wants (30%)

The second category, wants, encompasses discretionary expenses that bring you joy or enhance your lifestyle. These expenses are not necessary for survival but contribute to your overall well-being. Some examples of wants include:

- Entertainment: Dining out, going to the movies, concerts, streaming services.

- Travel: Vacations, weekend getaways, and exploring new places.

- Hobbies: Sports, crafts, gaming, and personal interests.

- Clothing: Non-essential clothing purchases and accessories.

- Gym Memberships: Fitness classes, gym subscriptions, and workout equipment.

Allocating 30% of your income towards wants allows you to enjoy life and engage in activities that bring you happiness, while still maintaining a balanced financial plan.

3. Savings (20%)

The third and final category, savings, is crucial for your financial security and future goals. This includes:

- Emergency Fund: Building a fund to cover unexpected expenses or loss of income.

- Retirement Savings: Contributing to retirement accounts, such as a 401(k) or IRA.

- Investments: Allocating funds towards stocks, mutual funds, or real estate.

- Debt Repayment: Accelerating the payoff of high-interest debt.

- Savings Goals: Setting aside money for a down payment, education, or other long-term goals.

By allocating 20% of your income towards savings, you establish a strong financial foundation and work towards achieving your future aspirations.

Implementing the 50/30/20 Rule

Now that you understand the different categories of the 50/30/20 rule, how can you effectively implement it? Here are some steps to help you get started:

1. Calculate Your After-Tax Income

To begin, calculate your after-tax income, which is the amount you receive in your bank account after taxes and other deductions have been taken out. This will be the basis for dividing your income into the three categories.

2. Determine Your Essential Expenses

Identify your needs and calculate their total cost per month. This will include expenses such as rent, utilities, groceries, and debt payments. This category should not exceed 50% of your after-tax income.

3. Assess Your Discretionary Expenses

Evaluate your wants and estimate how much you typically spend on discretionary items each month. This may include entertainment, travel, and other non-essential spending. Ensure that these expenses fall within the 30% allocation.

4. Set Savings Goals

Decide on your financial goals and allocate 20% of your after-tax income towards savings. This percentage may vary depending on your priorities, such as saving for retirement, building an emergency fund, or paying off debt. Work towards maximizing this category over time.

5. Track and Adjust

Regularly monitor your spending and compare it to the budget you’ve set based on the 50/30/20 rule. Use budgeting apps or spreadsheets to track your expenses and identify areas where you may need to make adjustments. Flexibility is key, as your financial situation and priorities may change over time.

The Benefits of the 50/30/20 Rule

While the 50/30/20 rule may not be suitable for everyone, it offers several benefits that make it worth considering:

- Simplicity: The rule provides a straightforward framework that is easy to understand and implement.

- Flexibility: It allows you to maintain a balance between essential expenses, discretionary spending, and savings, giving you room to enjoy life while building financial security.

- Goal-Oriented: By allocating a significant portion of your income towards savings, you can actively work towards achieving important financial milestones.

- Financial Awareness: Following the 50/30/20 rule encourages you to be mindful of your spending habits and prioritize your financial well-being.

- Adaptability: The rule can be adjusted to fit your unique circumstances and financial goals. You can increase or decrease the percentage allocations based on your specific needs.

Budgeting plays a vital role in managing personal finances effectively. The 50/30/20 rule offers a practical and flexible approach to budgeting, ensuring that your needs are met, wants are satisfied, and savings are prioritized. By implementing this rule, you can take control of your finances, make informed spending decisions, and work towards a more secure financial future. Remember, each person’s situation is unique, so feel free to adapt the rule to best suit your needs and goals. Happy budgeting!

50/30/20 Budgeting Rule and How to Use It

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the 50/30/20 rule in budgeting?

The 50/30/20 rule is a popular budgeting strategy that helps individuals allocate their income in a balanced way. It suggests spending 50% of your income on necessities, 30% on wants, and 20% on savings and debt repayment. This rule provides a simple guideline to maintain a healthy financial life.

How does the 50/30/20 rule work?

The 50/30/20 rule works by dividing your after-tax income into three major categories. First, allocate 50% of your income for essential expenses such as rent, utilities, groceries, and transportation. Then, reserve 30% for discretionary spending on non-essential items like dining out, entertainment, and hobbies. Finally, direct 20% towards savings, investments, or paying off debts.

Is it necessary to strictly follow the 50/30/20 rule?

While the 50/30/20 rule serves as a helpful guideline, it may not work for everyone in every situation. It can be adjusted based on individual circumstances and financial goals. The key is to find a budgeting approach that aligns with your needs and allows you to make progress towards your financial objectives.

What are the benefits of using the 50/30/20 rule?

Using the 50/30/20 rule can offer several benefits. It helps you prioritize your spending and ensures that you have enough money for both essentials and discretionary expenses. Additionally, it promotes saving and debt repayment, enabling you to build an emergency fund or work toward long-term financial goals.

Can I modify the percentages of the 50/30/20 rule?

Yes, the percentages of the 50/30/20 rule can be adjusted based on your financial situation and goals. For instance, if you have high debt, you may choose to allocate a larger portion to debt repayment. Similarly, if you have aggressive savings goals, you can increase the percentage allocated for savings.

Should I include my taxes in the 50/30/20 rule?

The 50/30/20 rule generally focuses on after-tax income, meaning taxes are not directly factored into the percentages. However, it’s essential to consider taxes when calculating your income and expenses to ensure you allocate the appropriate amounts to each category.

How can I track my expenses to implement the 50/30/20 rule?

To implement the 50/30/20 rule effectively, you can track your expenses using various methods. Utilize budgeting apps, spreadsheets, or online tools to monitor your spending. Categorize your expenses and compare them against the designated percentages to maintain a balanced budget.

What if my income fluctuates monthly?

If your income fluctuates from month to month, it can be challenging to adhere strictly to the 50/30/20 rule. In such cases, consider calculating the percentages based on your average monthly income over a longer period. Alternatively, you can adjust the percentages proportionally to accommodate the variations in your income.

Final Thoughts

The 50/30/20 rule in budgeting is a simple yet effective strategy for managing your finances. It suggests that 50% of your income should be allocated to necessities such as rent, bills, and groceries. Another 30% can be used for discretionary spending, such as dining out and entertainment. The remaining 20% should be saved or invested for future goals. By following this rule, you can ensure that your essential needs are covered while still allowing yourself some flexibility and saving for the future. Implementing the 50/30/20 rule in budgeting can bring balance and financial stability to your life.