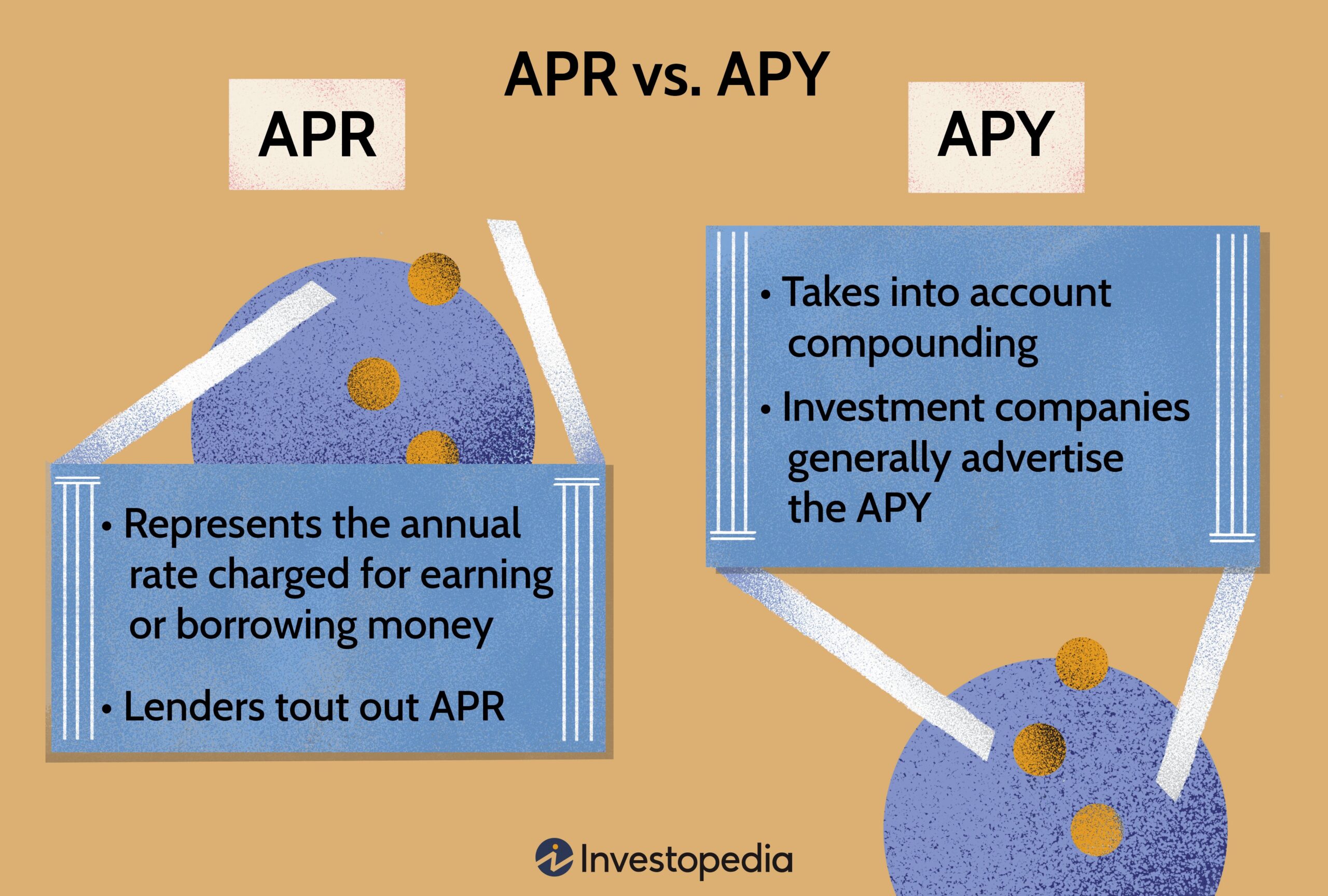

If you’ve ever wondered what the difference is between APR and APY, you’re not alone. These acronyms can be confusing, but fear not – I’m here to shed some light on the subject. The difference lies in how interest is calculated and compounded. APR, or Annual Percentage Rate, represents the cost of borrowing over a year, including fees and interest. On the other hand, APY, or Annual Percentage Yield, takes into account the compounding of interest. So, while APR measures the cost, APY shows the potential growth of your savings. Curious to learn more? Let’s dive in!

What is the Difference Between APR and APY?

When it comes to understanding the costs and returns associated with financial products, it’s important to have a clear grasp of the various terms and acronyms used in the industry. Two commonly used terms that often cause confusion are APR and APY. While they may sound similar, APR and APY stand for different concepts and are used to represent different aspects of interest rates and fees. In this article, we will delve into the details of APR and APY, explaining what they mean, how they differ, and when each one is used. So, let’s begin by understanding what APR and APY actually stand for.

Understanding APR (Annual Percentage Rate)

APR, or Annual Percentage Rate, is a term that represents the interest rate on a loan or credit card on an annual basis. It includes both the interest charged by the lender and any additional fees or costs associated with borrowing money. The APR is expressed as a percentage and provides borrowers with a standardized way of comparing the costs of different loan options. Here are some key points to understand about APR:

- APR includes the interest rate and fees.

- It represents the total cost of borrowing.

- APR is expressed as a percentage.

- It allows borrowers to compare different loan options.

- APR is used for mortgages, car loans, personal loans, and credit cards.

When you apply for a loan or a credit card, the lender is required by law to disclose the APR to you. This helps you understand the true cost of borrowing and allows you to make an informed decision. The APR takes into account not only the interest rate but also any upfront fees, closing costs, or other charges involved in obtaining the loan. This means that the APR provides you with a more accurate representation of the total cost of borrowing than just the interest rate alone.

Distinguishing APY (Annual Percentage Yield)

APY, or Annual Percentage Yield, is another term commonly used in the realm of finance. Unlike APR, which represents the cost of borrowing, APY is used to describe the return on an investment or savings account. APY takes into account the compound interest earned on the principal amount over a specific period of time. Here are a few important facts about APY:

- APY represents the total return on an investment or savings account.

- It factors in compound interest.

- APY is expressed as a percentage.

- It allows investors to compare different investment options.

- APY is used for savings accounts, certificates of deposit (CDs), and other investments.

When you deposit money into a savings account or invest in a financial product that offers compound interest, the APY tells you how much you can expect to earn over a given time period, including the effects of compounding. The higher the APY, the more your investment will grow over time.

Comparing APR and APY

Now that we have a clear understanding of APR and APY individually, let’s compare the two and highlight their differences:

1. Concept:

– APR: Represents the cost of borrowing money and includes interest rate and fees.

– APY: Represents the return on an investment or savings account and factors in compound interest.

2. Calculation:

– APR: Calculated by considering the interest rate and any additional fees or costs associated with borrowing.

– APY: Calculated by considering the interest rate and the frequency of compounding.

3. Purpose:

– APR: Used to compare loan options and evaluate the total cost of borrowing.

– APY: Used to compare investment options and evaluate the potential return on an investment.

4. Representation:

– APR: Expressed as a percentage.

– APY: Also expressed as a percentage.

5. Applications:

– APR: Applies to mortgages, car loans, personal loans, and credit cards.

– APY: Applies to savings accounts, CDs, and other investment products.

When to Use APR and APY?

To better understand when to use APR and APY in real-life situations, let’s explore a few examples:

- Scenario 1: Buying a Car

- Scenario 2: Opening a Savings Account

- Scenario 3: Investing in a Certificate of Deposit (CD)

- Scenario 4: Choosing a Credit Card

You’re in the market for a new car and need to finance your purchase. When comparing auto loans from different lenders, you should pay attention to the APR. This will help you determine the actual cost of the loan, including any fees associated with obtaining the loan. A lower APR means less cost to you over the life of the loan.

You want to open a savings account to start saving money for a down payment on a house. In this case, you should look for a savings account with a high APY. The higher the APY, the more interest your money will earn over time, helping you reach your savings goals faster.

You have a lump sum of money that you don’t need to access immediately and want to invest it to earn some interest. When considering different CD options, you should compare the APYs offered. A higher APY on a longer-term CD may result in greater returns over time.

If you frequently use a credit card for purchases and carry a balance, comparing the APRs of different credit cards is crucial. A lower APR will mean lower interest charges on your outstanding balance, saving you money in the long run.

Understanding the differences between APR and APY allows you to make informed decisions when it comes to borrowing, saving, and investing. By considering these two figures, you can better evaluate the true costs and returns associated with financial products and make choices that align with your financial goals.

In conclusion, APR and APY are crucial concepts to comprehend for anyone actively managing their finances. APR helps you understand the cost of borrowing, while APY allows you to evaluate the returns on your investments. By grasping the differences between these two terms and knowing when to use them, you can navigate the financial landscape with confidence and make informed choices that align with your financial goals.

What’s the Difference Between APR and APY? | Credit Intel by American Express

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the difference between APR and APY?

The difference between APR (Annual Percentage Rate) and APY (Annual Percentage Yield) lies in how they are calculated and what they represent. While both terms are used to express the cost of borrowing or the return on investment, they differ in the inclusion of compounding.

How is APR calculated?

APR is calculated by considering the interest rate and any additional fees or costs associated with the loan or credit product. It represents the annualized cost of borrowing over the loan term, without taking compounding into account.

What does APR include?

APR includes the base interest rate, lender fees, and certain other costs associated with the loan, such as origination fees or points. However, it does not account for the impact of compounding interest.

How is APY calculated?

APY takes into account the effect of compounding on the interest earned or paid. It considers the interest rate, compounding frequency, and any fees or charges connected to the investment or savings account. APY represents the actual yield over the course of a year.

What does APY include?

APY includes the base interest rate, the compounding frequency, and any fees or charges associated with the investment or savings account. It provides a more accurate representation of the overall return on investment.

Which is more beneficial, APR or APY?

The choice between APR and APY depends on the context. If you are borrowing money or seeking a loan, a lower APR is generally more favorable as it signifies lower borrowing costs. On the other hand, if you are saving or investing, a higher APY is preferred as it means your money will grow faster.

Can APR and APY be compared across different financial products?

Yes, APR and APY can be used to compare the cost of borrowing or the return on investment across different financial products. However, it is essential to consider the compounding periods and fees associated with each product to make an accurate comparison.

Are there any limitations to using APR and APY?

While APR and APY are useful tools for understanding the cost of borrowing or investment returns, they do not take into account other factors such as inflation, taxes, or market fluctuations. It’s important to consider these factors alongside APR and APY when making financial decisions.

Can APR and APY change over time?

Yes, both APR and APY can change over time. Variable interest rates, changes in compounding frequency, or adjustments to fees can impact both values. It’s important to review the terms and conditions of a financial product to understand how APR and APY may change.

Final Thoughts

APR, or Annual Percentage Rate, and APY, or Annual Percentage Yield, are two common terms used in the world of finance. While both represent a percentage, they have different meanings and implications. APR is used to calculate the cost of borrowing, such as loans or credit cards, and includes fees and interest. On the other hand, APY is used to calculate the effective interest earned on investments, such as savings accounts or certificates of deposit, taking into account compounding. Understanding the difference between APR and APY is crucial to make informed financial decisions. So, what is the difference between APR and APY? It lies in how they are used to determine the costs and returns associated with borrowing and investing, respectively.