Liquidity in finance is crucial. It directly impacts the stability and efficiency of financial markets, making it an essential aspect of any economic system. But what exactly is the importance of liquidity in finance? Simply put, liquidity refers to the ease and speed at which an asset or investment can be bought or sold without affecting its market price. In this blog article, we will delve into the significance of liquidity in finance, exploring its role in maintaining market stability, facilitating trades, and minimizing risks. So, let’s dive right in and understand why liquidity matters in the world of finance.

What is the Importance of Liquidity in Finance

When it comes to managing finances, liquidity plays a crucial role. Liquidity refers to the ease with which an asset can be converted into cash without causing a significant impact on its price. In simpler terms, it represents the ability of an individual or organization to access cash quickly and efficiently. Liquidity is a fundamental concept in finance, impacting various aspects of financial stability and decision-making. This article will delve into the importance of liquidity in finance, exploring its significance from different angles and shedding light on its implications for individuals, businesses, and the overall economy.

The Significance of Liquidity

Liquidity holds immense importance in finance due to its far-reaching consequences. Here’s why liquidity matters:

1. Financial Flexibility: Having high liquidity provides individuals and organizations with the flexibility to meet their financial obligations promptly. It allows them to seize opportunities, respond to emergencies, and adapt to changing circumstances without facing financial distress.

2. Operating Efficiency: Liquidity is vital for the smooth functioning of businesses. It enables them to meet short-term obligations like paying salaries, purchasing inventory, and covering operational expenses. Adequate liquidity ensures that day-to-day operations run seamlessly.

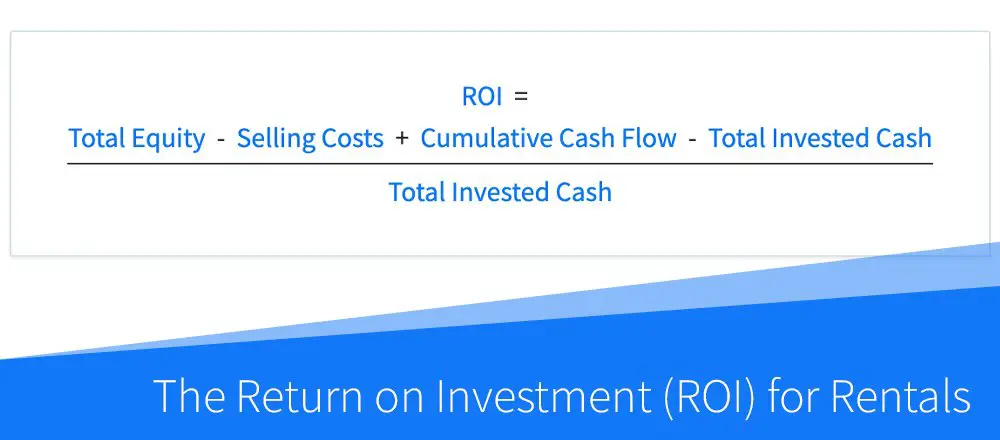

3. Investment Opportunities: Liquidity plays a crucial role in capital allocation decisions. With readily available cash, individuals and organizations can capitalize on attractive investment opportunities as they arise. It allows them to invest in assets such as stocks, real estate, or bonds promptly, potentially earning higher returns.

4. Risk Management: Liquidity acts as a buffer against unexpected financial challenges. It serves as a safety net, providing the ability to manage unforeseen events like job loss, medical emergencies, or economic downturns. Having liquid assets allows individuals and businesses to weather difficult times without resorting to high-interest debt or liquidating long-term investments at unfavorable prices.

Liquidity Ratios

To assess an entity’s liquidity position accurately, financial analysts employ liquidity ratios. These ratios measure the ability to meet short-term obligations and evaluate the health of an entity’s cash flow. Three commonly used liquidity ratios are:

1. Current Ratio: The current ratio compares an entity’s current assets to its current liabilities. It indicates the ability to cover short-term obligations using readily available resources. A ratio greater than 1 suggests a favorable liquidity position. However, excessively high current ratios may indicate inefficient resource allocation.

2. Quick Ratio (Acid-Test Ratio): The quick ratio focuses on more liquid assets by excluding inventory from current assets. It provides a more conservative measure of liquidity. A higher quick ratio suggests a more robust ability to meet short-term obligations without relying on inventory sales.

3. Cash Ratio: The cash ratio is the most conservative measure of liquidity as it compares only cash and cash equivalents to current liabilities. It represents the immediate availability of cash to settle short-term obligations. A high cash ratio implies greater financial resilience.

These ratios help stakeholders assess an entity’s liquidity position, enabling them to make informed decisions and manage risk effectively.

The Role of Liquidity in Financial Markets

Liquidity is of paramount importance in financial markets, where transactions occur regularly and involve significant sums of money. Here’s how liquidity impacts financial markets:

1. Price Stability: Adequate liquidity ensures price stability in financial markets. When there is sufficient liquidity, buyers and sellers can easily find each other, allowing transactions to occur at fair prices. On the other hand, illiquid markets may experience sharp price fluctuations and increased market volatility.

2. Efficient Capital Allocation: Liquidity facilitates the efficient allocation of capital within financial markets. It ensures that investors can swiftly buy or sell assets, allowing capital to flow towards more productive uses. Efficient capital allocation enhances economic growth and drives innovation.

3. Market Confidence: A liquid market enhances investor confidence. When investors know that they can quickly convert their assets into cash, it reduces the perception of risk. This confidence attracts more participants, deepening the market and promoting healthy competition.

4. Reduced Funding Costs: Liquidity plays a vital role in determining borrowing costs. In liquid markets, borrowers can access funds at lower interest rates due to the willingness of lenders to provide liquidity. Conversely, illiquid markets may increase borrowing costs and limit access to credit.

Liquidity Challenges and Solutions

While liquidity is essential, managing it can present challenges. Here are some common liquidity challenges and solutions:

1. Market Liquidity: Market liquidity refers to the ease of buying or selling an asset without causing a substantial impact on its price. In illiquid markets, investors may struggle to find buyers or sellers, leading to increased transaction costs and potential price manipulation. To address this challenge, market makers, liquidity providers, and regulatory interventions aim to enhance market liquidity.

2. Funding Liquidity: Funding liquidity refers to an entity’s ability to obtain additional funds to meet short-term obligations. Liquidity crises can arise when entities face difficulty rolling over debt or accessing new credit. To mitigate funding liquidity risks, maintaining diversified funding sources, establishing lines of credit, and prudent cash flow management are crucial.

3. Systemic Liquidity: Systemic liquidity refers to the overall availability of financial resources in an economy. During times of crisis, systemic liquidity can dry up, leading to widespread financial distress. Central banks play a vital role in managing systemic liquidity by providing emergency funding, implementing monetary policies, and regulating financial institutions.

4. Operational Liquidity: Operational liquidity focuses on an entity’s ability to meet day-to-day expenses. Poor cash flow management, inefficient working capital practices, or unexpected events can strain operational liquidity. Effective cash flow forecasting, optimizing inventory levels, and implementing sound financial management practices help address operational liquidity challenges.

In the world of finance, liquidity is a critical component that influences financial stability, decision-making, and market efficiency. It provides individuals and businesses with the flexibility and resilience to navigate uncertain times effectively. By understanding the significance of liquidity and employing appropriate liquidity management strategies, stakeholders can enhance their financial well-being and contribute to a healthier economy.

What is liquidity?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the importance of liquidity in finance?

Liquidity plays a crucial role in finance as it ensures that an entity has enough cash or assets that can be quickly converted into cash to meet its financial obligations. It allows businesses to cover their short-term liabilities, handle unexpected expenses, and seize opportunities that may arise.

How does liquidity impact a company’s financial health?

Liquidity directly influences a company’s financial health by enabling smooth operations, debt repayment, and investment in growth opportunities. Sufficient liquidity ensures that a company can meet its day-to-day expenses, maintain a positive cash flow, and sustain its business operations even during challenging times.

Why is liquidity essential for investors?

Liquidity holds significance for investors as it provides them with the ability to buy or sell assets without causing significant price fluctuations. Investors prefer liquid assets as they can easily convert them into cash, which provides flexibility and quick access to funds when needed.

What are the benefits of maintaining adequate liquidity in personal finance?

Maintaining adequate liquidity in personal finance offers several advantages. It allows individuals to handle emergencies, cover unexpected expenses, pay bills on time, and avoid excessive debt. It also provides a sense of financial security and the ability to take advantage of investment opportunities.

How does liquidity impact the stock market?

Liquidity in the stock market is crucial as it affects the ease of buying and selling securities. High liquidity ensures that there is a sufficient number of buyers and sellers, reducing transaction costs and price volatility. It promotes market efficiency and enables investors to enter or exit positions quickly without significant price impact.

Why do financial institutions place importance on liquidity management?

Financial institutions prioritize liquidity management to safeguard against potential liquidity crises. By maintaining sufficient liquidity, they can fulfill customer obligations, ensure the stability of the institution, meet regulatory requirements, and mitigate risks associated with unexpected cash flow disruptions.

How can a lack of liquidity impact businesses?

A lack of liquidity can severely affect businesses, hindering their ability to pay suppliers, meet payroll obligations, and settle debts. It may lead to bankruptcy, damage business reputation, limit growth opportunities, and decrease investor confidence. Lack of liquidity can also prevent companies from seizing strategic opportunities or responding to economic downturns.

What are some common liquidity ratios used in financial analysis?

Financial analysts and investors use various ratios to assess the liquidity of a company. Some commonly used liquidity ratios include the current ratio, quick ratio, and cash ratio. These ratios help gauge a company’s ability to meet short-term obligations and evaluate its overall liquidity position.

Final Thoughts

Liquidity is a vital aspect of finance as it ensures the smooth functioning of financial markets and institutions. It enables investors to easily buy or sell assets without significant price impact. The importance of liquidity in finance lies in its ability to provide stability and confidence in the market. It allows businesses to meet their short-term obligations and manage unexpected cash needs. Additionally, liquidity helps banks and financial institutions maintain solvency and manage risks effectively. In conclusion, understanding and maintaining adequate liquidity is crucial for a healthy and well-functioning financial system.