The role of a financial custodian is crucial in safeguarding and managing financial assets. Financial custodians act as trustworthy stewards, overseeing and protecting the assets of individuals, businesses, and organizations. From managing investment portfolios to ensuring compliance with regulatory requirements, financial custodians play a pivotal role in safeguarding and optimizing financial resources. In this article, we will delve into the intricate responsibilities of a financial custodian, shedding light on their key functions and the value they bring to the financial landscape. So, what exactly is the role of a financial custodian? Let’s explore.

What is the Role of a Financial Custodian?

A financial custodian plays a crucial role in today’s complex financial landscape. As the name suggests, a custodian is responsible for safeguarding and managing financial assets on behalf of individuals, businesses, or institutions. They act as a trusted intermediary, ensuring the integrity of financial transactions, maintaining accurate records, and providing various administrative services. In this article, we will delve into the key aspects of a financial custodian’s role, highlighting their responsibilities, benefits, and the importance they hold in the financial ecosystem.

Responsibilities of a Financial Custodian

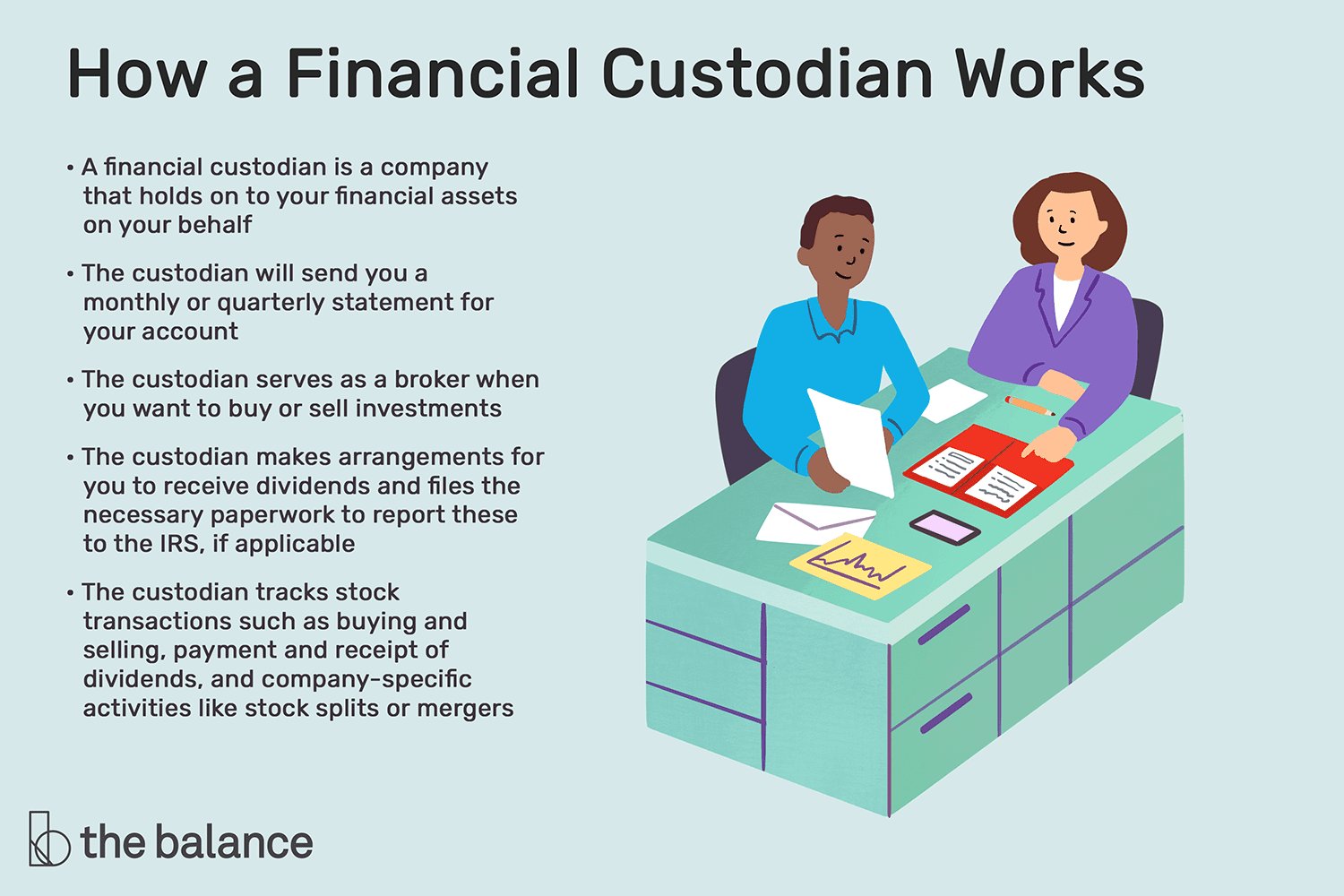

A financial custodian takes on numerous responsibilities to protect and manage assets entrusted to them. These responsibilities include:

Safekeeping of Assets

The primary duty of a custodian is to store and safeguard financial assets such as cash, securities, and other valuables. They ensure that these assets are held securely to minimize the risk of loss, theft, or damage. Custodians employ robust security measures, such as secure storage facilities, restricted access controls, and advanced technology systems to protect the assets under their custody.

Asset Settlement

Custodians facilitate the settlement of financial transactions by ensuring the timely and accurate transfer of assets between buyers and sellers. They validate the ownership of assets, verify transaction details, and process the necessary paperwork to complete the settlement process. This includes confirming trade instructions, reconciling transactions, and coordinating with various stakeholders involved in the transaction chain.

Account Administration

Financial custodians are responsible for the administration of client accounts. They maintain accurate records of assets, transactions, and holdings on behalf of their clients. This involves updating account balances, processing corporate actions such as dividends or stock splits, and providing regular statements to clients. Custodians also handle client inquiries, address account-related issues, and provide valuable reporting and analytics to assist clients in making informed decisions about their investments.

Corporate Governance and Proxy Voting

Custodians play a vital role in corporate governance by assisting shareholders in exercising their voting rights. They facilitate the voting process on behalf of their clients, ensuring that votes are cast in accordance with their instructions. This includes analyzing and disseminating proxy voting materials, voting on relevant matters, and providing reports on voting outcomes. Custodians enable shareholders to actively participate in the decision-making processes of the companies they invest in.

Risk Management and Compliance

Financial custodians are responsible for ensuring compliance with regulatory requirements and mitigating risks associated with asset custody. They maintain robust internal controls, conduct regular audits, and adhere to strict compliance standards to prevent fraudulent activities and ensure adherence to legal and industry regulations. Custodians also work closely with regulators, providing them with accurate and transparent information about the assets under their custody.

Asset Servicing

Custodians provide various asset servicing functions to support the efficient management of client portfolios. This includes income collection, processing of interest and dividend payments, corporate actions processing, tax reclamation, and foreign exchange services. By offering comprehensive asset servicing capabilities, custodians assist clients in maximizing the value and potential of their investments while reducing operational complexities.

The Importance of Financial Custodians

Financial custodians play a pivotal role in the smooth functioning of the financial markets and the protection of investors’ assets. Here are some key reasons highlighting their importance:

Asset Protection

Custodians act as guardians of financial assets, implementing robust security measures to minimize the risk of theft, loss, or unauthorized access. By providing secure storage and stringent controls, custodians instill confidence in investors, enabling them to entrust their assets to the custodial institution without worry.

Trust and Transparency

Custodians uphold trust and transparency by maintaining accurate records of assets, transactions, and holdings. Their diligent record-keeping practices enable investors to have a clear view of their investments, ensuring transparency in the custody process. This transparency builds trust between investors and custodians, fostering strong, long-term relationships.

Effective Risk Management

Financial custodians employ sophisticated risk management frameworks to identify, assess, and mitigate risks associated with asset custody. By staying ahead of potential risks, custodians protect investors’ assets from market volatility, fraud, and compliance breaches. Their risk management practices contribute to the overall stability of the financial ecosystem.

Efficiency and Operational Support

Custodians streamline the administrative processes associated with asset management, allowing investors to focus on their core investment strategies. With their expertise and technology infrastructure, custodians efficiently process transactions, provide timely reporting, and handle various operational aspects. This support enhances efficiency, reduces operational costs, and improves investors’ overall experience.

Regulatory Compliance

Financial custodians play a vital role in complying with regulatory requirements, ensuring that industry rules and legal obligations are met. By adhering to strict compliance standards, custodians protect investors from potential risks arising from non-compliance and maintain the integrity and reputation of the financial markets.

The Benefits of Using a Financial Custodian

Utilizing the services of a financial custodian offers several benefits to individuals, businesses, and institutions:

Professional Expertise

Financial custodians possess specialized knowledge and expertise in asset management and custody services. Their professional teams have years of experience in handling complex financial instruments and managing intricate custodial processes. By tapping into this expertise, investors can benefit from tailored solutions, personalized advice, and access to a wide range of financial services.

Reduced Administrative Burden

Outsourcing custodial responsibilities to a financial custodian reduces the administrative burden for investors. Custodians handle the day-to-day operational tasks, including account administration, trade settlement, and reporting, allowing investors to focus on investment strategies and decision-making. This frees up valuable time and resources that can be allocated to more strategic activities.

Advanced Technology Infrastructure

Financial custodians invest in state-of-the-art technology infrastructure to support their custodial operations. This includes advanced systems for secure data storage, transaction processing, and reporting. By leveraging cutting-edge technology, custodians enhance operational efficiency, accuracy, and scalability, ensuring seamless custody services for their clients.

Economies of Scale

Financial custodians can offer economies of scale by pooling the custodial needs of multiple clients. This enables them to negotiate better pricing with service providers, access a broader range of investment options, and provide cost-effective solutions. Investors can benefit from reduced costs, enhanced investment opportunities, and more competitive fee structures.

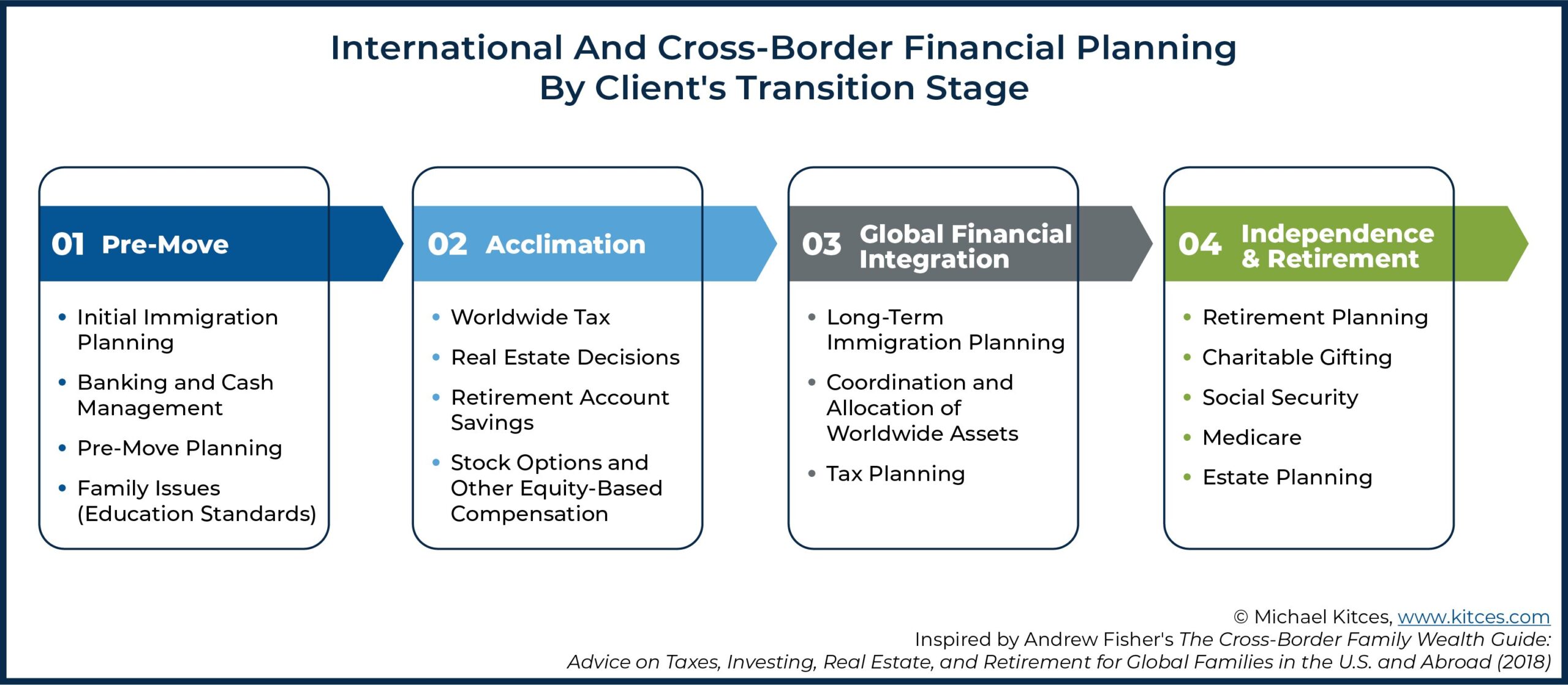

Access to Global Markets

Financial custodians facilitate access to global markets by managing the complexities associated with cross-border transactions, compliance regulations, and local market practices. They provide a gateway to international investments, enabling investors to diversify their portfolios and capitalize on global opportunities. Custodians navigate the intricacies of different markets, ensuring efficient settlement, reporting, and compliance with local regulations.

In conclusion, the role of a financial custodian is multifaceted and crucial in today’s financial landscape. They safeguard assets, facilitate transactions, handle administrative tasks, and ensure compliance with regulatory requirements. Custodians provide trust, transparency, and efficiency in asset management, enabling investors to focus on their investment strategies while knowing their assets are secure. By leveraging their professional expertise, advanced technology, and global reach, financial custodians contribute to the overall stability and growth of the financial ecosystem.

WHAT IS A CUSTODIAN BANK? Straight to the Point #STTP #132

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the role of a financial custodian?

A financial custodian plays a crucial role in safeguarding and managing financial assets on behalf of their clients. They are responsible for holding and administering financial investments, securities, and other assets in a secure and compliant manner.

What are the primary responsibilities of a financial custodian?

The primary responsibilities of a financial custodian include safekeeping and record-keeping of assets, executing trades and settlements, processing transactions, verifying and reconciling balances, providing asset valuation reports, and ensuring compliance with regulatory requirements.

What kind of assets do financial custodians typically handle?

Financial custodians typically handle a wide range of assets, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), derivatives, real estate investment trusts (REITs), and other investment instruments. They may also manage cash, certificates of deposit (CDs), and other forms of monetary assets.

How does a financial custodian ensure the security of assets?

Financial custodians employ various security measures to protect assets. These may include physical security measures such as secure vaults and data centers, strong access controls, encryption, firewalls, and other cybersecurity measures. They also have internal controls and auditing processes in place to ensure the integrity and accuracy of asset records.

Do financial custodians handle client transactions?

Yes, financial custodians handle client transactions. They facilitate the buying and selling of securities, process client instructions for fund transfers, handle dividend distributions, and carry out other transaction-related activities on behalf of their clients. They ensure that these transactions are executed accurately and in compliance with relevant regulations.

What role does regulatory compliance play in the duties of a financial custodian?

Regulatory compliance is of utmost importance to financial custodians. They must adhere to various regulations and guidelines imposed by regulatory bodies to ensure the protection of client assets and maintain transparency in their operations. Compliance requirements include reporting, disclosure, record-keeping, and anti-money laundering (AML) measures.

Can individuals and businesses benefit from using a financial custodian?

Yes, individuals and businesses can benefit from using a financial custodian. By entrusting their assets to a custodian, they can enjoy professional asset management, secure storage, efficient trading and settlement processes, reliable record-keeping, access to comprehensive financial reports, and peace of mind knowing that their assets are being managed by experts.

How do financial custodians contribute to risk management?

Financial custodians play a crucial role in risk management. They implement robust risk controls, monitor market conditions, perform due diligence on investment options, conduct regular audits, and maintain up-to-date compliance procedures. By doing so, they help mitigate risks and ensure the safety and integrity of client assets.

Note: The questions and answers provided are for informational purposes only and should not be considered as financial advice.

Final Thoughts

The role of a financial custodian is crucial in today’s complex financial landscape. They serve as a trustworthy intermediary, holding and safeguarding financial assets on behalf of clients. A financial custodian ensures compliance with regulatory requirements, manages transactions, and provides accurate record-keeping. Their responsibilities include trade settlement, asset safekeeping, and reporting. By actively overseeing and managing financial activities, a custodian helps clients have peace of mind knowing that their assets are secure. In summary, the role of a financial custodian is to protect and manage financial assets on behalf of clients, providing essential services to ensure their financial well-being.