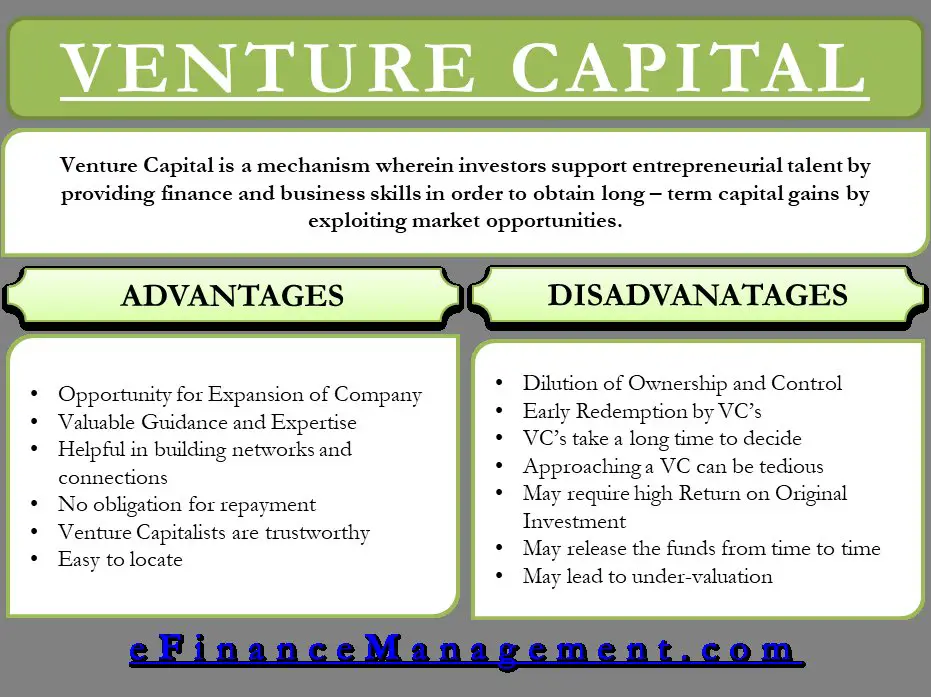

Venture capital – a term you’ve likely encountered in the world of finance and startups. So, what is venture capital and its pros and cons? In simple terms, venture capital refers to the funding that investors provide to early-stage companies with high growth potential. It is an avenue for entrepreneurs to secure the necessary financial support to turn their ideas into successful businesses. However, like any investment strategy, venture capital comes with its own set of advantages and disadvantages. Let’s delve into these, exploring the opportunities and challenges associated with this dynamic approach to funding startups.

What is Venture Capital and Its Pros and Cons

Introduction to Venture Capital

Venture capital plays a crucial role in fueling the growth and success of startups and emerging companies. It involves the provision of funding to early-stage, high-potential businesses that exhibit promise and potential for substantial returns. Venture capitalists (VCs) are investors who provide this funding in exchange for equity or ownership stakes in the companies they support. This form of financing is typically sought after by entrepreneurs who are looking to scale their businesses quickly and aggressively. In this article, we will delve into the world of venture capital, exploring its pros and cons, and shedding light on its impact on both entrepreneurs and investors.

The Pros of Venture Capital

Venture capital offers numerous advantages for both entrepreneurs and investors. Let’s take a closer look at some of the key benefits:

1. Access to Capital

One of the most significant advantages of venture capital is the access it provides to substantial amounts of funding that may otherwise be challenging to obtain. Startups often face difficulty securing traditional bank loans or attracting angel investors due to the high-risk nature of their ventures. Venture capitalists are willing to take on this risk and provide the necessary capital to fund innovative ideas and ventures that have the potential for exponential growth.

2. Expertise and Mentorship

Beyond providing financial support, venture capitalists bring a wealth of experience, expertise, and connections to the table. They often have a deep understanding of the industry and can provide valuable guidance and mentorship to entrepreneurs. This support extends beyond just financial matters and can include strategic planning, marketing assistance, operational insights, and access to a vast network of contacts. Such guidance can significantly enhance the chances of success for startups, as they benefit from the knowledge and experience of seasoned investors.

3. Validation and Credibility

Securing venture capital funding can serve as a validation of an entrepreneur’s business model and idea. The due diligence process conducted by venture capitalists before making an investment involves rigorous analysis of the company’s potential, market opportunities, and competitive advantages. When a startup secures funding from a reputable venture capital firm, it not only gains access to capital but also receives a vote of confidence that can enhance its credibility and attract further investment from other sources.

4. Accelerated Growth and Scale

With the infusion of venture capital, startups can accelerate their growth and scale their operations more rapidly than would have been possible with limited resources. The funding allows them to invest in research and development, expand their market reach, hire top talent, and invest in marketing and sales efforts. This can result in a faster market penetration and increased market share, giving startups a competitive edge and positioning them for long-term success.

5. Flexibility in Repayment

Unlike traditional loans, venture capital funding does not require immediate repayment with interest. Instead, venture capitalists typically seek a return on their investment through equity ownership or a share of the company’s future profits. This provides entrepreneurs with more flexibility in managing their cash flow in the early stages when revenues may be limited. By aligning the interests of the investors and entrepreneurs, venture capital fosters a partnership-like relationship that allows both parties to focus on long-term value creation.

6. Availability of Follow-on Funding

Another advantage of venture capital is the potential for follow-on funding rounds. If a startup demonstrates significant progress and meets specific milestones, venture capitalists may be willing to invest additional capital to support further growth. This ongoing access to funding can be critical for startups as they continue to expand and evolve in a highly competitive market.

The Cons of Venture Capital

While venture capital provides numerous benefits, entrepreneurs should also be aware of the potential drawbacks associated with this type of financing. Here are some of the cons:

1. Loss of Control

By accepting venture capital, entrepreneurs must be prepared to relinquish a portion of their ownership and control in the company. Venture capitalists often require a significant equity stake and a seat on the company’s board of directors as part of their investment terms. This loss of control can impact decision-making authority and the overall direction of the company, as entrepreneurs may need to consult and seek approval from the venture capital firm.

2. Pressure for Rapid Growth

Venture capitalists invest with the expectation of substantial returns within a relatively short timeframe. This can create pressure for rapid growth and profitability, and entrepreneurs may find themselves needing to meet aggressive targets set by their investors. The focus on quick growth can lead to a high-stress environment, requiring entrepreneurs to make strategic decisions that prioritize short-term gains over long-term sustainability.

3. Dilution of Ownership

As a company goes through multiple funding rounds, each subsequent funding round can result in dilution of existing shareholders’ ownership. With each equity issuance, the ownership stake of the founders and early employees decreases. While this dilution is a natural consequence of raising additional capital, entrepreneurs must carefully consider the long-term impact on their ownership and control over the company.

4. Loss of Confidentiality

Venture capitalists often require access to sensitive company information during the due diligence process, which may include business plans, financials, and intellectual property. This exposure can potentially increase the risk of confidential information being shared or leaked. Entrepreneurs must take necessary precautions to protect their intellectual property and trade secrets when engaging with potential venture capital investors.

5. Exit Expectations

Venture capitalists invest with the expectation of eventually exiting the investment and realizing a return on their capital. This typically occurs through an initial public offering (IPO), acquisition, or merger. Entrepreneurs should be aware that venture capitalists will have an exit strategy in mind from the outset, and their goals may not always align with the long-term vision of the company. This misalignment of objectives can create tension and conflicts of interest between entrepreneurs and investors.

6. Limited Access for Certain Industries

Not all industries are attractive to venture capitalists. Some sectors, such as traditional retail or service-based businesses, may struggle to attract venture capital funding due to their slower growth potential or lack of scalability. Industries that require significant upfront capital investment or have longer development cycles may also face challenges in securing venture capital. In such cases, entrepreneurs may need to explore alternative funding sources that better align with their specific industry needs.

Venture capital has played a pivotal role in fostering innovation, driving economic growth, and supporting the success of countless startups and emerging companies. Despite its advantages and disadvantages, venture capital remains a powerful tool for entrepreneurs seeking rapid growth and access to capital. Successful entrepreneurs are those who carefully weigh the pros and cons, considering their specific business goals, industry dynamics, and long-term vision before deciding to engage with venture capital firms. With the right partnership and strategic alignment, venture capital can be a catalyst for transforming innovative ideas into thriving businesses.

The Ultimate Beginner's Guide to Venture Capital! (Compensation, Hours, Lifestyle, Pros & Cons)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is venture capital?

Venture capital refers to a form of private equity investment where investors provide funding to early-stage or high-potential startups in exchange for equity or ownership in the company.

What are the pros of venture capital?

Venture capital offers several advantages, including access to financial resources, expertise, and networks that can help startups grow and succeed. It also allows entrepreneurs to retain control over their businesses while receiving the necessary funding.

What are the cons of venture capital?

Although venture capital provides significant benefits, there are some drawbacks. Entrepreneurs may have to give up a portion of their ownership and decision-making power. Additionally, venture capitalists often expect high returns on their investments, which can create pressure for rapid growth.

How does venture capital differ from traditional funding methods?

Unlike traditional funding methods, such as bank loans or personal savings, venture capital involves investors taking a higher risk by investing in startups that may not have established market traction or revenue. Additionally, venture capitalists often provide mentorship and guidance to help startups grow.

What types of businesses are suitable for venture capital funding?

Venture capital funding is typically suited for businesses with high-growth potential, disruptive technologies, or innovative business models. Startups in sectors like technology, biotechnology, and clean energy are often sought after by venture capitalists.

How do venture capitalists make money?

Venture capitalists make money primarily through exits, such as initial public offerings (IPOs) or acquisitions. When the startups they invest in become successful, venture capitalists can sell their equity stake at a higher valuation, thereby realizing a profit.

What are the criteria venture capitalists consider before investing?

Venture capitalists evaluate several factors before deciding to invest, including the startup’s market potential, the scalability of its business model, the capabilities of the founding team, and the competitive landscape. They also consider the risk-reward ratio and the potential for a return on investment.

Are there alternative funding options apart from venture capital?

Yes, there are alternative funding options available for startups. Some alternatives include angel investors, crowdfunding platforms, grants, business incubators, and government programs. Each option has its own advantages and disadvantages, so it’s essential to research and choose the most suitable option for your business.

Final Thoughts

Venture capital is an investment method utilized by companies and individuals to provide funding to startups and small businesses. It offers various advantages, including access to financial capital, expertise, and networks. However, venture capital also comes with certain drawbacks. One disadvantage is the potential loss of control for the entrepreneur due to the involvement of external investors. Additionally, venture capital investments often carry high risks and may require a significant portion of equity in return. Overall, venture capital can be a valuable tool for startups, but it is essential to carefully weigh its pros and cons before pursuing this funding option.