Donating stocks to charity can be a philanthropic gesture that benefits both the donor and the organization receiving the contribution. If you’re wondering what to consider when donating stocks to charity, you’ve come to the right place. In this article, we will explore the key factors to keep in mind when making such a donation. By understanding the process, potential tax advantages, and choosing the right charity, you can make a positive impact and maximize the benefits of your stock donation. Let’s delve into the details and ensure your charitable giving is both meaningful and advantageous.

What to Consider When Donating Stocks to Charity

Donating stocks to charity can be a powerful way to support causes you care about while potentially benefiting from certain tax advantages. However, it’s important to carefully evaluate the process and consider various factors before making a donation. This article will guide you through the key considerations to keep in mind when donating stocks to charity.

The Benefits of Donating Stocks

Donating stocks can offer several advantages over donating cash, both for the donor and the charity. Understanding these benefits can help you make an informed decision about your charitable giving:

- Tax Deductions: When you donate appreciated stocks held for more than one year, you can generally claim a charitable deduction for the fair market value of the stocks on the date of the donation. This means you can potentially lower your tax liability while supporting a cause you believe in.

- Avoiding Capital Gains Taxes: By donating stocks directly to a charity, you can avoid paying capital gains taxes on the appreciation of those stocks. This can be particularly advantageous if you hold highly appreciated stocks with significant gains.

- Impactful Giving: Donating stocks allows you to make a substantial impact on the nonprofit organization of your choice. The value of the donated stocks can help the charity fulfill its mission and support its programs more effectively.

- Portfolio Diversification: If you have a concentrated stock position, donating stocks can be a strategy to diversify your investment portfolio while simultaneously supporting charitable causes.

Choosing the Right Charity

Selecting the right charity for your stock donation is crucial. Take the time to research and consider the following factors:

- Mission Alignment: Ensure that the charity’s mission aligns with your own values and philanthropic goals. Look for organizations that have a track record of positive impact and transparency in their operations.

- Financial Stability: Evaluate the financial stability and accountability of the charity. Analyze their financial statements, annual reports, and ratings from reliable sources such as Charity Navigator or GuideStar.

- Tax-Exempt Status: Verify that the charity you are considering is eligible to receive tax-deductible donations. The organization should have 501(c)(3) tax-exempt status granted by the Internal Revenue Service (IRS).

- Administration and Overhead Costs: Consider the charity’s administrative and overhead costs. Ensure that a significant portion of your donation goes directly to programs and initiatives rather than being spent on excessive administrative expenses.

Valuing Your Stocks

Determining the value of your donated stocks is critical for tax purposes. Here are a few essential points to keep in mind:

- Fair Market Value: The fair market value (FMV) of the donated stocks is the average price between the highest and lowest quoted selling prices on the date of the donation. You can find this information on financial news websites or by contacting your broker.

- IRA Distributions: If you’re donating stocks held in an Individual Retirement Account (IRA), special rules apply. In most cases, the FMV of the stocks donated from an IRA is the value of the stocks on the date of the distribution from the IRA.

- Qualified Appraisal: For certain donations valued above a specific threshold, you might need to obtain a qualified appraisal of the stock’s FMV. This requirement typically applies when the value exceeds $5,000.

- Consult a Tax Professional: To accurately determine the FMV of your stocks and comply with IRS regulations, consult with a tax professional or financial advisor.

Stock Donation Process

Once you have selected the charity and valued your stocks, it’s time to execute the donation. The following steps outline the typical process:

- Contact the Charity: Reach out to the charity you’ve chosen and inform them of your intention to donate stocks. They will guide you through their specific procedures and provide the necessary information for the transfer.

- Coordinate with Your Broker: Contact your broker or financial institution to initiate the stock transfer. Provide them with the charity’s account information. Your broker will handle the transaction and transfer the stocks to the charity’s brokerage account.

- Notify the Charity: Inform the charity once the stock transfer is initiated and share any relevant details, such as the number of shares and the company’s name. This allows the organization to track the donation and properly acknowledge your generosity.

- Obtain Receipt and Acknowledgment: After the transfer is complete, request a receipt or acknowledgment from the charity. This documentation is essential for claiming the tax deduction.

- Report the Donation: When filing your taxes, report the stock donation as a charitable deduction. Consult with a tax professional or refer to IRS guidelines to ensure accurate reporting.

Tax Considerations and Limitations

While donating stocks can offer tax benefits, it’s crucial to understand the potential limitations and seek professional advice when needed:

- Itemizing Deductions: To claim a tax deduction for stock donations, you must itemize your deductions on your tax return. If you typically take the standard deduction, donating stocks may not provide additional tax benefits.

- AGI Limitations: The IRS generally limits the deduction for charitable contributions to a percentage of your adjusted gross income (AGI). Currently, the limit is set at 60% of AGI for cash donations and 30% of AGI for stock donations.

- Carryover Provision: If your stock donation exceeds the applicable AGI limit, you can carry forward the excess deduction for up to five additional years. This allows you to maximize the tax benefits over multiple years.

- Consult a Tax Advisor: The tax implications of donating stocks can be complex. It’s advisable to consult a tax professional or financial advisor who can provide guidance tailored to your specific circumstances.

Safeguarding Your Financial Interests

When donating stocks, it’s essential to protect your financial interests and ensure a smooth process. Consider the following precautions:

- Consult a Financial Advisor: Seek advice from a qualified financial advisor who can analyze the potential impact of the stock donation on your overall financial plan and investment portfolio.

- Research Legal Obligations: Understand the legal obligations associated with donating stocks, such as insider trading restrictions or lock-up periods that may apply to certain stocks.

- Review Donation Policies: Familiarize yourself with the charity’s stock donation policies, including any restrictions on accepting certain types of securities or the minimum value required for stock donations.

- Ensure Secure Transfer: Work with reputable brokerage firms and ensure a secure transfer of your stocks. Confirm that your broker utilizes proper encryption and safeguards to protect your sensitive information.

By considering all these factors and taking the necessary precautions, you can confidently donate stocks to charity while maximizing the benefits for both yourself and the organizations you support. Remember, consulting with professionals and financial advisors is key to making well-informed decisions throughout the process. Together, let’s make a positive impact on the world through strategic and meaningful giving.

Giving Appreciated Stock to Charity

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What should I consider when donating stocks to charity?

When considering donating stocks to charity, there are several factors to keep in mind:

How can I determine the value of my donated stocks?

The value of your donated stocks can be determined by calculating the fair market value on the date of donation. This can be done by referring to the closing price of the stocks on that specific date.

Are there any tax benefits to donating stocks to charity?

Yes, donating stocks to charity can offer tax benefits. Generally, you can claim a tax deduction for the full fair market value of the donated stocks, as long as you have owned them for more than one year.

Can I donate stocks to any charity?

Not all charities accept stock donations, so it is important to check with the charity beforehand. Most well-established charities have procedures in place for accepting stock donations.

Do I need to have a specific type of brokerage account to donate stocks?

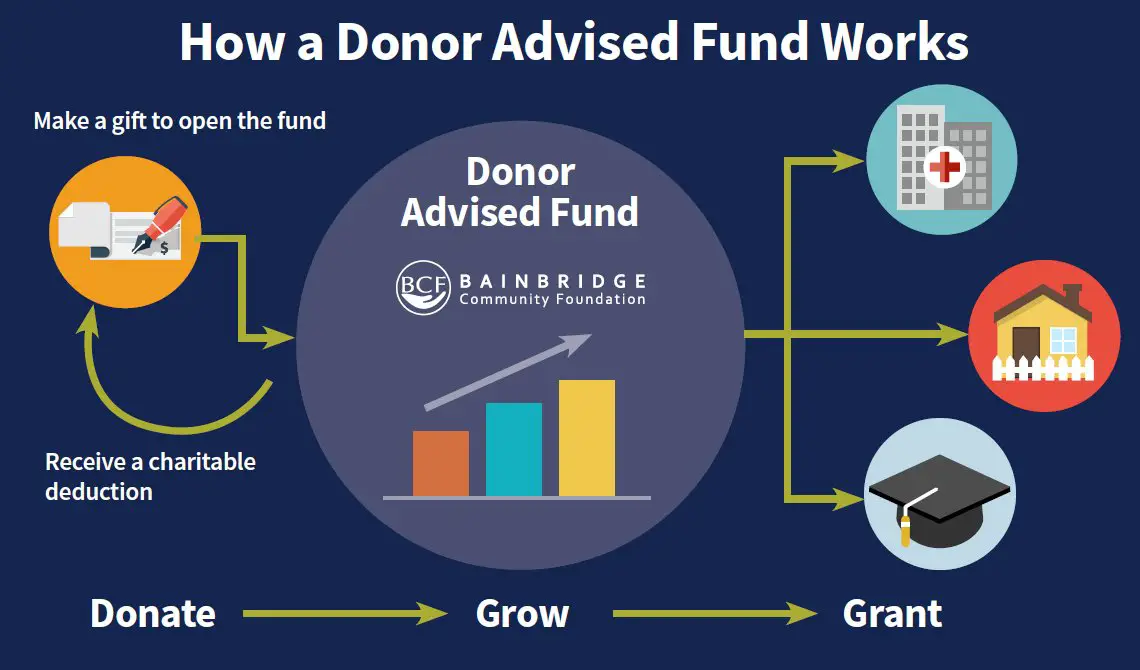

No, you can donate stocks from various types of brokerage accounts, including individual or joint accounts, retirement accounts, and even donor-advised funds.

What are the potential advantages of donating stocks instead of cash?

Donating stocks instead of cash can provide several advantages. It allows you to avoid capital gains tax on the appreciation of the stocks, potentially providing a greater benefit to both you and the charity.

Are there any limitations on the amount of stocks I can donate?

There are usually no limitations on the amount of stocks you can donate. However, it is advisable to consult with a tax advisor or financial planner to ensure you maximize the potential tax benefits and avoid any potential limitations.

What documentation do I need when donating stocks to charity?

You should keep records of the stock donation, including the date of donation, the number of shares donated, and the fair market value of the stocks. This documentation will be necessary for tax purposes.

Final Thoughts

In conclusion, when considering donating stocks to charity, there are a few key factors to keep in mind. Firstly, ensure that the charity is eligible to accept stock donations and that they have the necessary infrastructure in place to handle them. Secondly, consider the tax implications and the potential deductions you may be entitled to. Lastly, consult with a financial advisor or tax professional to fully understand the financial and legal implications. By taking these considerations into account, you can make a meaningful impact through stock donations while potentially maximizing your tax benefits.