Looking to tap into the value of your home? Considering a home equity line of credit? You’ve come to the right place! When it comes to what to consider when getting a home equity line of credit, there are a few key factors that can greatly impact your financial journey. From interest rates and repayment terms to potential risks and benefits, it’s important to have a clear understanding of the process before making any decisions. So, let’s dive right in and explore everything you need to know when it comes to obtaining a home equity line of credit.

What to Consider When Getting a Home Equity Line of Credit

When it comes to financing your dreams, unlocking the potential of your home equity can be a smart move. A home equity line of credit (HELOC) offers homeowners the flexibility of accessing funds based on the equity they have built up in their homes. Whether you want to renovate your house, consolidate debts, or pay for educational expenses, a HELOC can provide you with the necessary funds. However, before diving into this financial tool, it’s important to consider several factors to ensure that a home equity line of credit is the right choice for you. In this article, we will explore those key considerations and help you make an informed decision.

Your Financial Goals

Before applying for a home equity line of credit, take the time to evaluate your financial goals. Understanding why you need the funds will help you determine if a HELOC aligns with your objectives. Some common reasons homeowners choose a HELOC include:

- Home renovations or improvements

- Debt consolidation

- Education expenses

- Emergency funds

- Investment opportunities

Identifying your priorities will enable you to assess whether a home equity line of credit is the most suitable option for your financial needs.

Your Home Equity and Loan-to-Value Ratio

One of the primary factors to consider when applying for a HELOC is the amount of equity you have in your home. Equity represents the value of your home minus any outstanding mortgage balance. The more equity you have, the higher the potential credit limit you can access through a home equity line of credit.

Furthermore, lenders typically have maximum loan-to-value (LTV) ratios that determine the percentage of your home’s value that can be borrowed against. Understanding your LTV ratio is crucial since it affects the amount you can borrow and the interest rate you may qualify for. As a general rule, a lower LTV ratio reduces the risk for lenders, resulting in better loan terms for borrowers.

Interest Rates and Repayment Terms

When considering a home equity line of credit, it’s essential to understand the interest rates and repayment terms associated with the loan. Here are a few key points to consider:

- Variable or Fixed Rate: HELOCs often have variable interest rates that can fluctuate over time. Alternatively, some lenders offer fixed-rate options, providing stability and predictable monthly payments. Decide which option aligns better with your financial goals and risk tolerance.

- Introductory Rates: Some lenders entice borrowers with low introductory rates that increase after a specific period. Take into account both the introductory rate and the adjusted rate to evaluate the long-term affordability of the HELOC.

- Repayment Period: HELOCs typically have two phases: the draw period and the repayment period. During the draw period, usually 5-10 years, you can borrow funds and make interest-only payments. The repayment period, usually 10-20 years, requires principal and interest payments. Understand the timeframes involved and ensure they align with your financial situation.

- Flexibility: Some HELOCs allow you to convert your balance to a fixed-rate loan. This feature can be useful if you anticipate interest rates increasing in the future or prefer the stability of a fixed monthly payment.

Evaluating these interest rate and repayment term factors will help you select the most suitable HELOC for your needs.

Costs and Fees

Before finalizing your decision, it’s crucial to understand the costs and fees associated with a home equity line of credit. Here are some fees commonly associated with HELOCs:

- Application Fees: These fees cover the administrative costs of processing your HELOC application.

- Appraisal Fees: Lenders may require a professional appraisal to determine the value of your home.

- Annual Fees: Some lenders charge an annual fee for maintaining the HELOC account.

- Closing Costs: Similar to when you first purchased your home, you may need to cover closing costs, including attorney fees, title search fees, and recording fees.

- Early Termination Fees: If you decide to close your HELOC early, some lenders may impose fees for early termination.

Understanding the costs and fees involved will enable you to calculate the total expenses associated with obtaining and maintaining a home equity line of credit. This information is essential for determining the long-term affordability of the loan.

Qualification Requirements and Credit Score Impact

When applying for a home equity line of credit, it’s important to be aware of the qualification requirements set by lenders. These requirements may vary, but common factors lenders consider include:

- Credit Score: Lenders typically require a good credit score to qualify for the best HELOC terms. Reputable lenders may be more inclined to offer favorable rates and terms to borrowers with higher credit scores.

- Debt-to-Income Ratio: Lenders assess your ability to manage additional debt by evaluating your debt-to-income ratio. A lower ratio increases your chances of qualifying for a HELOC.

- Employment and Income Stability: Demonstrating a stable employment history and sufficient income reassures lenders of your ability to repay the borrowed funds.

Keep in mind that applying for a HELOC may impact your credit score, as lenders will generally run a credit check during the application process. While the impact is typically minimal, it’s important to be mindful of this potential consequence.

By understanding the qualification requirements and potential credit score impact, you can be better prepared when applying for a home equity line of credit.

Alternatives to a Home Equity Line of Credit

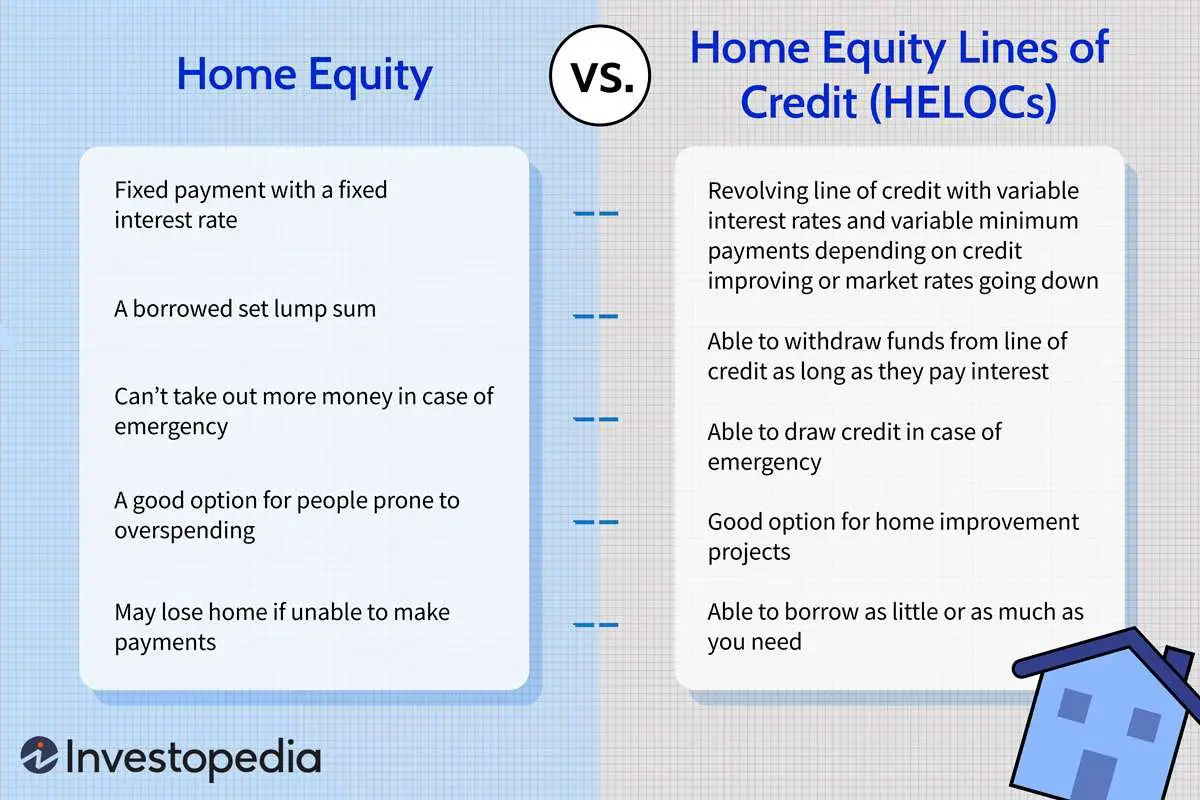

While a home equity line of credit can be a valuable financial tool, it’s essential to explore alternative options to ensure you make an informed decision. Consider the following alternatives:

- Home Equity Loan: A home equity loan provides a lump sum of money upfront, typically with a fixed interest rate. This option may be more suitable for individuals who prefer a one-time borrowing scenario.

- Personal Loan: If you don’t want to leverage your home equity, a personal loan can offer a fixed amount with predictable monthly payments.

- Cash-Out Refinance: Refinancing your mortgage allows you to access funds by replacing your existing mortgage with a new one. This option can provide additional funds while potentially securing a lower interest rate.

- 0% APR Credit Cards: For short-term financing needs, a credit card with a 0% annual percentage rate (APR) promotional offer can be an attractive option. Just ensure you can pay off the balance before the promotional period ends to avoid high interest charges.

Evaluating these alternatives will help you determine if a home equity line of credit is the best fit for your specific financial circumstances.

Remember, a home equity line of credit is a significant financial commitment. By thoroughly considering these factors and exploring alternatives, you can make an informed decision and choose the financing option that aligns with your long-term goals and financial well-being.

Home Equity Line of Credit – Dave Ramsey Rant

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What should I consider when getting a home equity line of credit?

When considering a home equity line of credit, there are several important factors to take into account:

How does a home equity line of credit work?

A home equity line of credit, or HELOC, allows you to borrow money using the equity in your home as collateral. It functions like a credit card, giving you access to a revolving line of credit that you can use and repay as needed.

What are the advantages of a home equity line of credit?

Some advantages of a home equity line of credit include:

- Lower interest rates compared to other types of loans

- Flexibility in borrowing and repaying, as you only pay interest on the amount you use

- Potential tax benefits on the interest paid (consult with a tax advisor)

- Ability to use the funds for various purposes, such as home improvements, education, or debt consolidation

What are the potential risks of a home equity line of credit?

While a home equity line of credit can be beneficial, it’s essential to be aware of the potential risks:

- Defaulting on your payments could lead to foreclosure on your home

- If property values decline, you may end up owing more than the value of your home

- You may be tempted to overspend, leading to increased debt

- Fluctuating interest rates can result in higher monthly payments

How much can I borrow with a home equity line of credit?

The amount you can borrow with a home equity line of credit depends on various factors, including the value of your home, the outstanding mortgage balance, your credit score, and the lender’s criteria. Generally, lenders allow you to borrow up to 85% of the appraised value of your home minus any outstanding mortgage balance.

What is the repayment period for a home equity line of credit?

A home equity line of credit typically has two phases: the draw period and the repayment period. During the draw period, which usually lasts around 10 years, you can borrow and make interest-only payments. After the draw period ends, the repayment period begins, usually lasting around 20 years, during which you repay both the principal and interest.

What are the fees involved in a home equity line of credit?

When getting a home equity line of credit, you may encounter certain fees, such as:

- Application fee

- Origination fee

- Appraisal fee

- Annual maintenance fee

- Early termination fee

It’s important to review and understand the fees associated with a HELOC before proceeding.

How does a home equity line of credit affect my credit score?

Opening a home equity line of credit can have both positive and negative effects on your credit score. Initially, the credit inquiry and new account may cause a slight dip in your score. However, consistently making on-time payments can improve your payment history and boost your score over time. Conversely, missing payments or maxing out your available credit limit can have a negative impact on your credit score.

Final Thoughts

When considering a home equity line of credit (HELOC), there are a few key factors to keep in mind. Firstly, it is crucial to carefully assess your financial situation and determine whether a HELOC is the right option for you. Secondly, consider the interest rates and terms offered by different lenders, ensuring you choose the most favorable option. Additionally, be mindful of any potential fees or penalties associated with the HELOC. Finally, understand the risks involved, as your home serves as collateral for the loan. By considering these factors, you can make an informed decision when obtaining a home equity line of credit.