Investing in real estate trusts can be a lucrative option for individuals seeking to diversify their investment portfolio. But with so many choices available, it’s essential to know what to consider when investing in real estate trusts. From assessing the trust’s track record and management team to evaluating the underlying properties, making informed decisions can lead to significant returns. In this article, we’ll explore the key factors to keep in mind before investing in real estate trusts, empowering you to make the right choices for your financial future. So, if you’re looking to optimize your investment strategy in this sector, stick around!

What to Consider When Investing in Real Estate Trusts

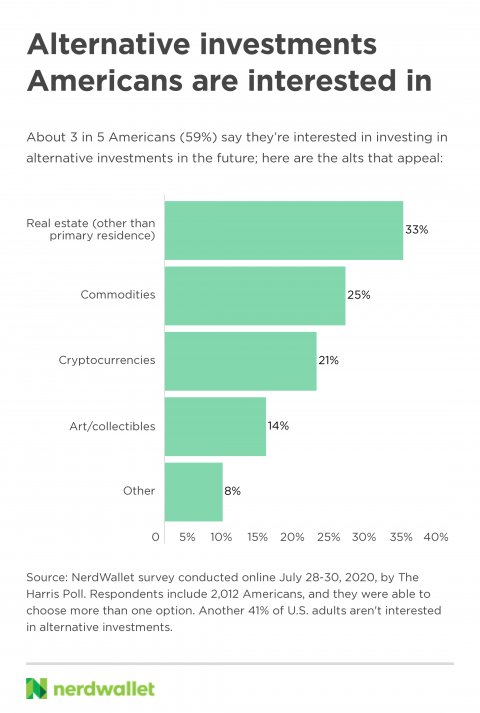

Investing in real estate trusts can be a lucrative and exciting venture. Real estate investment trusts (REITs) offer individuals the opportunity to invest in the real estate market without the need for direct ownership or management of properties. These investment vehicles provide a diversified portfolio of real estate assets, allowing investors to reap the benefits of rental income, property appreciation, and potential tax advantages. However, before diving into the world of real estate trusts, there are several crucial factors to consider. In this article, we will explore these considerations in detail, allowing you to make informed decisions when venturing into real estate trust investments.

1. Understand the Types of Real Estate Trusts

Real estate trusts come in various forms, each with its investment strategy and focus. The primary types of REITs include:

- Equity REITs: These trusts invest in and own physical properties, such as apartment buildings, office spaces, retail centers, and industrial complexes. They generate income from rental payments and property appreciation.

- Mortgage REITs: Unlike equity REITs, mortgage REITs primarily invest in real estate loans and mortgage-backed securities. They earn income through interest payments and the appreciation of mortgage assets.

- Hybrid REITs: As the name suggests, hybrid REITs are a combination of equity and mortgage REITs. These trusts invest in both physical properties and mortgage assets.

Understanding the different types of real estate trusts is crucial, as each has unique risk profiles, income streams, and growth potential. Depending on your investment goals and risk tolerance, you may choose to invest in a specific type of REIT or diversify your portfolio across different categories.

2. Evaluate the Track Record of the REIT

A thorough evaluation of the track record of the real estate trust is essential before making any investment decisions. Consider the following factors when assessing a REIT:

- Historical Performance: Review the past performance of the trust to determine its consistency in generating income and delivering returns to investors. Look for a history of dividend payments and steady growth in funds from operations (FFO) or net operating income (NOI).

- Market Presence: Analyze the trust’s market presence and reputation. Take into account the expertise and experience of the management team in the real estate industry.

- Portfolio Quality: Examine the quality and composition of the trust’s real estate assets. Assess the diversification across property types, locations, and tenant mix. A well-diversified portfolio can help mitigate risks and increase stability.

- Occupancy Rates: Look for consistent high occupancy rates, as this indicates a stable income stream. Low vacancy rates also suggest that the trust’s properties are in demand.

By evaluating the track record of a real estate trust, you can gain insights into its reliability, stability, and growth potential.

3. Assess the Investment Strategy and Objectives

Before investing in a real estate trust, it is crucial to align your investment goals with the trust’s strategy and objectives. Consider the following aspects:

- Risk Appetite: Evaluate your risk tolerance and match it with the trust’s risk profile. Some REITs may focus on higher-risk, high-growth potential properties, while others may prioritize stable, income-generating assets.

- Geographic Focus: Determine whether the trust’s geographic focus aligns with your investment preferences. Investing in trusts with properties in different regions can provide geographic diversification.

- Property Types: Assess the types of properties in which the trust invests. Different property sectors, such as residential, commercial, or industrial, may offer varying levels of risk and return.

- Investment Horizon: Consider your investment time frame and compare it with the trust’s investment strategy. Some REITs may have long-term development projects, while others may focus on short-term income generation.

Aligning your investment objectives with the real estate trust’s strategy can help ensure a better fit and increase the chances of achieving your financial goals.

4. Analyze the Financials and Dividend History

A thorough analysis of the financials and dividend history of a real estate trust is crucial in understanding its financial strength and potential income stream. Consider the following factors:

- Dividend Yield: Evaluate the dividend yield, which indicates the annual dividend payment as a percentage of the share price. A higher dividend yield may be attractive, but it is essential to assess its sustainability.

- Funds from Operations (FFO) or Net Operating Income (NOI): Examine the FFO or NOI growth over time. A steady increase in FFO or NOI may indicate a healthy and growing income stream.

- Debt Levels: Analyze the trust’s debt levels and debt-to-equity ratio. Excessive debt can increase financial risk and potentially limit growth opportunities.

- Interest Rate Sensitivity: Consider the trust’s sensitivity to changes in interest rates. Higher interest rates can impact borrowing costs and property valuations.

By analyzing the financials and dividend history of a real estate trust, you can gain insights into its financial stability, growth potential, and ability to generate consistent income.

5. Understand the Tax Implications

Investing in real estate trusts can have significant tax advantages. However, it is crucial to understand the tax implications before making any investment decisions. Consider the following:

- Dividend Tax Treatment: Real estate trusts are required to distribute a significant portion of their income as dividends. The tax treatment of these dividends varies, and understanding whether they are taxed at ordinary income rates or qualified dividend rates is essential.

- Pass-Through Entity: Most REITs are structured as pass-through entities, meaning they are not taxed at the corporate level. Instead, the income passes through to investors, who are then responsible for paying taxes on their share of the income.

- Opportunity Zones: Some real estate trusts may invest in properties located in designated opportunity zones, which provide tax incentives for investors. Understanding the potential tax benefits associated with opportunity zone investments is crucial.

- Consult a Tax Professional: Given the complexities of real estate trust taxation, it is advisable to consult a tax professional who can provide personalized advice based on your specific tax situation.

Understanding the tax implications of real estate trust investments can help you maximize your after-tax returns and make informed decisions.

6. Evaluate the Management Team and Governance

The management team and governance of a real estate trust play a significant role in its success. Evaluate the following:

- Management Expertise: Assess the experience and expertise of the trust’s management team. Look for a team with a proven track record in the real estate industry and successful execution of investment strategies.

- Corporate Governance: Examine the trust’s corporate governance practices, including board independence, transparency, and alignment of interests between management and shareholders.

- Executive Compensation: Evaluate the compensation structure of the trust’s executives, ensuring it is reasonable and aligned with performance.

A strong management team and effective governance structure can contribute to the trust’s long-term success and the protection of investor interests.

7. Consider the Fees and Expenses

Investing in real estate trusts involves costs and fees that can impact your overall returns. Consider the following:

- Management Fees: Real estate trusts usually charge management fees to cover operational expenses and compensation for the management team. Understand the fee structure and compare it with industry norms.

- Acquisition and Disposition Fees: Some real estate trusts may charge fees when acquiring or selling properties. Evaluate the impact of these fees on the trust’s returns and your investment.

- Other Expenses: Consider any other expenses, such as legal fees, accounting fees, and administrative costs, associated with investing in the trust.

Understanding the fees and expenses associated with a real estate trust is crucial to assess its overall cost-effectiveness and impact on your investment returns.

In conclusion, investing in real estate trusts can provide an excellent opportunity to participate in the real estate market without the challenges of direct property ownership. However, it is essential to consider various factors before making investment decisions. By understanding the types of real estate trusts, evaluating track records, assessing investment strategies, analyzing financials, understanding tax implications, evaluating management teams, and considering fees and expenses, you can make informed choices and enhance your chances of success in real estate trust investments. Remember to consult with financial professionals and conduct thorough research before making any investment decisions.

Is A Real Estate Investment Trust A Good Idea?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What should I consider when investing in real estate trusts?

When investing in real estate trusts, there are several important factors to consider:

What is a real estate trust?

A real estate trust, also known as a real estate investment trust (REIT), is a company that owns, operates, or finances income-generating real estate. By investing in a real estate trust, individuals can gain exposure to the real estate market without directly owning properties.

How do real estate trusts generate income?

Real estate trusts generate income through various means, such as collecting rent from tenants, leasing properties, or receiving interest from real estate-related loans. They distribute a significant portion of their income to shareholders in the form of dividends.

What are the benefits of investing in real estate trusts?

Investing in real estate trusts can provide several benefits, including diversification, regular income through dividends, potential capital appreciation, and professional management of the properties within the trust.

What are the risks associated with real estate trust investments?

Like any investment, real estate trusts come with risks. These risks may include fluctuations in property values, changes in interest rates, vacancy rate increases, economic downturns, and changes in government regulations affecting the real estate market.

How can I assess the performance of a real estate trust?

To evaluate the performance of a real estate trust, you can analyze factors such as its historical returns, dividend yields, occupancy rates, property locations, quality of management, and the overall economic conditions affecting the real estate market.

Are real estate trusts suitable for long-term investments?

Real estate trusts can be suitable for long-term investments due to their potential for stable income and potential for capital appreciation over time. However, it’s important to carefully assess your investment goals, risk tolerance, and market conditions before making any investment decisions.

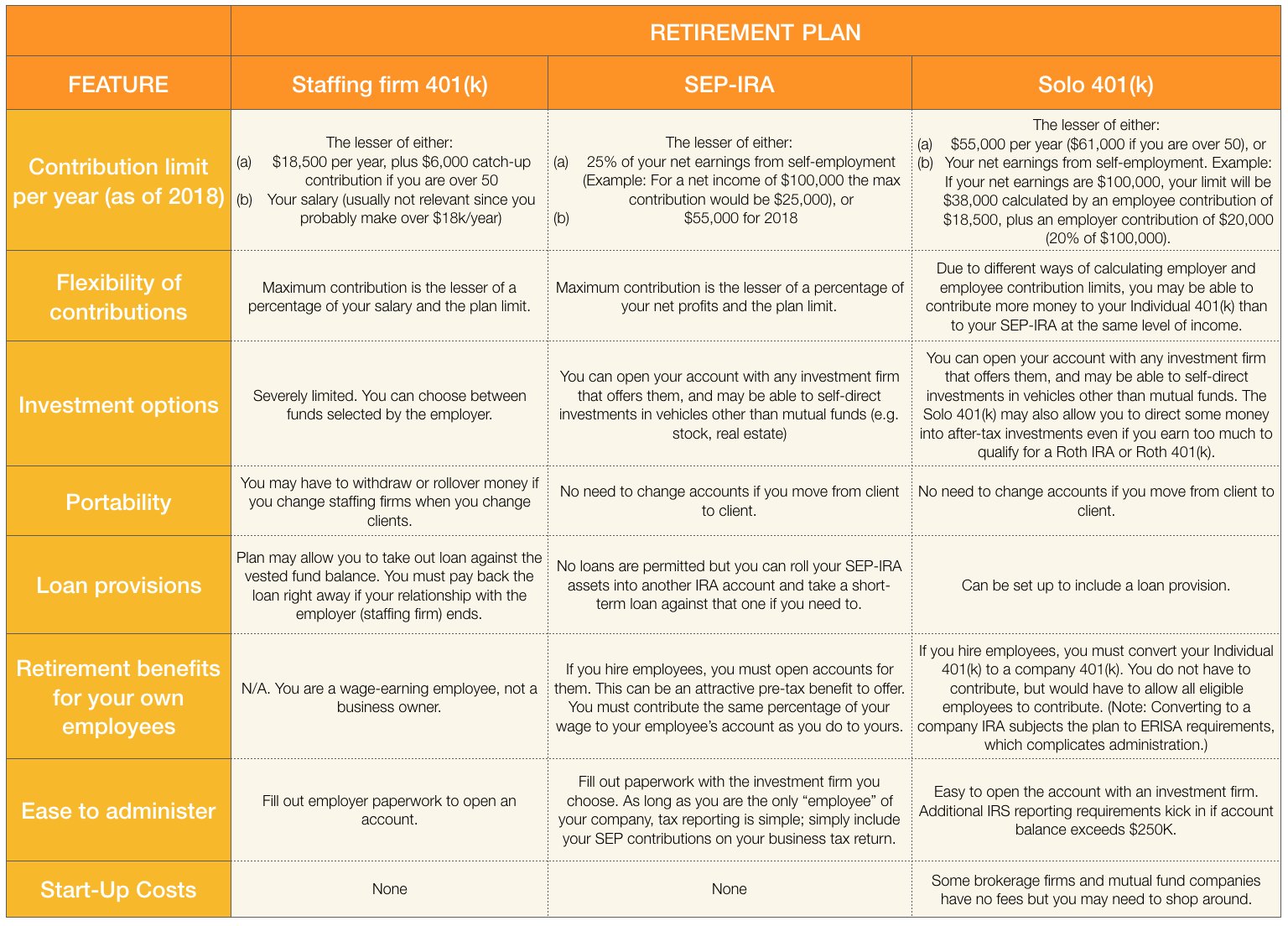

Can I invest in real estate trusts through my retirement account?

Yes, it is possible to invest in real estate trusts through certain retirement accounts, such as self-directed Individual Retirement Accounts (IRAs) or employer-sponsored 401(k) plans that offer real estate investment options. However, specific rules and regulations may apply, so it’s advisable to consult a tax or financial advisor before proceeding.

How can I buy shares of a real estate trust?

To invest in a real estate trust, you can purchase shares through a brokerage account, either online or with the assistance of a financial advisor. It’s important to research and choose a real estate trust that aligns with your investment objectives and risk tolerance.

Final Thoughts

When investing in real estate trusts, there are several key factors to consider. Firstly, it is important to thoroughly research the trust’s track record and performance history. Examining the types of properties held within the trust and their locations can provide insight into potential risks and rewards. Additionally, understanding the trust’s management team and their expertise in real estate can help gauge their ability to make sound investment decisions. Evaluating the trust’s financial stability and dividend history is also crucial. Lastly, considering the overall market conditions and trends in the real estate sector can inform investment decisions. By considering these factors when investing in real estate trusts, investors can make informed choices and optimize their potential returns.