Are you considering refinancing your mortgage? If so, you’re not alone. Many homeowners find themselves exploring this option to potentially save money, lower their interest rates, or shorten their loan term. But before you dive in, it’s important to understand what to consider when refinancing your mortgage. Making informed decisions can make a significant impact on your financial future. In this article, we will walk you through some key factors to keep in mind as you navigate the refinancing process. So, let’s get started!

What to Consider When Refinancing Your Mortgage

Refinancing your mortgage can be a strategic financial move that provides you with the opportunity to save money, lower your monthly payments, or even access funds for other purposes. However, it’s essential to carefully consider several factors before diving into the refinancing process. From understanding your goals and financial situation to analyzing the costs and benefits, here’s a detailed guide on what to consider when refinancing your mortgage.

1. Assess Your Financial Goals and Situation

Before jumping into refinancing, take the time to assess your financial goals and current circumstances. Understanding what you hope to achieve through refinancing will help you make informed decisions. Consider the following questions:

- Are you looking to lower your monthly payments?

- Do you want to pay off your mortgage faster?

- Are you interested in accessing funds for home improvements or other financial needs?

By defining your goals, you can tailor your refinancing strategy accordingly.

2. Check Your Credit Score

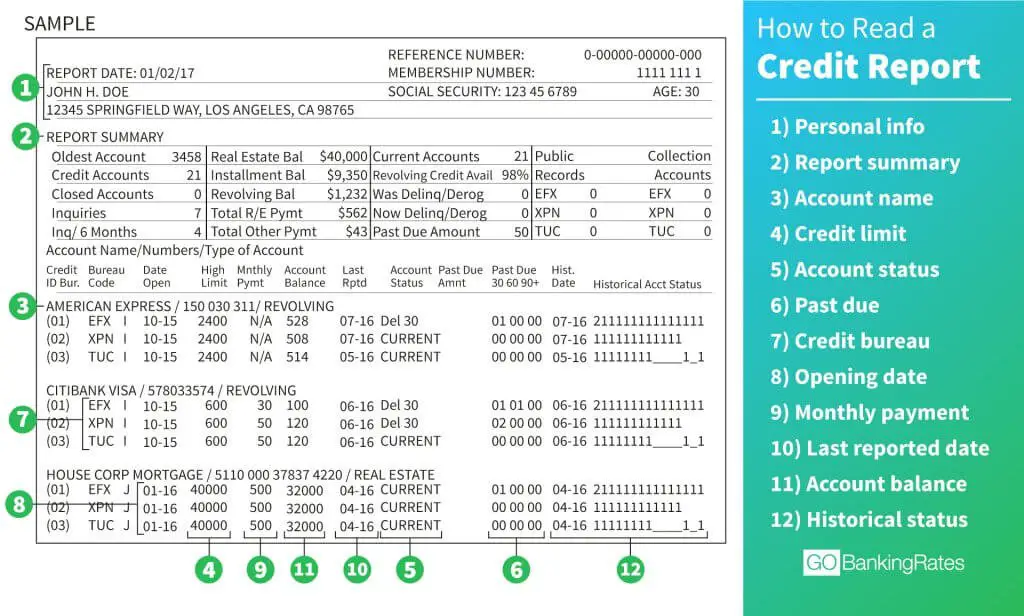

Your credit score plays a vital role in refinancing your mortgage. Lenders use credit scores to evaluate your creditworthiness and determine the terms of your loan. Before applying for refinancing, take the time to review your credit report and address any errors or issues. Improving your credit score can help you secure better interest rates and terms.

3. Calculate Your Home’s Equity

Understanding the equity in your home is crucial when refinancing. Equity represents the value of your home that you truly own, and it can affect your eligibility for refinancing options. Calculate your home’s equity by subtracting your mortgage balance from the current market value of your property. Ideally, having at least 20% equity in your home will provide you with more options and better interest rates.

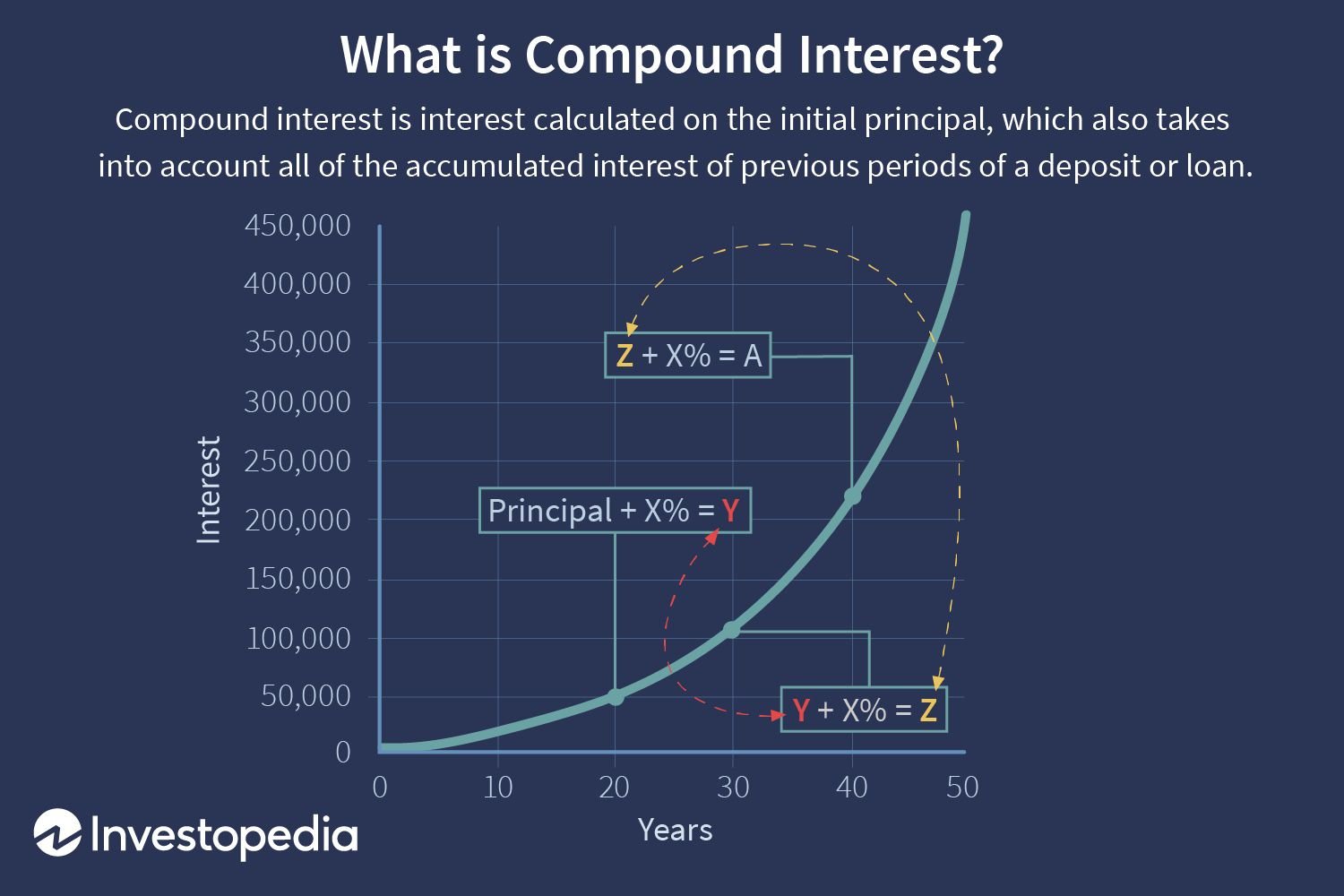

4. Research Current Interest Rates

Interest rates fluctuate over time. Before refinancing, research and compare current interest rates. Lower interest rates can save you money in the long run, but it’s also vital to consider any associated fees and closing costs. Use online resources or consult with mortgage professionals to stay informed about the prevailing interest rates.

5. Understand Different Loan Options

When refinancing, you’ll encounter various loan options. Educate yourself about the different types of loans available and evaluate which one aligns with your financial goals. Some of the common loan options include:

- Fixed-rate mortgages: These loans offer a consistent interest rate throughout the loan term.

- Adjustable-rate mortgages (ARM): With ARMs, the interest rate fluctuates over time, often starting with a lower rate for an initial period.

- Cash-out refinancing: This option allows you to access the equity in your home by borrowing more than what you owe.

- FHA loans: Ideal for first-time homebuyers, FHA loans are insured by the Federal Housing Administration.

Evaluate each option carefully, considering factors such as interest rates, loan terms, and eligibility requirements.

6. Calculate Your Break-Even Point

Refinancing is not without costs. As you explore refinancing options, it’s crucial to calculate your break-even point. The break-even point represents the time it takes for your monthly savings to offset the costs associated with refinancing. Consider factors such as closing costs, application fees, and any prepayment penalties you may incur. If you plan to sell your home in the near future, it’s also essential to assess whether you’ll recoup the costs before moving.

7. Explore Lender Options

When refinancing, don’t settle for the first lender you come across. Take the time to explore multiple lender options, comparing interest rates, fees, and customer reviews. Be sure to consider both traditional banks and online mortgage lenders. Gathering quotes from different lenders will help you make an informed decision and potentially save money.

8. Gather the Necessary Documentation

The refinancing process involves paperwork, so it’s essential to gather the necessary documentation ahead of time. While specific requirements may vary, you’ll generally need the following:

- Proof of income, such as pay stubs or tax returns.

- Bank statements and asset documentation.

- Proof of homeowner’s insurance.

- Employment verification.

By having all these documents readily available, you can streamline the refinancing process and avoid delays.

9. Consider Working with a Mortgage Professional

Navigating the refinancing process can be overwhelming, especially if you’re unfamiliar with the intricacies of mortgage loans. Consider working with a mortgage professional who can guide you through the process, answer your questions, and help you find the best refinancing options for your needs. Their expertise can prove invaluable and save you both time and money.

10. Review and Understand the Terms

Once you’ve identified a potential lender and loan option, carefully review the terms and conditions before moving forward. Pay attention to details such as interest rates, loan duration, prepayment penalties, and any potential hidden fees. Understanding the terms will ensure you make an informed decision and avoid any unpleasant surprises down the line.

To wrap up, refinancing your mortgage is a significant financial decision that requires careful consideration. By assessing your goals, understanding your financial situation, and exploring various options, you can make an informed decision that aligns with your long-term financial objectives. Remember, refinancing is not a one-size-fits-all solution, so take the time to evaluate your personal circumstances and consult with professionals when needed.

Mortgage Refinance Explained – When Should You REFINANCE?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What factors should I consider when refinancing my mortgage?

When considering refinancing your mortgage, there are several factors you should keep in mind:

– Current interest rates: Compare the current interest rates with the rate on your existing mortgage to determine if refinancing would result in savings.

– Your credit score: A good credit score can help you qualify for a lower interest rate on the new loan.

– Loan term: Consider whether you want to extend or shorten the repayment period of your mortgage when refinancing.

– Closing costs: Take into account the closing costs associated with refinancing, such as appraisal fees, application fees, and attorney fees.

– Equity in your home: Evaluate the amount of equity you have in your home, as it may affect your loan options and interest rate.

– Financial goals: Determine if your financial goals align with refinancing, such as reducing monthly payments, paying off the mortgage sooner, or accessing cash equity.

What are the potential benefits of refinancing my mortgage?

Refinancing your mortgage can provide various benefits, including:

– Lowering monthly payments: Refinancing to a lower interest rate may decrease your monthly mortgage payments.

– Interest savings: By securing a lower interest rate, you can save money on interest over the life of the loan.

– Debt consolidation: Refinancing can allow you to consolidate high-interest debt into your mortgage, potentially reducing overall interest costs.

– Accessing home equity: You can tap into your home’s equity by refinancing, giving you access to cash for home improvements, investments, or other expenses.

– Changing loan terms: Refinancing also allows you to change the length of your loan term, such as switching from a 30-year to a 15-year mortgage to pay off your home sooner.

Will refinancing my mortgage affect my credit score?

Refinancing your mortgage may have a temporary impact on your credit score. When you apply for a new loan, the lender will perform a hard inquiry on your credit report, which can cause a slight decrease in your score. However, if you make your mortgage payments on time and manage your new loan responsibly, your credit score should recover and potentially improve over time.

How much does it cost to refinance a mortgage?

Refinancing a mortgage typically incurs closing costs, which can range from 2% to 6% of the loan amount. These costs may include appraisal fees, origination fees, title insurance, attorney fees, and more. It’s essential to consider these costs when determining if refinancing is financially beneficial in the long run. Some lenders offer “no-closing-cost” refinancing options, but these usually come with a slightly higher interest rate.

Can I refinance my mortgage if I have bad credit?

While refinancing with bad credit can be challenging, it’s not impossible. Lenders may consider other factors such as your income, employment history, and the amount of equity you have in your home. However, keep in mind that having bad credit may result in a higher interest rate, which could impact the overall financial benefits of refinancing. It’s advisable to improve your credit score before refinancing to secure better terms.

Should I choose a fixed or adjustable rate mortgage when refinancing?

The decision between a fixed or adjustable rate mortgage (ARM) depends on your financial goals and risk tolerance. A fixed-rate mortgage offers stability as the interest rate remains the same throughout the loan term. On the other hand, an ARM usually starts with a lower fixed rate for a specific period, then adjusts periodically. If you plan to stay in your home for a long time, a fixed-rate mortgage may provide peace of mind. However, if you anticipate selling the property or refinancing again in a few years, an ARM with an initial fixed-rate period could be advantageous.

What documents do I need to refinance my mortgage?

When refinancing your mortgage, you’ll typically need to provide the following documents:

– Proof of income: Recent pay stubs, W-2 forms, and tax returns to verify your income.

– Credit information: Authorization to access your credit report and FICO score.

– Bank statements: Statements from your bank accounts to demonstrate your financial stability.

– Property information: Documentation related to your property, such as the deed, homeowners insurance, and property tax information.

– Employment verification: Proof of employment, such as employer contact information and recent pay stubs.

– Other financial information: Details about your debts, assets, and any existing mortgages or loans.

How long does the refinancing process usually take?

The refinancing process typically takes between 30 to 45 days, although it can vary depending on several factors such as the lender’s efficiency, required documentation, and any issues that may arise during the appraisal or underwriting. It’s crucial to stay in close communication with your lender and promptly provide any requested documents to expedite the process.

Final Thoughts

Considering refinancing your mortgage? Here are key factors to keep in mind. First, evaluate your financial goals and determine if refinancing aligns with them. Next, consider the current interest rates and how they compare to your existing mortgage. Assess any potential fees or closing costs associated with the refinance. Additionally, examine your credit score and financial health to ensure you qualify for favorable terms. Lastly, seek quotes from multiple lenders to secure the best possible deal. By carefully considering these factors, you can make an informed decision when refinancing your mortgage.