Are you aware of what to know about disability insurance policies? If not, worry not, as we have got you covered! Understanding disability insurance policies is crucial for safeguarding your income and ensuring financial stability in the event of an unexpected disability. In this article, we will delve into the important aspects of disability insurance policies, empowering you to make informed decisions regarding your coverage. So, let’s explore the ins and outs of disability insurance policies together, ensuring you have the knowledge needed to protect yourself and your loved ones.

What to Know About Disability Insurance Policies

Disability insurance is a type of coverage that offers financial protection in the event that you become disabled and are unable to work. It provides a source of income to help cover your living expenses and other financial obligations. Understanding the key aspects of disability insurance policies can help you make an informed decision when selecting the right coverage for your needs. In this article, we’ll explore the essential elements of disability insurance policies, including the types of coverage, eligibility criteria, benefit amounts, and more.

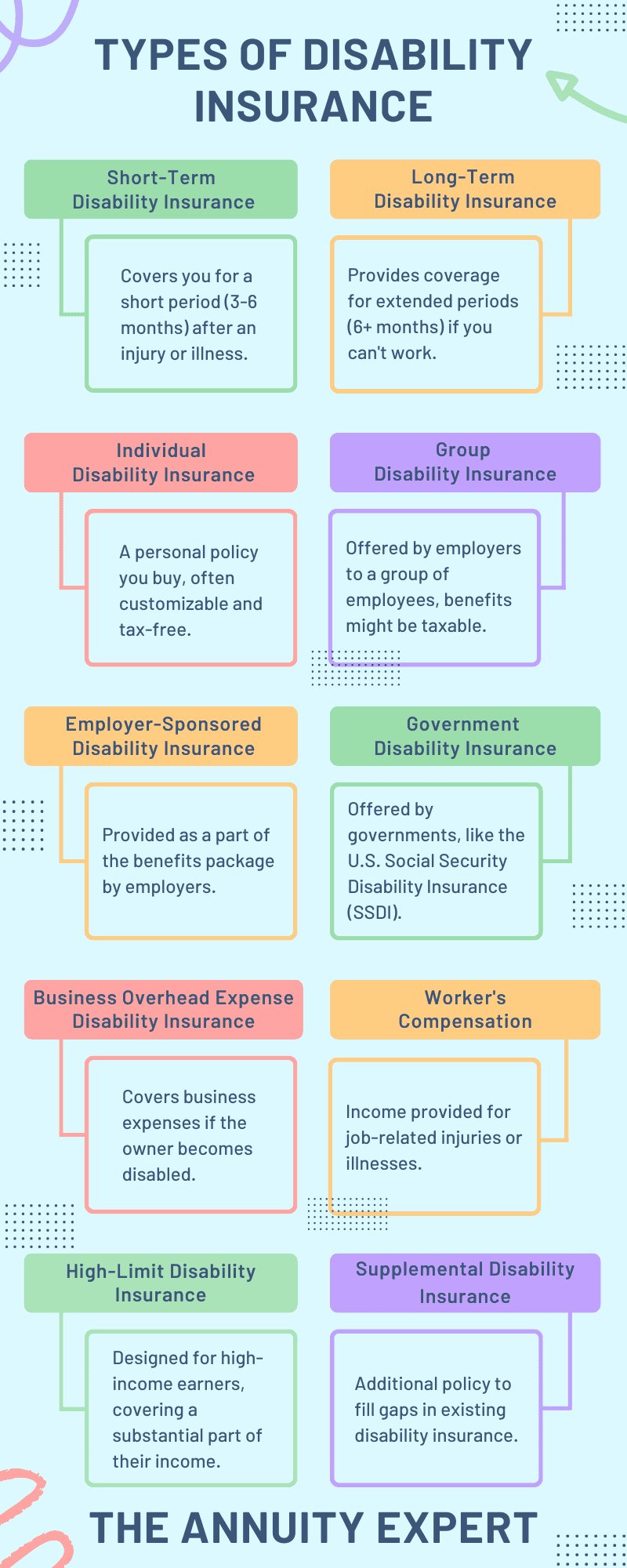

Types of Disability Insurance Coverage

There are two main types of disability insurance coverage: short-term disability insurance (STD) and long-term disability insurance (LTD). Each type of coverage serves a specific purpose and offers different benefits.

- Short-Term Disability Insurance (STD): STD policies typically provide coverage for a shorter duration, usually ranging from a few weeks to several months. They are designed to replace a portion of your income during a temporary disability, such as recovery from surgery or a non-work-related injury. STD benefits typically kick in after a waiting period, which can vary depending on the policy.

- Long-Term Disability Insurance (LTD): LTD policies are designed to provide coverage for an extended period, often until retirement age if necessary. They come into play when a disability lasts beyond the coverage provided by STD insurance. LTD benefits usually begin after a waiting period ranging from 30 to 180 days, depending on the policy. These policies offer more comprehensive income replacement and are especially crucial for individuals with chronic or severe disabilities.

Eligibility Criteria for Disability Insurance

While the specific eligibility requirements can vary between insurance providers and policies, there are some general criteria you should be aware of when considering disability insurance:

- Occupational Requirements: Some policies may have specific occupational requirements, meaning you must be engaged in certain types of work to be eligible for coverage. For example, coverage may be limited for high-risk professions or self-employed individuals.

- Medical Evaluation: Disability insurance policies typically require a thorough medical evaluation to assess your health condition. The insurer will consider pre-existing medical conditions, lifestyle factors, and overall health to determine your eligibility and premium rates.

- Income Threshold: Insurers may set a minimum income requirement for individuals seeking disability insurance coverage. This threshold ensures that the coverage is adequate compared to your income level.

Benefit Amounts

When it comes to disability insurance, the benefit amount refers to the percentage of your income that will be replaced if you become disabled. This percentage can vary depending on the policy and may range from 50% to 80% of your pre-disability income. It’s essential to carefully consider the benefit amount while selecting a disability insurance policy to ensure it adequately covers your financial needs during a disability.

Definition of Disability

Disability insurance policies have different definitions of disability, and it’s crucial to understand how a policy defines disability before purchasing coverage. There are two main types of disability definitions:

- Own Occupation: Under an own occupation definition, you are considered disabled if you can no longer perform the duties required by your specific occupation. This type of definition offers a higher level of coverage as it considers your ability to work in your current profession.

- Any Occupation: An any occupation definition requires that you are unable to work in any occupation for which you are reasonably qualified based on your education, training, and experience. This definition is more stringent and provides coverage only if you cannot work in any job.

Exclusions and Limitations

It’s essential to carefully review the exclusions and limitations outlined in a disability insurance policy. These are specific scenarios or conditions that may not be covered by your policy. Common exclusions include:

- Pre-existing conditions: Some policies may exclude coverage for disabilities arising from pre-existing conditions, especially during the initial waiting period.

- Self-inflicted injuries: Disabilities resulting from self-inflicted injuries, such as suicide attempts, are generally excluded from coverage.

- Drug or alcohol-related disabilities: Disabilities caused by substance abuse or related conditions may not be covered.

It’s important to carefully read through the policy terms and conditions to understand the specific exclusions and limitations that apply. This will help ensure that you have a comprehensive understanding of what is covered and any potential gaps in coverage.

Waiting Periods

Disability insurance policies often include a waiting period, which is the amount of time you must wait before receiving benefits after becoming disabled. The waiting period can range from a few days to several months, depending on the policy. A longer waiting period typically results in lower premium costs, while a shorter waiting period provides quicker access to benefits. Consider your financial situation and emergency savings when deciding on an appropriate waiting period.

How Premiums Are Determined

The cost of disability insurance premiums can vary based on several factors, including:

- Age: Younger individuals generally pay lower premiums than older individuals.

- Health: Your overall health condition and medical history may impact your premium rates.

- Occupation: High-risk occupations may have higher premiums due to the increased likelihood of disability.

- Benefit Period and Amount: Longer benefit periods and higher benefit amounts typically result in higher premiums.

It’s important to obtain quotes from multiple insurance providers and compare the premiums and coverage options. Consider working with an insurance agent specializing in disability insurance to help you navigate the process and find the best policy for your needs and budget.

Renewability and Policy Updates

Disability insurance policies can have different renewability and update provisions. The two common types are:

- Guaranteed Renewable: A policy with guaranteed renewability ensures that the insurer cannot cancel your coverage as long as you continue to pay the premiums. The premium rates, however, can increase over time.

- Non-Cancelable: A non-cancelable policy guarantees that the insurer cannot increase the premium rates or cancel the coverage as long as you pay the premiums on time.

Understanding the renewability and update provisions is crucial, as they can impact the long-term affordability and stability of your disability insurance coverage.

In conclusion, disability insurance plays a critical role in providing financial security if you experience a disability and are unable to work. By understanding the various aspects of disability insurance policies, including the types of coverage, eligibility criteria, benefit amounts, definitions of disability, exclusions, waiting periods, premiums, and renewability provisions, you can make an informed decision to protect yourself and your loved ones. Take the time to evaluate your needs, compare policies, and consult with an insurance professional to find the most suitable disability insurance coverage for your specific circumstances.

Disability insurance explained: How it works and the types of coverage available

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is disability insurance?

Disability insurance is a type of insurance that provides financial protection to individuals who are unable to work due to a disability. It replaces a portion of the insured person’s income if they become disabled and unable to perform their job duties.

What does disability insurance cover?

Disability insurance typically covers a percentage of your income if you are unable to work due to a disability. It can provide financial support for medical expenses, mortgage or rent payments, daily living expenses, and other bills during the period of disability.

Who needs disability insurance?

Anyone who relies on their income to cover living expenses should consider disability insurance. It is especially important for individuals who do not have sufficient savings to sustain themselves in the event of a disability.

What types of disability insurance policies are available?

There are two main types of disability insurance policies: short-term disability insurance and long-term disability insurance. Short-term disability insurance typically covers disabilities that last for a few weeks to a few months, while long-term disability insurance covers longer-lasting disabilities.

How does the disability insurance claims process work?

When filing a disability insurance claim, you will typically need to provide medical documentation proving your disability. The insurance company will review your claim and may require additional information or examinations. Once approved, you will start receiving the agreed-upon benefits.

What factors should I consider when choosing a disability insurance policy?

When choosing a disability insurance policy, you should consider factors such as the benefit amount, waiting period before benefits begin, length of coverage, definition of disability, and any exclusions or limitations. It is important to carefully review the policy terms and compare different options before making a decision.

Is disability insurance expensive?

The cost of disability insurance can vary depending on factors such as your age, health, occupation, benefit amount, and policy features. Generally, disability insurance premiums are affordable, especially when compared to the potential financial impact of a disability.

Can I get disability insurance if I have a pre-existing condition?

It may be possible to get disability insurance with a pre-existing condition, but it depends on the specific condition and the insurance company’s underwriting guidelines. Some policies may exclude coverage for pre-existing conditions, while others may provide limited coverage or higher premiums. It’s important to discuss your specific situation with an insurance provider.

Final Thoughts

Disability insurance policies are crucial for protecting individuals from the financial hardships that can occur if they are unable to work due to a disability. Understanding the key aspects of these policies is essential when considering coverage options. Firstly, it is important to know that disability insurance policies typically provide a percentage of your income as benefits if you become disabled. Secondly, there are two main types of disability insurance: short-term and long-term. Thirdly, it is vital to consider the policy’s definition of disability and the waiting period before benefits start. Lastly, it is advisable to carefully review the policy’s exclusions and limitations. By being well-informed about disability insurance policies, individuals can ensure that they choose the coverage that best suits their needs and protects their financial well-being in times of disability.