Are you searching for the perfect insurance plan that covers all your needs? Look no further! When considering a comprehensive insurance plan, it’s important to understand what to look for to ensure you have the right coverage. In this article, we will guide you through the essential factors to consider when choosing a comprehensive insurance plan. From the types of coverage to the policy limits and deductibles, we’ve got you covered. So, let’s dive in and explore what to look for in a comprehensive insurance plan.

What to Look for in a Comprehensive Insurance Plan

When it comes to protecting yourself, your loved ones, and your assets, having a comprehensive insurance plan is crucial. Insurance provides a safety net that ensures you are financially covered in case of unexpected events. However, not all insurance plans are created equal. The key is to find a comprehensive insurance plan that meets all your needs and provides you with peace of mind. In this article, we will explore the essential elements to look for when choosing a comprehensive insurance plan.

1. Adequate Coverage

The first and foremost aspect to consider when selecting a comprehensive insurance plan is ensuring that it offers adequate coverage. You must carefully assess your needs and determine the level of coverage you require. Consider the following points:

- Evaluate the potential risks and hazards specific to your situation. For example, if you live in an area prone to natural disasters, such as hurricanes or earthquakes, make sure the plan includes coverage for these events.

- Calculate the value of your assets. If you own a home, ensure that the plan covers the full replacement cost in case of damage or loss. For vehicles, verify that the plan covers both repairs and liability.

- Assess your personal liability coverage needs. This is especially crucial if you have significant assets or are at risk of being involved in a lawsuit.

2. Wide Range of Coverage Types

Comprehensive insurance plans should encompass various coverage types to provide well-rounded protection. Look for plans that include the following types of coverage:

Home Insurance

Home insurance covers your property and possessions against damage, theft, and liability. It should protect both the structure of your home and its contents. Additionally, a comprehensive plan may include coverage for additional living expenses if you are temporarily unable to live in your home due to covered events.

Auto Insurance

Auto insurance is essential for all vehicle owners. A comprehensive auto insurance plan should offer coverage for accidents, theft, vandalism, and liability. It should also cover medical payments, uninsured or underinsured motorists, and provide roadside assistance.

Health Insurance

Health insurance provides coverage for medical expenses, hospital stays, surgeries, and medication. Look for a plan that includes preventive care, prescription drug coverage, and access to a broad network of healthcare providers.

Life Insurance

Life insurance ensures financial protection for your loved ones in the event of your death. A comprehensive life insurance plan should provide coverage that matches your financial obligations, including mortgage payments, education expenses, and income replacement.

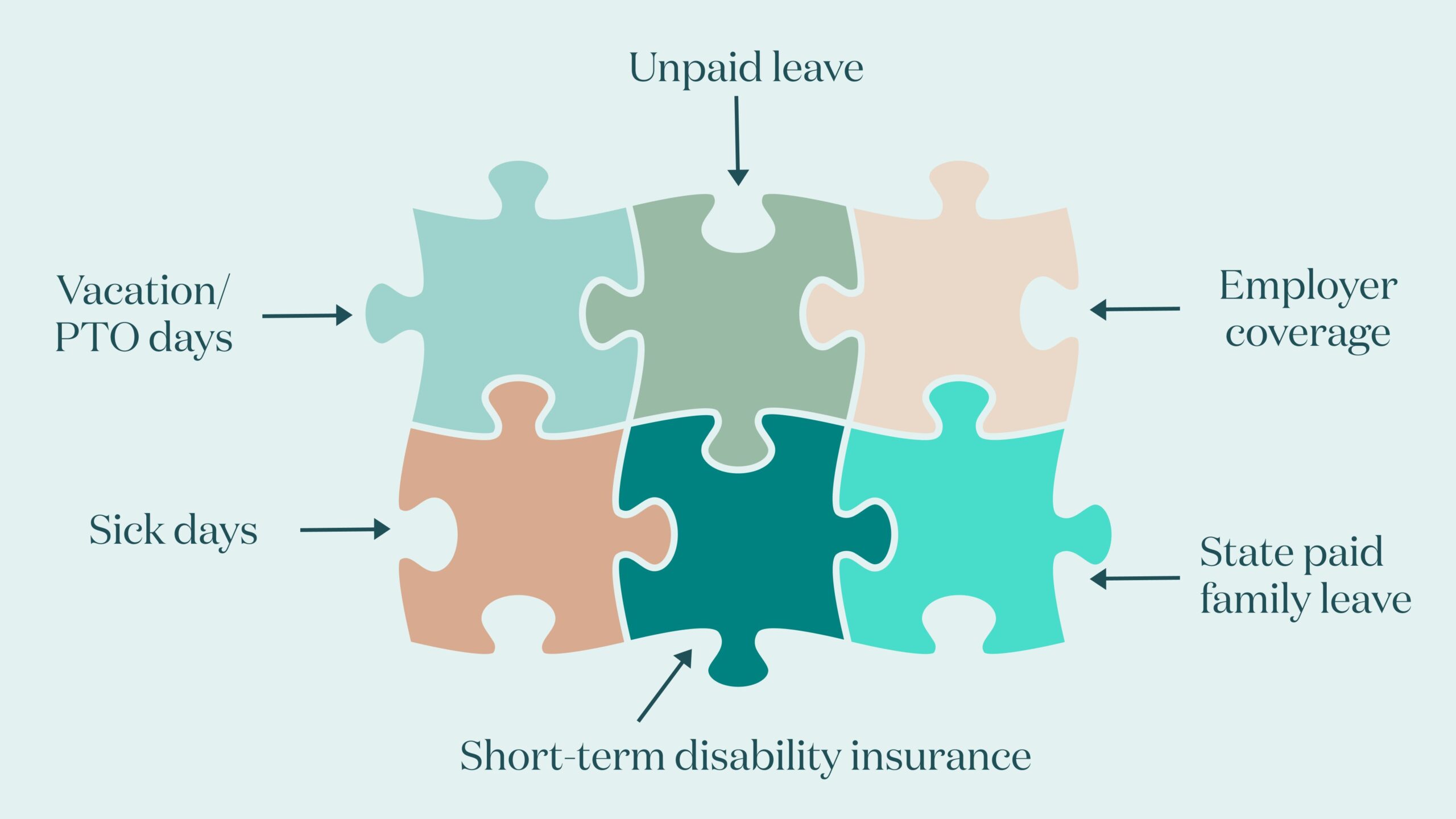

Disability Insurance

Disability insurance offers income protection if you are unable to work due to illness or injury. Look for a plan that provides both short-term and long-term disability coverage, and consider the waiting period and benefit duration.

3. Transparent Exclusions and Limitations

While a comprehensive insurance plan offers extensive coverage, it is equally important to understand its exclusions and limitations. Insurance policies often have specific conditions that limit coverage for certain situations or events. Make sure to:

- Read the policy carefully and understand any exclusions or limitations listed.

- Ask the insurance provider or agent to clarify any areas that are unclear to you.

- Be aware of any deductibles or copayments you may be responsible for.

- Consider purchasing additional coverage or riders if you anticipate needing protection outside the standard policy.

4. Price and Affordability

While price should not be the sole determining factor, it is important to consider your budget when choosing a comprehensive insurance plan. Here are some tips:

- Obtain quotes from multiple insurance providers to compare prices for similar coverage.

- Consider bundling multiple policies with the same provider. Many insurers offer discounts for bundling home, auto, and other policies.

- Review the deductibles and premiums of each plan and determine if they align with your financial capabilities.

- Balance the cost with the value of coverage provided and the financial protection it offers.

5. Financial Stability and Reputation of the Insurance Provider

When purchasing a comprehensive insurance plan, it is crucial to choose a reputable insurance provider with financial stability. The last thing you want is to invest in a plan only to find out that the insurance company is unable to fulfill its obligations. Consider the following:

- Research the financial strength of the insurance provider by checking their credit ratings from reputable agencies, such as A.M. Best or Standard & Poor’s.

- Read reviews and seek recommendations from friends, family, or trusted advisors who have experience with the insurance provider.

- Look for an insurer with a good claims-paying history and a responsive customer service team.

In conclusion, finding a comprehensive insurance plan requires careful consideration and evaluation of your specific needs. Look for a plan with adequate coverage, a wide range of coverage types, transparent exclusions, and limitations, affordability, and a reputable insurance provider. Remember, insurance is an investment that provides financial protection and peace of mind in the face of uncertainties. Take the time to research, compare options, and choose wisely to ensure you have the right coverage for your needs.

How Much Car Insurance Do You Need | 4 EASY STEPS

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What should I look for in a comprehensive insurance plan?

When searching for a comprehensive insurance plan, consider factors such as coverage options, deductibles, premiums, network of healthcare providers, policy limits, and additional benefits or riders. It is important to assess your specific needs and compare different plans to find the one that offers the best value and meets your requirements.

How do I determine the coverage options in a comprehensive insurance plan?

To determine the coverage options in a comprehensive insurance plan, carefully review the policy documents or contact the insurance provider. Look for details related to medical services, hospitalization, emergency care, prescription drugs, preventive care, mental health services, and any other specific areas of coverage you require.

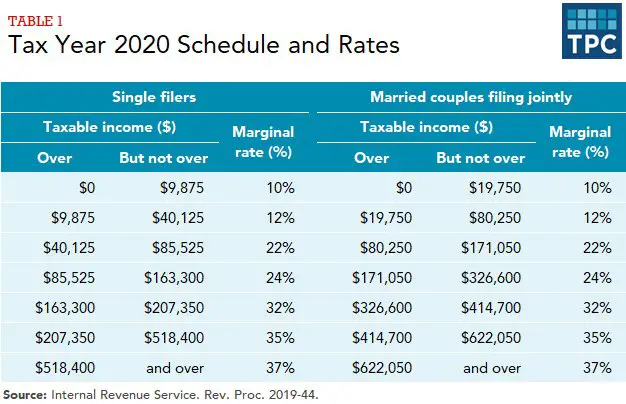

What should I consider when evaluating the deductibles in a comprehensive insurance plan?

When evaluating deductibles in a comprehensive insurance plan, keep in mind that a higher deductible usually means lower monthly premiums. However, you need to be prepared to pay a higher out-of-pocket amount before the insurance coverage kicks in. Consider your budget, healthcare needs and the deductible structure to assess what works best for you.

Is the premium the only cost I need to consider while choosing a comprehensive insurance plan?

No, the premium is not the only cost to consider when choosing a comprehensive insurance plan. You should also factor in out-of-pocket costs such as deductibles, co-pays, and co-insurance. Additionally, consider the potential costs of services or treatments that may not be covered by the plan.

What is a provider network, and why is it important in a comprehensive insurance plan?

A provider network refers to the list of healthcare providers, hospitals, and clinics that have agreed to provide services to members of a particular insurance plan at negotiated rates. It is important in a comprehensive insurance plan because using in-network providers can help minimize costs and ensure that you receive the full benefits of the plan.

How do policy limits affect the coverage in a comprehensive insurance plan?

Policy limits in a comprehensive insurance plan define the maximum amount the insurance company will pay for covered services. It is essential to carefully review these limits to understand the extent of coverage and ensure it aligns with your healthcare needs.

What additional benefits or riders should I consider in a comprehensive insurance plan?

Additional benefits or riders can vary among insurance plans. Consider options such as dental and vision coverage, maternity benefits, prescription drug coverage, mental health services, wellness programs, or any other features that align with your specific needs. Evaluate the cost and benefits of these additional options before making a decision.

How can I compare different comprehensive insurance plans?

To compare different comprehensive insurance plans, gather information about their coverage, deductibles, premiums, provider networks, policy limits, additional benefits, and riders. Utilize comparison tools provided by insurance marketplaces or consult with insurance professionals to assess which plan offers the best value and fits your requirements.

Final Thoughts

When searching for a comprehensive insurance plan, there are several key factors to consider. Firstly, ensure that the plan covers all of your specific needs, including healthcare, property, and liability. Additionally, look for a plan that offers a wide network of providers and allows for flexibility in choosing doctors and specialists. It’s also important to review the coverage limits and deductibles to ensure they align with your budget and potential risks. Finally, evaluate the plan’s customer service and claims process, as a responsive and reliable insurer is crucial for a smooth experience. By prioritizing these aspects, you can find a comprehensive insurance plan that provides the necessary coverage and peace of mind.