Do you ever wonder why considering inflation is important in retirement planning? Well, the answer is quite simple: inflation has the power to erode the value of your savings over time. As you envision a comfortable and worry-free retirement, it’s crucial to take into account the rising cost of goods and services. Otherwise, you may find yourself falling short of the funds needed to maintain your desired lifestyle. In this article, we will delve into the significance of factoring in inflation when planning for retirement, and explore strategies to protect your future financial well-being. Let’s dive in!

Why Considering Inflation is Important in Retirement Planning

Introduction

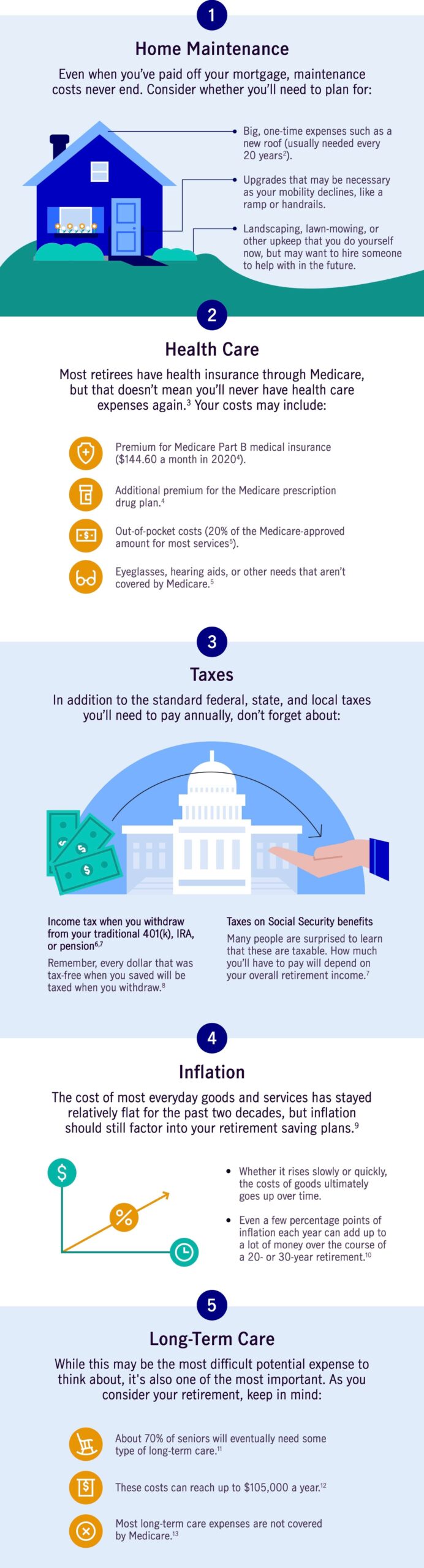

Retirement planning is a crucial aspect of financial management that everyone should prioritize to secure their future. While most people focus on saving and investment strategies, it’s equally important to consider the impact of inflation on retirement plans. Inflation refers to the general increase in prices and decrease in purchasing power over time. Ignoring inflation can significantly impact the purchasing power of your retirement savings and undermine your financial security. This article explores why considering inflation is important in retirement planning and provides valuable insights into mitigating its effects.

The Impact of Inflation on Retirement Savings

Inflation erodes the value of money over time, meaning that the same amount of money will buy less in the future than it does today. Suppose you plan to retire in 30 years with a retirement nest egg of $1 million. Without accounting for inflation, that $1 million might seem like a substantial amount. However, if we assume a moderate annual inflation rate of 3%, the purchasing power of that $1 million will be significantly diminished by the time you retire. In other words, your retirement savings won’t stretch as far as you initially anticipated.

1. The Rising Cost of Living

One of the key reasons to consider inflation in retirement planning is the rising cost of living. As prices increase over time, your expenses are likely to rise, affecting your retirement lifestyle. The cost of basic necessities, healthcare, housing, and even leisure activities will inevitably increase due to inflation. Failing to account for this can result in a substantial gap between the income you’ll need to sustain your desired lifestyle and the income you’ll actually have during retirement.

2. Longevity and Its Impact

Another factor to consider is the increasing life expectancy. With advancements in healthcare, people are living longer, which means retirement funds need to last longer. If you don’t factor inflation into your retirement plans, you may risk outliving your savings. Planning for an extended retirement period with increasing expenses is crucial to ensure financial security throughout your retirement years.

Strategies to Mitigate the Impact of Inflation

Now that we understand the importance of considering inflation in retirement planning, let’s explore some effective strategies to mitigate its impact:

1. Invest in Inflation-Protected Securities

Inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), can be an excellent addition to your retirement investment portfolio. These bonds provide protection against inflation by adjusting their value based on changes in the Consumer Price Index (CPI). By investing in TIPS, you can ensure that your savings keep pace with inflation and maintain their purchasing power.

2. Diversify Your Investments

Diversification is a fundamental strategy in any investment plan, but it becomes even more crucial when considering the impact of inflation. By diversifying your investment portfolio and including a mix of assets, such as stocks, bonds, real estate, and commodities, you can potentially counter the effects of inflation. Different types of investments tend to perform differently under changing economic conditions, allowing you to mitigate the risk of inflation on your overall portfolio.

3. Regularly Review and Adjust Your Retirement Plan

Retirement planning is not a one-time activity; it requires regular review and adjustments. As you progress through different life stages and economic conditions change, it’s essential to reassess your retirement plan to ensure it remains aligned with your goals. Regularly reviewing and adjusting your retirement plan allows you to account for inflation, changes in expenses, and other financial considerations, keeping your retirement on track.

4. Consider a Retirement Income Annuity

Retirement income annuities can be an effective tool to combat the impact of inflation. An annuity provides a steady income stream during retirement, ensuring you won’t outlive your savings. Opting for an inflation-adjusted annuity can further safeguard your retirement income by providing periodic increases to match the rise in the cost of living. Including annuities in your retirement plan can add stability and protect against the erosive effects of inflation.

Inflation is an inevitable part of the economic landscape, and overlooking its impact on retirement planning can have dire consequences. By considering inflation and implementing appropriate strategies, you can protect the purchasing power of your retirement savings and enjoy a comfortable lifestyle during your golden years. Remember to regularly review your retirement plan, diversify your investments, and explore options like inflation-protected securities and retirement income annuities. By taking these proactive steps, you can navigate the challenges of inflation and secure a financially stable retirement.

Consider Inflation On Your Retirement Savings

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Why is considering inflation important in retirement planning?

Inflation is an essential factor to consider in retirement planning because it erodes the purchasing power of money over time. As prices rise, the value of your savings decreases, making it crucial to account for inflation when estimating your retirement expenses.

How does inflation impact retirement savings?

Inflation reduces the value of your retirement savings over time. Without factoring in inflation, you may underestimate the amount of money needed to maintain your desired standard of living during retirement. Ignoring inflation can lead to a shortfall in funds and financial difficulties later in life.

What strategies can I use to account for inflation in retirement planning?

To account for inflation in retirement planning, you can consider the following strategies:

1. Investing in assets with potential returns higher than the inflation rate.

2. Adjusting your savings goals to account for inflation.

3. Diversifying your investment portfolio to mitigate inflation risks.

4. Regularly reviewing and adjusting your retirement plan to align with changing economic conditions.

How can inflation affect my retirement income?

If you do not consider inflation in your retirement planning, the purchasing power of your retirement income will decrease over time. This means that the fixed income you rely on during retirement may not be sufficient to cover rising expenses, potentially leading to financial strain.

Are there any specific retirement accounts that address inflation concerns?

Retirement accounts such as 401(k)s, IRAs, and Roth IRAs do not explicitly address inflation concerns. However, you can choose investments within these accounts that have the potential to outpace inflation, such as stocks, real estate investment trusts (REITs), or inflation-protected securities.

What is the historical average rate of inflation?

The historical average rate of inflation in the United States has been around 2-3% annually. However, it is important to note that inflation rates can vary over time and across different countries. It is advisable to consider long-term historical trends and consult updated economic data when planning for retirement.

Can inflation be predicted accurately for retirement planning?

Predicting future inflation rates precisely is challenging as they are influenced by numerous factors such as government policies, global economic conditions, and technological advancements. While economists and analysts make projections, it is best to consider a range of inflation scenarios and incorporate a margin of safety in your retirement planning.

What are the consequences of not considering inflation in retirement planning?

Not considering inflation in retirement planning can have several negative consequences. These include running out of money earlier than expected, being unable to meet rising expenses, having to rely on insufficient government benefits, or needing to return to work in retirement. Careful consideration of inflation helps ensure a more financially secure retirement.

Final Thoughts

Considering inflation is important in retirement planning as it directly impacts the purchasing power of your savings over time. Failing to account for inflation can lead to a significant erosion of your retirement funds, leaving you financially vulnerable in your later years. By factoring in inflation when calculating retirement goals and savings targets, you can ensure that your money will continue to support your desired lifestyle and cover rising costs of living. Planning for inflation helps safeguard your future financial security and allows you to maintain a comfortable standard of living throughout your retirement years.