Looking for ways to secure your financial future? Want to create a more stable and prosperous life for yourself? Then, it’s time to consider why you should have multiple income streams. In today’s uncertain economy, relying on a single source of income can be risky. By diversifying your income streams, you not only increase your earning potential but also create a safety net that can help you weather unexpected financial challenges. In this blog article, we will explore the benefits of having multiple income streams and provide practical tips on how to get started. So, let’s dive in and explore why you should have multiple income streams to achieve financial freedom.

Why You Should Have Multiple Income Streams

In today’s fast-paced and uncertain world, having multiple income streams is becoming increasingly essential. Relying solely on a single source of income is no longer a wise or secure strategy. Diversifying your income streams allows you to mitigate financial risks, maximize your earning potential, and achieve greater financial stability. In this article, we will explore the reasons why you should have multiple income streams and how it can benefit you in various aspects of your life.

1. Financial Security and Stability

One of the key advantages of having multiple income streams is the enhanced financial security and stability it provides. Life is full of unexpected events, and having only one source of income can make you vulnerable to financial setbacks. Whether it’s a sudden job loss, a medical emergency, or an economic downturn, having multiple income streams acts as a safety net, ensuring that you have alternative sources of funds to rely on during difficult times.

By diversifying your income, you reduce the risk of losing all your earnings at once. If one stream dries up, you can fall back on your other income sources to sustain your lifestyle and meet your financial obligations. This level of stability provides peace of mind and allows you to weather financial storms with greater ease.

1.1 Reducing Dependency on a Single Employer

Relying solely on a single employer for your income leaves you vulnerable to changes in the job market or the financial health of the company. In an uncertain economy, job security is not guaranteed. By having multiple income streams, you are not reliant on a single employer, reducing the impact of a job loss or downsizing. You can explore new opportunities or transition to other income streams without facing an immediate financial crisis.

1.2 Protection Against Market Fluctuations

Having diverse sources of income also protects you from industry-specific or market fluctuations. Certain sectors may experience periods of high demand and profitability, while others may face downturns or instability. By having income streams from different sectors or industries, you can balance out the impact of these fluctuations. If one sector experiences a decline, your income from other sectors can help offset the loss and maintain your overall financial stability.

2. Maximizing Earning Potential

Another compelling reason to have multiple income streams is the opportunity to maximize your earning potential. Relying solely on a single income source often limits your ability to increase your earnings significantly. When you diversify your income, you open yourself up to multiple avenues for generating revenue, allowing you to tap into different income streams and explore various opportunities for growth.

2.1 Increased Income Generation

The more income streams you have, the more potential you have for generating higher levels of income. Each income stream offers different possibilities and potentials for growth. For example, if you have a full-time job, you can explore side hustles, freelancing, or entrepreneurship to supplement your earnings. By diversifying your income, you can tap into various markets, industries, or customer segments, increasing your chances of earning more.

2.2 Leveraging Different Skills and Talents

Having multiple income streams allows you to leverage different skills and talents you possess. Each stream can be aligned with a specific skill set or interest, enabling you to monetize diverse areas of expertise. For instance, if you enjoy writing, you can earn income through freelance writing, blogging, or publishing books. If you have artistic abilities, you can sell your artwork, offer design services, or teach art classes. By capitalizing on your unique talents, you can unlock additional income-generating opportunities.

3. Building Wealth and Achieving Financial Goals

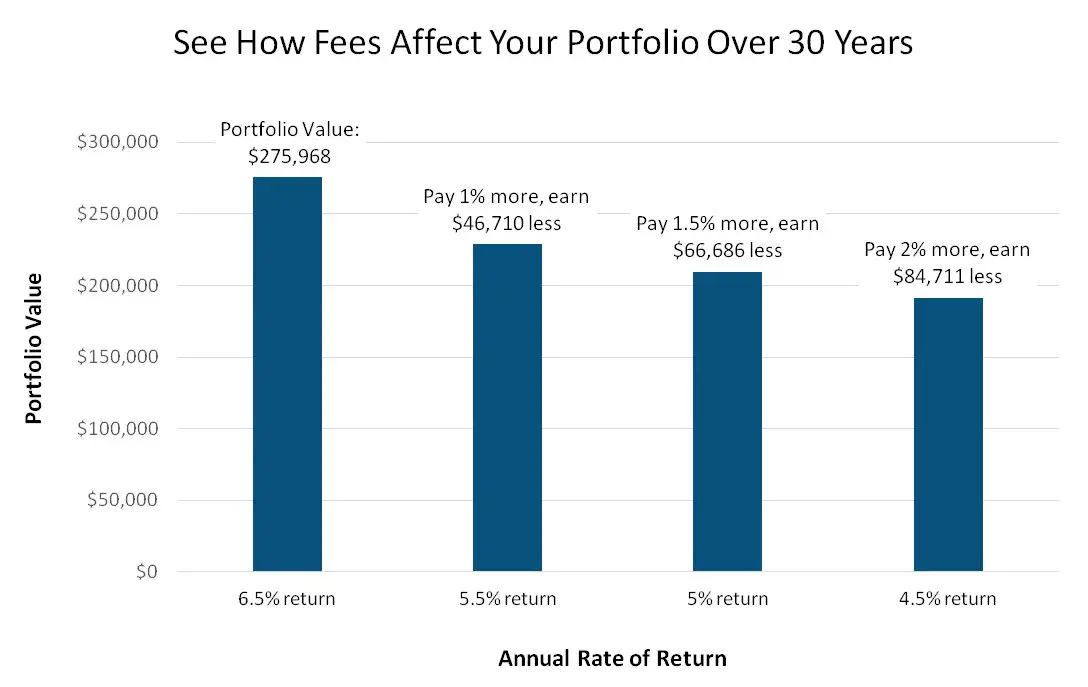

Having multiple income streams can accelerate your journey towards building wealth and achieving your financial goals. With more income at your disposal, you have the potential to save more, invest wisely, and grow your wealth over time. By strategically allocating your earnings from different streams, you can diversify your investment portfolio and create additional income sources, such as rental properties, dividends, or royalties.

3.1 Faster Debt Repayment

With multiple income streams, you can allocate a portion of your earnings specifically towards debt repayment. By directing additional income towards paying off debts, such as credit card balances, loans, or mortgages, you can expedite your debt-free journey. This not only saves you money on interest payments but also frees up more of your income for savings and investments.

3.2 Enhanced Saving and Investing Opportunities

Diversifying your income allows you to save and invest more effectively. With multiple streams of income, you can allocate a portion towards emergency funds, retirement savings, or other financial goals. By spreading your savings across different income streams, you create a robust financial foundation, minimizing the impact of market fluctuations or unforeseen expenses.

4. Fulfillment and Flexibility

Having multiple income streams can also provide a sense of fulfillment and flexibility in your life. It allows you to pursue your passions, explore new interests, and create a work-life balance that aligns with your values and priorities.

4.1 Pursuing Passion Projects

With multiple income streams, you have the freedom to pursue passion projects or hobbies that bring you joy and fulfillment. You can allocate time and resources to activities that ignite your creativity or allow you to make a difference in your community. Whether it’s starting a blog, launching a podcast, or volunteering for a cause, having multiple income streams gives you the flexibility to pursue what truly matters to you.

4.2 Work-Life Balance

Diversifying your income can also lead to a better work-life balance. When you have multiple income streams, you have the flexibility to choose how and when you work. For example, if you have a full-time job and a side business, you can allocate your time in a way that suits your personal needs and preferences. This flexibility allows you to spend more time with loved ones, engage in self-care activities, or pursue personal interests while still earning a steady income.

In conclusion, having multiple income streams is a smart financial strategy that offers numerous benefits. It enhances your financial security and stability, maximizes your earning potential, accelerates wealth-building, and provides fulfillment and flexibility. By diversifying your income sources, you can create a robust financial foundation that allows you to navigate life’s uncertainties with confidence and achieve your long-term financial goals. So, start exploring different income streams today and unlock the endless possibilities they bring.

Multiple Streams of Income: Do They Work?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

Why should you have multiple income streams?

Having multiple income streams offers several benefits, including:

- Diversification of income sources

- Reduced financial vulnerability

- Increased financial stability

- Opportunity for wealth creation

- Flexibility and freedom in career choices

- Ability to withstand economic downturns

- Improved financial security

- Enhanced personal and professional growth

How can multiple income streams provide diversification?

By having multiple income streams, you are not reliant on a single source of income, reducing the risk of financial instability. Diversification ensures that if one income stream falters, you have others to fall back on, providing stability and peace of mind.

Can having multiple income streams reduce financial vulnerability?

Absolutely! Relying on a single income source can leave you vulnerable to unexpected changes, such as job loss or economic downturns. With multiple income streams, you are less susceptible to financial hardships and have a safety net to rely on during turbulent times.

How can multiple income streams increase financial stability?

When you have multiple streams of income, you create a more stable financial foundation. Even if one income source fluctuates, others can compensate, ensuring a consistent flow of money. This stability allows you to meet your financial obligations, plan for the future, and achieve your financial goals.

How can multiple income streams contribute to wealth creation?

Having multiple income streams means you have more opportunities to earn and save money. By diversifying your income sources, you can potentially increase your overall earnings, save more, and allocate funds towards wealth-building investments. Over time, this can contribute to long-term wealth creation and financial independence.

What kind of flexibility and freedom do multiple income streams offer?

When you have multiple income streams, you have the freedom to explore different career paths, pursue passion projects, or start your own business. This flexibility allows you to have greater control over your professional life and create a work-life balance that aligns with your goals and aspirations.

How can multiple income streams help withstand economic downturns?

In times of economic downturns, having multiple income streams provides a buffer against financial setbacks. If one income source is negatively impacted, others can continue generating income, helping you weather the storm and remain financially stable until the economy recovers.

How can multiple income streams improve financial security?

Financial security comes from having multiple sources of income that can cover your expenses, support your lifestyle, and provide a safety net in case of emergencies. With multiple income streams, you can build a more secure financial future and have peace of mind knowing that you are not solely dependent on a single income source.

How can multiple income streams contribute to personal and professional growth?

Having multiple income streams often requires learning new skills, exploring different industries, and expanding your network. This pursuit of diverse income sources can lead to personal and professional growth, as you gain valuable experience, knowledge, and connections across various fields.

Final Thoughts

In today’s uncertain economy, having multiple income streams is crucial. Diversifying your sources of income provides financial security and stability. By relying on one income stream, you expose yourself to greater risk. However, with multiple income streams, you can mitigate the impact of any potential setbacks or job losses. It also allows you to pursue your passions and interests while earning money. So, don’t hesitate to explore different avenues and build multiple income streams for a more secure and fulfilling financial future.