Are you looking for a way to maximize your healthcare savings while staying in control of your expenses? Look no further! In this article, we will show you how to benefit from a health savings account (HSA) and make the most of this valuable financial tool. With an HSA, you can proactively manage your healthcare expenses, save for future medical needs, and potentially enjoy tax advantages along the way. So, let’s delve into the ins and outs of how to benefit from a health savings account and take control of your healthcare finances like never before.

How to Benefit from a Health Savings Account

Introduction

In today’s world, where healthcare costs are soaring, it’s essential to have a financial plan in place to handle medical expenses. One option that can provide significant benefits is a Health Savings Account (HSA). An HSA is a tax-advantaged savings account specifically designed to help individuals and families save and pay for qualified medical expenses. This article will delve into the details of how you can benefit from a Health Savings Account and make the most of this valuable tool.

Understanding Health Savings Accounts

Before exploring the benefits, let’s start by understanding what a Health Savings Account entails. An HSA is an individual savings account that allows you to set aside pre-tax dollars to cover qualified medical expenses. These accounts are only available to individuals enrolled in a High Deductible Health Plan (HDHP).

With an HSA, you contribute funds that grow tax-free and can be withdrawn tax-free if used for qualified medical expenses. The account is portable, meaning it belongs to you regardless of changes in employment or insurance coverage. This flexibility is one of the many advantages of utilizing an HSA.

Benefits of a Health Savings Account

Now that we have a basic understanding of what an HSA is, let’s explore the various benefits it offers:

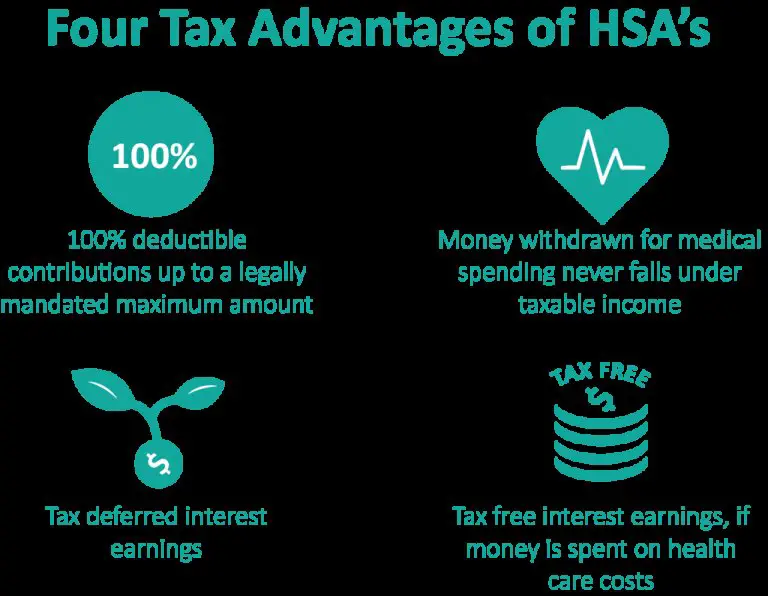

1. Tax Advantages

– Contributions: Contributions made to an HSA are tax-deductible, reducing your taxable income for the year. This allows you to save money on your taxes while building a nest egg to cover future medical expenses.

– Growth: The funds in your HSA can grow tax-free through investments, similar to a retirement account. This means your contributions have the potential to grow over time, providing even more financial security.

– Withdrawals: When you use the funds in your HSA for qualified medical expenses, withdrawals are tax-free. This ensures that you can use the full amount without any additional tax burdens.

2. Lower Healthcare Costs

– Lower Premiums: High Deductible Health Plans (HDHP) often come with lower monthly premiums compared to traditional health insurance plans. By opting for an HDHP and pairing it with an HSA, you can save money on your insurance premiums while still having coverage for catastrophic medical expenses.

– Reduced Out-of-Pocket Expenses: With an HSA, you have the ability to pay for qualified medical expenses using funds from your account, which can help reduce out-of-pocket expenses. This can be especially beneficial for individuals or families facing significant medical costs.

3. Flexibility and Portability

– Account Ownership: Unlike other healthcare-related accounts, an HSA is owned by you, meaning it stays with you regardless of changes in employment or insurance coverage. This allows you to continue using the funds and benefiting from the tax advantages even if you switch jobs or insurance providers.

– Investment Options: Many HSA providers offer investment options, allowing you to grow your savings beyond the standard interest rates. By investing your HSA funds wisely, you have the potential to increase your savings for future medical expenses.

4. Long-Term Savings

– Retirement Planning: One unique advantage of an HSA is that it can be used as a retirement savings tool. Once you turn 65, you can withdraw funds from your HSA for any purpose without penalty, although non-qualified withdrawals will be subject to income tax. This makes an HSA a valuable addition to your retirement savings strategy.

– Medicare Premiums: In retirement, your HSA funds can also be used to pay for Medicare premiums, including Medicare Parts B and D, as well as Medicare Advantage plans. This can help offset healthcare costs during your golden years.

Maximizing Your Health Savings Account

Now that you understand the benefits of an HSA, let’s explore some strategies for maximizing its potential:

1. Contribute the Maximum Amount

Each year, the IRS sets contribution limits for HSAs. It is important to contribute the maximum allowable amount to make the most of the tax advantages and long-term savings potential. For 2021, the maximum contribution limits are $3,600 for individuals and $7,200 for families. If you are over the age of 55, you can also make catch-up contributions.

2. Utilize Employer Contributions

If your employer offers a matching contribution to your HSA, take full advantage of this benefit. Employer contributions are essentially free money and can significantly boost your HSA balance.

3. Budget for Medical Expenses

Create a budget specifically for medical expenses to ensure you are setting aside enough funds in your HSA. By estimating your annual medical costs, you can contribute the appropriate amount to cover these expenses and take full advantage of the tax benefits.

4. Invest Wisely

If your HSA allows for investment options, consider investing your funds for potential growth. Consult with a financial advisor or do thorough research to make informed investment decisions that align with your goals and risk tolerance.

5. Keep Track of Qualified Medical Expenses

To avoid any confusion or potential penalties, it is crucial to keep thorough records of your medical expenses that qualify for HSA reimbursement. Save receipts, invoices, and any other relevant documents, as they may be required to substantiate your withdrawals.

6. Educate Yourself

Stay informed about the rules and regulations surrounding HSAs, as they can change over time. Familiarize yourself with the specific details of your HSA plan and educate yourself on eligible expenses, contribution limits, and any policy updates.

A Health Savings Account can be an invaluable tool for managing your healthcare costs and achieving financial security. From the significant tax benefits to the flexibility and long-term savings potential, an HSA offers numerous advantages. By understanding how to benefit from an HSA and implementing effective strategies, you can make the most of this powerful financial tool and secure your future healthcare needs. Start exploring your options today and take control of your healthcare expenses with a Health Savings Account.

Why Should I Use a Health Savings Account (HSA)?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a health savings account (HSA)?

A health savings account (HSA) is a tax-advantaged savings account that allows individuals to set aside pre-tax money to pay for qualified medical expenses.

How do I benefit from a health savings account?

By contributing to a health savings account, you can enjoy several benefits, including:

– Tax advantages: Contributions made to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

– Savings on healthcare costs: By using an HSA to pay for qualified medical expenses, you can save money on out-of-pocket healthcare costs.

– Long-term savings: Any money that is not used in a given year can be rolled over and continues to grow tax-free, allowing you to build a nest egg for future medical expenses.

– Flexibility: HSAs are portable, meaning you can take them with you if you change jobs or retire.

Who is eligible for a health savings account?

To be eligible for a health savings account, you must meet the following criteria:

– Be covered by a high-deductible health plan (HDHP)

– Not be enrolled in Medicare

– Not be claimed as a dependent on someone else’s tax return

What are the contribution limits for a health savings account?

In 2021, the contribution limits for a health savings account are $3,600 for individuals and $7,200 for families. Those aged 55 and older are eligible for an additional $1,000 catch-up contribution.

Can I invest the funds in my health savings account?

Yes, many HSAs offer investment options once your account balance reaches a certain threshold. By investing your HSA funds, you can potentially grow your savings over time.

Are there any restrictions on using the funds in my health savings account?

Funds in a health savings account can be used for a wide range of qualified medical expenses, including doctor visits, prescription medications, dental and vision care, and certain medical procedures. However, it’s important to note that non-medical expenses may be subject to taxes and penalties.

What happens to the funds in my health savings account if I change jobs or retire?

Unlike flexible spending accounts (FSAs), the funds in your health savings account are yours to keep, even if you change jobs or retire. You can continue to use the funds for qualified medical expenses or let them grow for future healthcare needs.

Can I use my health savings account to pay for my spouse’s or dependent’s medical expenses?

Yes, you can use the funds in your health savings account to pay for qualified medical expenses for your spouse and dependents, even if they are not covered by your HDHP.

Can I have both a flexible spending account (FSA) and a health savings account (HSA)?

In most cases, you cannot have both an FSA and an HSA at the same time. However, there are some exceptions, such as having a limited-purpose FSA that only covers dental and vision expenses. It’s best to consult with your employer or benefits provider to understand your specific options.

Final Thoughts

A health savings account (HSA) offers numerous benefits for individuals seeking to manage their healthcare expenses. By contributing to an HSA, you can enjoy tax advantages, flexibility, and control over your healthcare spending. With the ability to save for future medical expenses, the HSA acts as a financial safety net. Additionally, the funds in your HSA can be invested, potentially growing over time. By utilizing an HSA effectively, you can secure your financial future while enjoying the peace of mind that comes with comprehensive healthcare coverage. Benefit from a health savings account today and take control of your healthcare expenses.